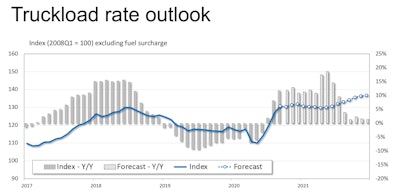

FTR’s forecast sees the strong year-end rates sustained through 2021 and rising further in 2022.FTR

FTR’s forecast sees the strong year-end rates sustained through 2021 and rising further in 2022.FTR

“Look for a good, solid first half,” said Don Ake, vice president for commercial vehicles. “It’s the second half where the questions come in.” He was speaking primarily about equipment production and sales, but echoed his colleagues’ questions about how the overall economy recovery will unfold.

Truck loadings are forecast to rise more than 5% this year after a decline of about 4% in 2020, said Avery Vise, trucking vice president. Flatbed will lead that, at more than 6%, “but it also took the biggest hit” in 2020. Other segments will trail flatbed slightly, except tankers, at about 3%.

Overall, 2020’s strong second half and prospects for continued high freight demand look good into 2022, FTR said. In the meantime, some unknowns cloud the timing and the intensity of the recovery: abatement of the pandemic, a new round of financial stimulus, a constrained driver pool, and restricted production of new trucks and trailers, which are already in big demand.

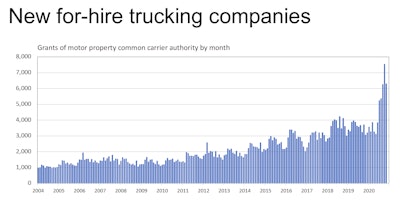

One aspect of trucking’s boom in late 2020 has been “a huge surge” since July in the addition of new for-hire trucking companies, Vise said, though these new, mostly one- or two-truck businesses don’t account for much increased overall capacity. “That’s because we’re shifting leased operators into operators with their own authority, for the most part,” he said.

As freight demand surged in the second half of 2020, many leased operators jumped on rapidly rising rates and obtained operating authority.FTR

As freight demand surged in the second half of 2020, many leased operators jumped on rapidly rising rates and obtained operating authority.FTR

With freight hot at year-end, fleets placed record-level orders for trucks and trailers in October and November, Ake said. The orders “reflect the forecast for 2021 based on conditions being as they are now,” he said. “Conditions as they are now are not normal. We do not expect those to continue.”

Fleets have placed orders for delivery in nine to 12 months, he said. Some of those orders might be canceled at mid-year unless the recovery is stronger and more stable than expected.

Fleets, too, seeing a strong freight market in late 2020 and anticipating further recovery well into 2021, placed record orders for new trucks and trailers.FTR

Fleets, too, seeing a strong freight market in late 2020 and anticipating further recovery well into 2021, placed record orders for new trucks and trailers.FTR

The analysts agreed that a new round of a federal stimulus, as the incoming Biden administration is calling for, appears likely, but its impact will largely depend on what form it takes. Issuing big checks to individuals tends to be a “sugar high” without no lasting effect, said Clay Slaughter, general strategy officer and general counsel.

Something broader, such as 2020’s rounds of the Paycheck Protection Program, provides a “more metered” approach to recovery, he said. Other broad approaches would be to stimulate jobs in certain economic sectors or to invest in areas such as highway or technical infrastructure.

The analysts said many of the big economic changes spurred largely by the pandemic are likely to remain at least in part: consumer spending shifting from goods to services, home delivery of products, retail sales outside of brick-and-mortar stores, work from home and its effect on housing market trends.

“We’re seeing a shift to goods because services has gone away,” said Bill Witte, FTR economy expert. Many people, especially those with higher incomes and working from home, “can’t or won’t spend it on services, so they’re spending it on goods.”

With so many people sheltering at home, and some of them likely to continue working from home, it changes the housing market because buyers are reconsidering where they want to live, said Slaughter. It also affects what they put in the home – perhaps a new desk and chair -- and if moving to a new location, even a full refurnishing.

The pandemic’s huge boost to online ordering has created local delivery jobs, diverting some drivers out of long-haul jobs. FTR Chairman and CEO Eric Starks noted how he and others have spotted personal vehicles and rented vehicles used for home deliveries, including a UPS driver jumping out of a U-Haul truck.

“This is just such as bizarre world in what we’re seeing,” Starks said. “Some of these things are structural, and they are now going to be permanent changes.”