Despite the poor rates environment many operators experienced first-hand in the depths of the economic shutdown in April and May, income for owner-operators actually rose year over year and quarter over quarter in the year’s second quarter, which encompasses both those months.

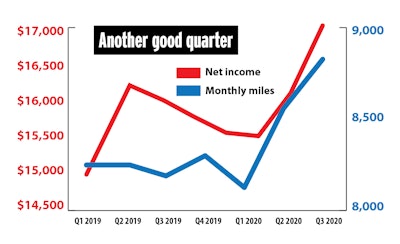

Despite the poor rates environment many operators experienced first-hand in the depths of the economic shutdown in April and May, income for owner-operators actually rose year over year and quarter over quarter in the year’s second quarter, which encompasses both those months.Owner-operators had a surprisingly good third quarter, as stronger rates and plenty of miles yielded the year’s best showing, according to client averages from financial services provider ATBS.

Net income for leased reefer haulers increased slightly from the second quarter of 2020, while leased dry van and flatbed operators, as well as independents as a whole, did very well in serving parts of the economy that were rebounding from the COVID-19 pandemic.

If this year’s third-quarter income of $17,116 were annualized, operators would earn over $68,000. Even though third quarters are typically good for dry vans as goods move to retailers stocking up for holidays, this year’s July-September quarter income for owner-operators was up 7% from a year ago.

Third quarters are usually strong due to pre-holiday retail shipping. This year’s third-quarter income was 7% higher than a year ago.

Third quarters are usually strong due to pre-holiday retail shipping. This year’s third-quarter income was 7% higher than a year ago.Spot rates in all three of those months in 2020 were above five-year averages, as a goods-heavy recovery poured freight into a spot market that was tight on capacity. Many operators work spot freight for loads.

“My sense is rates will stay high through year-end and there’s all the miles a driver can run right now,” said Todd Amen, ATBS president and CEO. “Owner-operators need to take advantage while we have a strong market because you never know when the next lockdown is coming.”

The firm’s average income for all operators was flat from the third quarter of 2019 through this year’s first quarter. It then rose noticeably in the second and third quarters.

Last quarter’s performance reflects not only stronger rates, but miles that steadily climbed during 2020. Net income per mile was flat, between 62 and 63 cents per mile, from the four quarters ending in June. Then it rose to 64 cpm in the most recent quarter.

ATBS reported these third-quarter net incomes by category:

Independents: $17,028

Dry van: $17,325

Reefer: $14,800

Flatbed: $19,508

What’s more, the fourth quarter began with even stronger rates than the second quarter ended on. Spot rates in October neared the record-setting rates in 2018, according to monthly averages from Truckstop.com. Meanwhile, fleets appear to expect freight activity to hold, with orders for new Class 8 trucks topping 50,000 in October – the strongest month since early 2018.

Also, October saw another month of strong hiring for the for-hire trucking industry, adding nearly 10,000 jobs in the month, according to the Department of Labor’s monthly employment report. That brings the total number of jobs added in for-hire trucking to 33,000 since May. However, total industry employment is still down 64,000 jobs from February.

Where freight and rates are headed after the usual fourth quarter holiday freight season, however, is somewhat of a “guessing game,” said Dean Croke, a principal analyst at DAT. “There’s certainly upward pressure, but there’s so much uncertainty about demand,” he said in late October.

Despite stronger averages for income and rates, Croke said the recovery hasn’t been felt evenly. “There’s winners and losers in nearly every sector,” he said. “If you’ve got a dry van and a lift gate, you’ve been driving the wheels off it,” he said. “If you have a flatbed, a dropdeck or haul specialized, those volumes aren’t as good. It’s so disjointed,” he said.

One potential positive looking to early 2021, however, is that shippers are already prepping freight for the usual spring freight season, Croke said, which could help ease the usual January-February dip sandwiched between the holidays and the usual March uptick.

Lidia Yan, founder of the digital freight brokerage NEXT Trucking, has heard the same from her company’s shipper customers. NEXT Trucking operates heavily in the port sector on the West Coast. “We’re seeing shippers push volumes as early as possible,” she said, “so that’s why we’re [expecting a longer peak season.”

Port freight entering the U.S. on the West Coast, which then heads to warehouses and then distributed across the country via truck freight, has been surging since July. “We’ve never seen this kind of chassis shortage” at the ports, she said. Of no surprise, the strongest import activity has centered around e-commerce categories and goods for people spending more time at home. Electronics and furniture demand has been particularly pronounced, Yan said, as have medical supplies, convenience and dollar-store supplies, monitors for home-office set-ups and TVs.