Previously in this series: Contract opportunities, strategy shifts for the smallest carriers

When Uber Freight announced a new in-app negotiation feature of its application for owner-operators booking loads through the brokerage in April, it seemed to come at a critical juncture. The new feature enabled owner-operators to name their price for a load rather than simply accept what Uber Freight’s partly algorithmic system offered. It had been in development for quite some time, yet landed amid one of the biggest collapses in available load volumes in history as COVID lockdowns threw things into disarray after an initial surge in loads.

With market metrics out of whack, Uber Freight’s and so many other brokers’ pricing discovery tools yielded no shortage of offers that were at best barely profitable for owner-ops, at worst downright insulting. (Think an 80-cents-per-mile full-truckload rate, as showed one of many screengrabs shared at the time.)

Many owner-operators took personally the speed and severity of the rates fall. As Uber Freight was announcing its bidding tool, the eventual Mayday three-week protest vigil outside the White House was being planned, with truckers calling for greater transparency into shippers’ contracted rates that often enough underly the business brokers do with them. Those rate contracts, many noted, do not often change so quickly, though there is experimentation of the sort in play today.

When carriers are offered only below-market rates, “they have to decide then what they’re not going to pay attention to,” said owner-operator William McKelvie during last month’s federal listening session that was a direct result of the protest. Those neglected things could easily be safety-sensitive investments in maintenance and equipment, he added, illustrating why the feds ought to care about the economics of trucking.

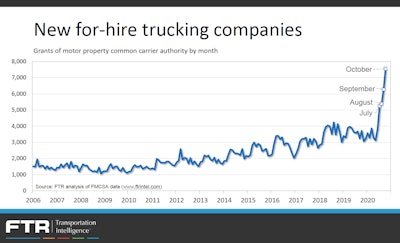

By July the situation had flipped. Rates soared on a “rebound in consumer spending, extraordinarily lean retail inventories, and a surge in imports,” said Avery Vise, Vice President of Trucking for FTR Transportation Intelligence. Many independent owner-operators and other carriers survived the crunch and new for-hire authorities began to explode.

The COVID-19 pandemic possibly has accelerated two trends that converge in an area of much consideration over the past decade. The digital world of freight matching, often occurring within mobile apps offered by brokers/3PLs (some operated by carriers who also lease owner-operators), has increasingly matured in functionality and utility. This has happened alongside carriers’ growing skittishness about owner-operator lease agreements, given California’s A.B. 5 independent contractor law and other legal wrangling well before that.

The challenge for independents in digital brokering arrangements will be to make sure they have the flexibility – whether it involves getting on the phone or some other form of negotiation – to end up with loads that are sufficiently profitable. Old-hand independents and those new to the game must know their own power when it comes to pricing, and exercise it when it’s called for.

“July saw what was at the time the most new [monthly] grants of trucking authority ever, nearly 25% more than the previous record month of August 2018,” Vise said. “Each month since July has set a new record for new grants of operating authority. In October, the number of new trucking companies receiving authority surpassed September by 20% and August 2018 by 78%.”

The extremity of the new entrant numbers “might be more nuanced,” said FTR’s Avery Vise. “About a third of the carriers obtaining authority over the past four months report operating trucks but not tractors. Some of these entities might be local delivery or other ‘non-trucking’ operations that are choosing to obtain federal authority even though they might not need it.”

The extremity of the new entrant numbers “might be more nuanced,” said FTR’s Avery Vise. “About a third of the carriers obtaining authority over the past four months report operating trucks but not tractors. Some of these entities might be local delivery or other ‘non-trucking’ operations that are choosing to obtain federal authority even though they might not need it.”This capacity may not exactly be “new,” Vise contended, but rather formerly leased owner-operators moving to establish themselves as carriers to take advantage of high spot rates while they last. In any case, it isn’t readily apparent by load board metrics. “Ratios of loads to trucks are at or near record levels due not only to strong load volume but also continued low truck postings by historical standards,” he said.

Read more in this series — from shifts in owner-ops’ experience of the nation’s truck stops to expanding telehealth options and new direct-freight opportunities — via this link.

Read more in this series — from shifts in owner-ops’ experience of the nation’s truck stops to expanding telehealth options and new direct-freight opportunities — via this link.Vise guesses those new carriers are turning to brokers’ digital freight engines, as “brokers and 3PLs increasingly can marshal their carrier capacity as effectively as asset-based carriers and, often, provide comparable levels of visibility” to their customers, he said. They make for attractive paths of least resistance to freight for new carrier businesses, too.

Looking back to the pandemic crunch of April-May, those below-market rates owner-operator McKelvie invoked were in fact pretty reflective of the market of the time, in many views.

“We saw the phenomenon you’re talking about play out in the market in April,” said Mark Petersen, a C.H. Robinson vice president, “as the shutdown forced contract and dedicated carriers into the broader market and we saw [shipper] customers take advantage of the lower prices they offered.”

Say, 25 of ACME Blue Trucking’s 50 drivers are dedicated to the Generic Big Box account, whose docks are all suddenly shut down. Equally suddenly, those drivers’ dispatchers post their rigs on the load board as available just to keep operators in a paycheck. Multiply that times [INSERT LARGE NUMBER] and you’ve got a description of the huge boost in available capacity metrics at the time, sending rates through the floor.

In traditional pricing, a flesh-and-blood human would “look at the data available and scratch their head and look around some more and say, ‘It should be this,’ or ‘It should be that,'” said Bar Ifrach, leading the data-science side of Uber Freight’s marketplace. Today’s data science-driven pricing is “basically that on steroids — it considers a lot more data and a lot more factors.”

When something happens that hasn’t been seen before, like the quick crash in April, machine intelligence is fast and unforgiving. Human intervention may well be necessary. “Sometimes you need to tweak a few things to keep them stabilized,” Ifrach said. “We’ve done that.”

In-app bidding is a part of it, a way to collect more textured, carrier-influenced data related to market price discovery, sure, but also a basic negotiation tool delivered in-app rather than over the phone and something of an enhancement to what retired owner-operator and current owner-op consultant Gary Buchs (also an Overdrive Extra contributor) memorably called “the owner-operator’s number one freight negotiations tool.” That’s your right of refusal: No, I won’t move for that rate.

In-app bidding is greasing the skids for negotiation, at least, for users within Uber Freight, partly a response to those carriers who’d rather just submit a quick counter-offer than haggle over rates on the phone. “It’s provided good utility for us to get those additional market inputs,” Ifrach said. “We’re getting lots of bids,” though the function isn’t “available on all loads. We’re still testing and rolling it out gradually.”

Like many owner-operators, Buchs remains skeptical of automation of business processes as complicated as price negotiation, even as the “Book Now” option makes its way through all manner of freight platforms, typically as an option brokers can use (including within both major load boards) to offer quick convenience if the price is right.

Beware the power of the digital nudge and the convenience it offers, he has suggested. Buchs worries about removing the human touch from pricing, giving owner-operators little option to adequately sell excellent service without first capitulating to the nudge of an initial offer price.

The convenience element is indeed attractive, though, if the price is right. More asset-based carriers’ brokerages are moving in this direction, too, if not already there. Schneider National’s new FreightPower smartphone-based connection engine to the company’s brokered power-only and live loads will eventually be almost wholly “book now”-based when it comes to pricing acceptance.

There is no in-app way to negotiate, according to Erin Van Zeeland, who heads up the Schneider Logistics brokerage business. Carriers can negotiate, however, by dialing in via call buttons within the app. Owner-operators Crystal and Jeff Kozloski of JAK Transport (Jeff hauls in a 2013 Peterbilt 386, Crystal works the back office) note negotiation’s still a necessity with a portion of the freight in the Schneider Logistics network as FreightPower is in the process of integrating two TMS systems that formerly fed its web-based Load My Truck portal.

In that old portal, offer prices weren’t displayed, Crystal said. She handled the vast majority of the arranging of mostly power-only loads for Jeff before FreightPower came into play. The couple have been guinea pigs for the new system since tests began in earnest in July. Both laud its convenience.

“Last week,” Jeff said, “I was empty in Iron Mountain, Michigan, very early in the morning … before the guys were in the office at Schneider. There was a bunch of loads a half-hour from where I was. I just got on there and grabbed one.”

In past, Crystal added, “He had to rely on me or rely on calling into Schneider.”

Van Zeeland hoped the system would be a boon to independent carriers’ time management. “We know for certain that carriers are taking two-three hours on every load,” she said, counting negotiating. “We wanted to take that hassle factor out.”

Yet convenience also puts a lot of initial name-your-price power in a broker’s hands — it could “eliminate their need to negotiate” altogether with an owner-operator who knows what he/she’s capable of, and what that’s really worth or ought to be, noted Buchs. Brokers might be well more successful when they “just throw the bid out there and ‘we know somebody will take it.’”

How are pricing algorithms performing in the current market, a far cry from the doldrums of April? (Market metrics sit well in owner-operators’ favor.) Judge by the example of Uber Freight’s in-app bidding function and you could make the case many believe there’s still plenty money left on the table. “We never see anyone bid below the offer price,” said Ifrach, perhaps no surprise. Yet other motives are at play, too, for the company. “What we want to accomplish for bidding is giving carriers the perfect load for them. Rather than have someone deadhead 100 miles, we want to help them get something perfect for their schedule. Bidding allows us to differentiate for whom the load works best.”

As C.H. Robinson’s Mark Petersen put it in the prior piece of this series, data science’s utility for truckers is also in helping carriers maximize utilization. And cutting down on deadhead, he said, saves the broker and its shipper money as well by helping keep rates manageable.

Next in this series: ‘Contactless’ load and unload on the rise, but far from universal for owner-operators