As freight has rebounded, rates too have come back to life. “Shippers will see challenges in procuring spot market capacity without paying higher spot rates,” said Jim Nicholson, vice president of Loadsmart. That trend should last at least through the traditionally robust Memorial Day to July 4 freight season.

As freight has rebounded, rates too have come back to life. “Shippers will see challenges in procuring spot market capacity without paying higher spot rates,” said Jim Nicholson, vice president of Loadsmart. That trend should last at least through the traditionally robust Memorial Day to July 4 freight season.Load availability has surged in recent weeks, particularly for dry van and reefer loads, as lifted shutdown orders have jump-started retail sales and as produce season has spiked demand for reefer haulers. Even flatbed has seen some strength via a stronger-than-anticipated construction season.

Truckstop.com, for instance, says load availability jumped 31% last week from the week prior, continuing an eight-week run of growth, spread across the three major truckload segments. The board’s load-to-truck ratio over the past two weeks was stronger than the same weeks in 2019 and topped the five-year average for those weeks of the year.

However, analysts expect a return to annual seasonal trends, meaning July and August are likely to see a cooling period for freight demand and rates, thus continuing the dramatic up-and-down cycle experienced throughout 2020.

“The spot market roller coaster continues,” said Ken Adamo, DAT’s chief of analytics. “The restocking boom shot per-mile rates up,” he said, in late March and into early April. Then, “social distancing and shuttering of the economy brought things down in early May,” he said.

But freight demand has since seen a recovery, with Memorial Day weekend acting as a “kickstarter,” said Jim Nicholson, vice president of digital brokerage Loadsmart. Load volumes this June have in fact outpaced the same time period of the past two years. He expects that strength to continue through the usual Independence Day time frame.

“We’re on a very solid run here,” said Stephen Bindbeutel, an analyst at Truckstop.com and the company’s vice president of product. “All signs are cautiously optimistic,” he said. Though rates are lagging behind the growth in freight demand, Bindbeutel expects per-mile averages to grow in the coming weeks. Last week, spot rates on average climbed 2.2%, he said.

Retail sales, which were up 18% nationally in May from April, have been one of the main drivers of the short recovery period. Though major chains like J.C. Penny, J. Crew, Neiman Marcus and Pier 1, among others, have announced bankruptcies, other retailers are booming.

Home improvement stores like Lowe’s and Home Depot have seen huge spikes in sales, as have sporting goods retailers. Also, sales for furnishings for home offices have soared — chairs, printers and monitors. “Retail patterns have shifted dramatically,” said Chris Caplice, executive director of MIT’s Center for Transportation & Logistics and head of the Chainalytics Freight Market Intelligence Consortium.

Caplice’s focus is mostly on the contract freight market, where there’s been “an incredible imbalance,” he said, in terms of freight demand. Some sectors, for instance, have remained resilient throughout the downturn. Others, such as industrials and manufacturing, “have just stopped,” he said. Carriers with diverse sources of freight have been able to better weather the storm than those focused on a niche that went dry.

Though indicators in trucking and across the economy show the recent pop in growth slowing, the positive swing in the market has prompted forecasting firm FTR to shift its outlook for second quarter GDP losses. “It’s not going to be as negative as we thought it would be a month ago,” said Avery Vise, FTR’s vice president of trucking.

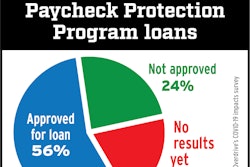

But key questions remain for the remainder of the year. Payments from the coronavirus aid and stimulus bill from Washington, such as PPP loans for small businesses and the $600 per week paid to those who file unemployment, will sunset in the coming weeks. “We don’t really know how [that’s] going to play out on the other side,” Vise said. Likewise, he pointed to a recent report from the Federal Reserve that forecasted high unemployment — upwards of 9% — through the end of 2020.

“There’s no question we will see incremental improvements over the next few months,” Vise said. “There’s just a lot of friction in all of that. Right now, our forecast is that, yes, we’re headed toward really good [economic] times, but that those good times aren’t going to come for another year.”