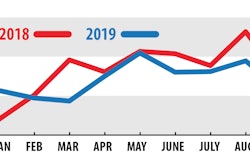

Just like a convergence of factors spurred trucking’s upswell in 2018, so too is a convergence of changes to blame for the steady descent back to reality in 2019. A global economic slowdown, combined with a ramp-up in capacity and a cooling effect after the sugar high wore off from the 2017 Tax Cuts and Jobs Act, all contributed to general sluggishness for the trucking sector.

And it doesn’t appear that 2020 will be any easier. Just this week at the CCJ Solutions Summit (the annual fleet conference produced by Overdrive sister publication CCJ), ACT Research’s Kenny Vieth predicted next year will be a “very, very tough year” for the industry. He attributed this forecast to an excess in capacity — 75,000 trucks, by his estimation — and a growing private fleet marketshare, combined with slowing economic growth.

Likewise, in their monthly State of Freight webinar, economists Eric Starks and Bill Witte from FTR last week cited decelerations across the economy — notably in housing, manufacturing, business investments and consumer spending — as headwinds overall, likewise for the truck freight demand next year.

Nonetheless, they noted, freight is still at “high levels,” despite hitting a plateau. As Starks said at the firm’s annual conference in September, trucking’s simply in a holding pattern.

That may be uncomfortable and suppress rates, but it’s far from the “bloodbath” idea being hit by some. A slowdown is not a downturn, though it may feel that way. Reporting from Overdrive contributor Tom Quimby, writing for CCJ earlier this month, drove that point home.

Despite a few high-profile fleet closures, announced downsizing events and choppy jobs reports, the number of carriers in the market has actually increased this year, said Avery Vise, also of FTR. “While we’re losing a lot, we’re also adding a lot,” he said. The industry is “not in any kind of crisis,” despite the headlines and the quick return to normal after 2018.

Quimby’s report does note that carriers who work the spot market — often heavy with owner-operators and smaller fleets — were most at risk in the slowdown, as spot market rates are more volatile and can dry up quickly, as many owner-operators have experienced over the past year.

But there are bright spots. Millennials are moving into home ownership. Consumer spending, which has underpinned much of the economy’s recovery over the past decade, remains strong. The yield curve has un-inverted (a measure of short-term interest rates vs. long-term rates that often is a recession predictor). The economy continues to add jobs. The trade war with China, which Starks, Witte and Vieth all cited as a major economic headwind, has inched toward some progress.

Even Vieth, who said Tuesday that trucking was in for a tough 2020, expressed some optimism for the coming 12 months. Slowdowns cycle out after a year or two, he said, and the current down cycle is already a year old. And should the U.S. and China end the trade stalemate, he added, trucking could see another surge.