Find all the pieces of this series in the anchor story at this link: Hotshot trucking retains its fundamental allure

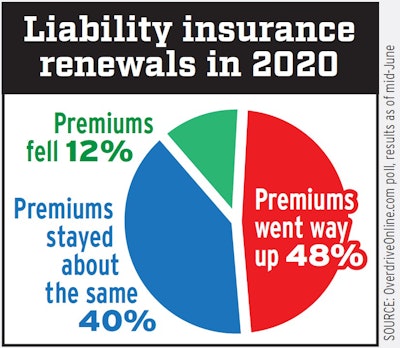

For Overdrive’s audience of owner-operators, liability insurance premium changes this year have been a mixed bag. Insurance agent Steve Libertore said the “hard market” for insurance still seems to be the norm for the small fleets and independents he deals with.

For Overdrive’s audience of owner-operators, liability insurance premium changes this year have been a mixed bag. Insurance agent Steve Libertore said the “hard market” for insurance still seems to be the norm for the small fleets and independents he deals with.S2 Transport’s Scott Sabatini estimates his insurance cost is a little more than 10% less than what it would be for a comparable Class 8 truck and trailer operation. Some of that comes out of the physical damage coverage, given generally lower costs of replacement. Part does come out of the liability side, but it certainly doesn’t equate to the big cost windfall some expect when they explore turning to hotshot.

S2’s insurance costs remain relatively high, due to being in business less than two years. It’s the same case for hotshot owner-operator Jason Kendall, who pays $1,700 monthly for insurance, $1,400 of that in liability alone, he said. He, too, is looking forward to reaching two years in business at the end of this year.

Owner-operator Debbie Desiderato’s situation sheds some light on costs for someone with much longer experience. She was insured for years while running a Class 8 Kenworth and 53-foot dry van under her own authority, with a spotless record and no claims whatsoever. When she transitioned to a hotshot rig pulling a flatbed, her liability costs went down a little, but physical damage went up, given “a brand-new hotshot truck and trailer” versus her older Class 8 equipment.

Her insurance – with a $2 million liability limit she boosted within the last year to satisfy a military-specialized broker’s requirements – sits at just $7,200 annually. That’s less than half of what owner-operator hotshot car-hauler Jason Kendall’s paying in a similar freight niche.