Working into contracted freight is the goal of many an independent owner-operator looking to grow or increase stability. For most such operators avenues to such freight tend to flow through a brokerage. In a time like the present, it may seem as if contracted freight has lost some of its luster. Though with shorter-term contracts gaining more interest amid the ongoing uncertainty and volatility, there could be new avenues for more owner-operators to crack the nut of contract freight.

The truckload freight market exists on a continuum, with spot freight at the purely transactional end, not under contract at all. On the other side is dedicated freight, with carriers’ trucks hauling exclusively for a single customer. In between is where the lion’s share of truckload exists — the broader contract market, as Chris Caplice, an analyst for DAT Solutions and executive director of MIT’s Center for Transportation and Logistics, sees it.

There are many flavors therein, the traditional one being where a shipper and a carrier agree on a price for movement from point A to point B for a year’s time. The shipper typically estimates volume, but doesn’t guarantee it.

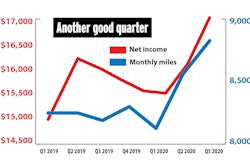

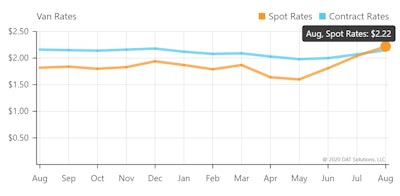

In August, average spot rates in DAT’s tracking rose to a level above the average contract rate, the first time that’s happened since January 2018 for dry van freight. For reefers, similar dynamics are at play in the current rate averages, though it’s not been as long since spot rates have been above the average contract rate. 2018 was exceptional in that regard, and at least as far as rates for freight movement is concerned, the market appears to be back to those levels.

The average August contract rate for dry vans was $2.15/mile. Source: DAT Trendlines

The average August contract rate for dry vans was $2.15/mile. Source: DAT TrendlinesBut the big shifts this year in what freight is moving and to where, and the extreme rates volatility, have resulted in more discussion around contract terms potentially getting shorter than the typical one year of many large shippers. That’s long been “one of the flavors” in the contract freight market, Caplice said, though a recent survey of large shippers he works with showed few reporting shorter-term contracts.

C.H. Robinson this week announced a tool it’s tested with 100 of its shipper customers that it’s calling “Procure IQ.” The company believes executing more dynamic, shorter contracts with its shippers is likely to be the result of its wider use.

The tool, designed for large shippers of truckload freight, gives a truck-transportation buyer a window on the C.H. Robinson network, including average pricing paid along specific lanes and a variety of ways to analyze their own book of business. “What we’re exposing is the realities” of the trucking marketplace for the shipper, said Tim Gagnon, vice president of data science and analysis at Robinson.

How it works: After a shipper inputs its shipping needs and data, such as lane origin and destination, and volume estimates, those data are set against Robinson’s transactional dataset. (That’s based on 18 million annual loads and 200,000 carriers in business with the broker.) With some predictive analytics built in, Procure IQ then gives that shipper a custom visual analysis, with recommendations for each move.

The tool offers shippers a new way to engage with Robinson, 80 percent of whose business is under contract of some kind. “A big part of this process is education — us learning about the shipper’s network, or the shipper learning about the overall network,” Gagnon said.

Education could be, for instance, a customer newly understanding and being able to visualize on a map a “producer marketplace … with more outbound than inbound loads,” and the price premium that reality creates for carriers. “From a carrier perspective, we’re thinking about this all the time. A lot of people perceive just the transactional part” of the broker’s relationship with carriers, but “we’re much more engaged in planning with carriers.”

In a certain sense, Gagnon added, technology like this brings the large shipper closer to the universe of owner-ops and small fleets working with Robinson by leading the way to a better understanding of the market they operate in. And C.H. Robinson sees the tool’s potential to change bid processes themselves with greater efficiency. It also promises a bit more of a transactional element within the shipper-broker relationship, underpinned by the ability to analyze the freight network in a collaborative way. That could lead to more dynamic, shorter freight contract lengths, with less effort required in the bidding process to make the right call by all parties.

Time will tell if analytics tools like this change anything fundamentally about smallest carriers’ engagement with large shippers directly. As it is, said Caplice, outside of working through a broker, “I don’t know how they break through to the big shippers,” given the cumbersome annual bid process and inability of the smallest carriers to commit to much volume.

The turmoil of markets this year has lately been a boon to small carriers as retailers have turned to spot negotiations increasingly to fill their needs in a reopened economy boosting consumer activity. The shippers C.H. Robinson has taken through its Procure IQ process to date, Gagnon said, have been willing to do so in large part due to that turmoil.

In Caplice’s view, it’s as simple as “the trucks aren’t where we need them,” he said, taking the shipper’s viewpoint. “Data we’re looking at [shows] the percentage of shippers going to the spot market … is going up.”

It feels like a good time for many small fleets, as attested by Southern California-based Angus Transportation small fleet owner Jimmy Nevarez. “Other than the crazy fires, freight is on fire as well,” he said, speaking from home base not far from the Bobcat Fire. “I lost one driver to the lure of greener grass on the other side of the fence, and gained two others in his place, but could probably still use another one or two with the volume we are seeing, to be honest.”

As Caplice and others know, though, total volumes are not back to normal, the significant caveat to the good times owner-operators like Nevarez are experiencing.

It’s likewise a caveat to the circumstances James Jaillet reported on here last week, and which Commercial Motor Vehicle Consulting’s Chris Brady underscored in his recent analysis of the recovery: Consumer spending has driven much of the freight takeoff of late, yet industrial production remains at much lower volumes as business spending has recovered more slowly.

Brady’s conclusion: The recent “strong growth in freight volumes from the re-opening of the economy and retailers replenishing depleted stocks is not sustainable, as consumption growth has begun to decelerate to sluggish-to-moderate growth rates, while business investment spending is gradually recovering.”

From Nevarez’s vantage, there’s no big new venture into contracts and expansion in the offing, likely. “I am not one to expand without knowing what winter will bring, though, so I may hold at four-five trucks.”