It’s not exactly the greatest of times for the most seasoned, long-in-business of hotshot haulers, as my colleague Tom Quimby wrote some weeks back. Freight in a variety of sectors had fallen off the cliff, direct clients in some instances had shut down entirely, and some were relying on spot loads that everybody and his brother were also relying on — or at least hoping to rely on.

Now imagine your three-truck business (and its equipment) is just 15 months old, truck and trailer payments continue, and you’re relying on the services of an independent dispatcher working load boards and other contacts to keep your 40-foot flatbeds filled. That’s been the situation of the three-truck S2 Transport fleet, headquartered in Ohio. It’s run from the operations side by President Scott Sabatini, a military veteran with prior trucking experience, and Steve Libertore, a man whose name you may well recognize.

No, Libertore’s not one of my owner-op or small-fleet-owner sources from years past, but rather an insurance agent who’s long specialized in insurance for the smallest of trucking companies operating with authority. He’s still in that business, now with Kincaid Insurance Group, with offices in Indiana and Ohio and specializing in part in transportation. His motivation for joining up with Sabatini (while both continue with other basically full-time jobs) to manage a three-truck fleet?

Both men were driven to go out on their own in some fashion, generally speaking, but Libertore noted the complementary past experience of the two. Sabatini’s “background is safety, compliance and driver recruiting,” says Libertore. “I’m risk management.” While Sabatini handles the day-to-day logistics, “I’m looking at the back end.”

The S2 Transport three-truck fleet’s drivers are all company employees and pull in 2018 Ram 3500 trucks outfitted with fifth wheels like this one, pictured this past winter in Vermont.

The S2 Transport three-truck fleet’s drivers are all company employees and pull in 2018 Ram 3500 trucks outfitted with fifth wheels like this one, pictured this past winter in Vermont.Also, though, what he’s learned in the short time they’ve navigated the wide world of hotshot flatbed — a lot of their loads end up being LTL in nature — gives him a leg up, he feels, over competing insurance agents. “I don’t know how many agents can say that ‘I understand what you’re going through’ to a client with this or that,” he says, “the ELD issues and everything. I’m experiencing this firsthand myself.”

Problems he has a new appreciation for range from an ELD malfunction and/or user error that cost one of his drivers an out of service violation that’s now dinging their insurance, to the high cost of plates in IRP — “$4,800 for three 2018 Ram 3500 pickups” plated for 43,000 pounds, powered by Cummins diesels — to, gulp, insurance.

S2’s logo on one of its 2018 Rams’ hoods in Colorado.

S2’s logo on one of its 2018 Rams’ hoods in Colorado.Libertore says they had exactly one option for an insurer given their new authority: Progressive. Shopping around for better rates wasn’t in the cards. They’ve done everything they can to minimize costs and take advantage of discounted services for better efficiency, and risk management, when they can. For instance, the fleet uses the dashcam option of its ELD provider, KeepTruckin, obtained with a discount add-on to the logs service via a partnership with Progressive.

Nonetheless, when the insurance policy comes up for renewal and the three-truck company has gotten two years behind it, Libertore naturally will be well-positioned to shop around for better rates — after two years, he says, a small fleet’s insurance options typically widen out a bit among insurers in his experience.

That was the reason we were talking to begin with, for what it’s worth. After owner-operator Bryan Hutchens found at renewal mid-pandemic that his one-truck business would be seeing a big rate reduction with a change in insurers his agent was able to make, I wondered whether Libertore was also seeing competition among insurers for business. Or — if Hutchens’ experience perhaps had more to do with his particular situation than anything else.

Unfortunately, at least according to Libertore, the “hard market” for insurance seems still to be the norm for small fleets, with 5-10 percent premium increases at renewals still very common. (Eagle Express small fleet owner Leander Richmond recently reported a small increase for his 12-truck fleet in March that amounted to about $25 per truck annually.)

Libertore believed Hutchens’ reduction situation to be “unusual,” he says, adding that the best thing carriers who may be struggling through this period can hope for from insurers is a little “flexibility from the underwriters’ standpoint – to let you park trucks and not charge you for covering them.” For more on that front, read this.

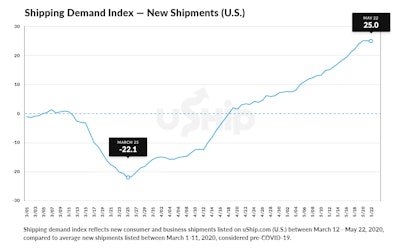

Interesting COVID-19 ‘rebound’ graph from a hotshot-heavy freight platform

Check out this graph from the uShip platform, where private parties can offer freight, much of it the smaller variety, out to connect with individual truckers, trucking companies and brokers (likewise all mostly of the smaller variety, including when it comes to the equipment — Sprinter vans, hotshots, box trucks are common). The graph, make note, is reflective of both loads listed from individual consumers there and businesses.

uShip’s Vice President of Corporate Communications, Dean Jutilla, outlined the categories where the big recent-history increase in items need transport on the platform is coming from:

- Furniture from online retailers and marketplaces (like Etsy and other partners)

- Motorcycles, ATVs, boats, and kayaks

- Used heavy equipment (from Ritchie Bros. Auctioneers)

- Used cars and light trucks

COVID-19’s lockdowns changing shopping patterns to online vendors? I’d say so. Also, new buying and selling prompted by, respectively, stimulus money going out and folks getting rid of unnecessary belongings online? Check.

But take a look at the third item. I had a conversation Tuesday with longtime broker and trucker Paul Berman, of the East Coast Transport 3PL (more on that later, for certain). He made note of an opportunity for owner-operators in the current market, given some high-profile large trucking company failures and that equipment moving at least in part through auctions where generally low demand might equate to a deal on an equipment upgrade, such as you may need it.

The particular benefit to moving to later model equipment, from his point of view — ECT might be more readily able to partner with you on some of its contracted freight with shippers who require equipment of recent vintage. Berman specifically cited the “no more than 7 years old” figure.

“There will trucks at good pricing on the market” now and into the near future, he said, if you have the capital to invest. He believes “it will continue to get more difficult to find freight if you have an older truck – especially anything that’s time and/or temperature-related.” Much of East Coast’s business is centered around the food industry, he noted, a substantial amount of that running in reefer trailers. And though they do post loads to boards, their focus is on building a dedicated carrier based on regular, repeat lanes. Except in cases where shippers have demanded it to keep a contract, he says, they haven’t dropped their rates through the crisis. Find them via this link.