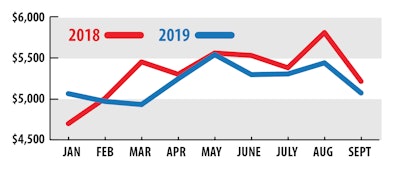

Overall owner-operator income, as tracked by ATBS, has trended as might be expected this year as the trucking economy adjusted to cooler conditions.

Overall owner-operator income, as tracked by ATBS, has trended as might be expected this year as the trucking economy adjusted to cooler conditions.Even as freight demand returned to pre-2018 levels this year, owner-operator income showed a respectable performance during the third quarter, based on client averages from financial services provider ATBS.

Average monthly income for July, August and September was $5,327, slightly below the second quarter, but well above the first quarter’s $4,971. Also, it was only slightly below the year-ago average of $5,573 during the third quarter, which represented the tail end of an exceptionally hot freight market.

For all leased and independent ATBS clients, monthly miles averaged 8,474 in this year’s third quarter, yielding 63 cents per mile. There was little difference between independents’ average monthly net income in the quarter, $5,375, and that of leased operators as a whole.

The market for leased dry van and reefer haulers showed no major changes in the quarter from the rest of 2019. Net income averaged $5,417 for dry van, $4,720 for reefer. Leased flatbed haulers, averaging $5,610, were well above the all-operator average of $5,327.

However, flatbedders’ monthly net income dropped steadily from $6,299 in July to $4,814 in September as their miles hit a low for the year, 6,449, in September. This year’s seasonal decline was much more pronounced than a year ago, though it wasn’t immediately clear what drove the short-term trend.

Commercial activity was strong, based on the third-quarter Commercial Construction Index report, produced by the U.S. Chamber of Commerce and USG Corp., a leading manufacturer of building materials. The CCI rose to its highest score since it was created in 2017.

Nationwide housing starts in July and September were at or above the year’s average, and the August count was the year’s highest. As the fourth quarter began, October had the year’s second highest total starts.