Previously in this series: No Turning Back: New era for direct freight

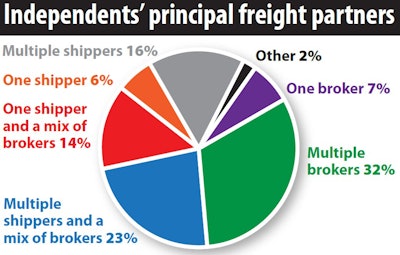

In the five years passed since Overdrive last asked for independent readers’ characterization of their principal customers, the “multiple shippers” choice rose by the highest percentage to double where it sat in 2015. Since then, conditions have been such that pursuit of direct business, always a goal of small fleets and owner-operators, has become more of a reality. COVID-19’s roiling of the freight markets, too, is offering further opportunities for those small enough to be nimble and smart enough to keep an eye out for the prize.

In the five years passed since Overdrive last asked for independent readers’ characterization of their principal customers, the “multiple shippers” choice rose by the highest percentage to double where it sat in 2015. Since then, conditions have been such that pursuit of direct business, always a goal of small fleets and owner-operators, has become more of a reality. COVID-19’s roiling of the freight markets, too, is offering further opportunities for those small enough to be nimble and smart enough to keep an eye out for the prize.Other new opportunities in the current market will flow through freight partner brokers, an avenue for most (76%) of Overdrive’s independent readers to some or all of their freight.

Large broker C.H. Robinson has brought technology to bear in its close work with shippers and carriers. Its new Procure IQ tool enables shippers to engage directly with Robinson, 80% of whose business is under contract of some kind. The tool gives shipper customers a window into Robinson’s carrier network, with an eye toward helping shippers through their own bid processes.

“A big part of this process is education — us learning about the shipper’s network, or the shipper learning about the overall network,” said Tim Gagnon, C.H. Robinson’s vice president of Data Science and Analysis.

He said the technology brings the large shipper closer to the universe of owner-operators and small fleets working with Robinson by leading the way to a better understanding of their markets.

Robinson’s use of data science helps carriers, too, whether they’re owner-operators “following the sun” — forever searching for hot markets on both ends of a load — or carriers with “a desire to be more predictable in what they do,” said Mark Petersen, Robinson’s vice president of North American Surface Transportation. “We can empower both of those mindsets.”

For those chasing the sun, Robinson’s recommendation engines can cut down on deadhead between those points, which in turn helps the broker keep rates manageable. Carriers looking for predictability can get closer collaboration to “watch where freight is consistent in our network,” Petersen said, and build lanes, triangles or other predictable patterns for owner-operators.

As with other brokers, Robinson’s dedicated freight lanes are on the rise, particularly headed into retail distribution centers, Petersen said, while power-only opportunities abound to run with the broker’s owned trailer pool.

Such opportunities are expanding nationwide, particularly for retail freight. In October, small-fleet owner Ben Cadle heard from a fellow Bennett agent about a pandemic-inspired opportunity. It will put two of his trucks on a dedicated lane between Augusta and Atlanta pulling doubles and triples, supporting e-commerce and other holiday-related freight.

“The rates are pretty good on it, and it’s dedicated,” he said. “I can count on that money.”

It’s hard to say whether the turmoil of freight markets this year will resolve itself quickly. What’s easier to predict: The boon to small carriers it’s been since the initial lockdowns — as retailers increasingly have turned to spot negotiations to fill their needs — should continue at least through the spread of a vaccine. Long term, it’s likely to change bidding processes to benefit small fleets.

Cadle believes supply-chain shifts easily could last longer than the virus. He believes large businesses are accepting that they’re “functioning with everybody working from home” and realizing how much can be saved by reducing commercial real estate costs. The pandemic is “changing the world possibly like 9/11 did. It will change it for a while, I know that.”

Read more in this series — from reporting on shifts in owner-ops’ experience of the nation’s truck stops to expanding telehealth options — via this link.

Read more in this series — from reporting on shifts in owner-ops’ experience of the nation’s truck stops to expanding telehealth options — via this link.One significant caveat is that though it does feel like good times for many small carriers, total freight volumes are not back to pre-pandemic levels. Commercial Motor Vehicle Consulting head Chris Brady underscored that in analysis of the recovery: Consumer spending has driven much of the freight takeoff, yet industrial production has continued to lag at lower volumes as business spending recovers more slowly. Brady’s conclusion is that strong volume growth is “not sustainable.”

Independent owner-operator Jose Williams feels that when a COVID-19 vaccine emerges and gets distributed, manufacturers that create trade-show exhibits are likely to return to a semblance of normalcy. Yet “they may use virtual shows to cut down on how many trade shows they do in a year,” he said — a potential long-term impact.

As for navigating brokers unwilling to make the long-term relationship investment in his business to reciprocate his own efforts, Williams has found an effective go-between in the relatively new SmartHop dispatch platform. He credits the service for actually responding materially to his feedback in his early arrangement with them in June, much better than he can say for a lot of entities.

“You’ve heard the saying, ‘You find out who your friends are when you’re down.’ … Good work should mean something. You keep the guy that’s really doing the work. You fire the fool who isn’t.”

When the crunch hit early in the year, “I saw where the benefit is for all the good work I did for all these brokers out here — nowhere.”

If it’s going to be all-transactional for them, Williams suggested, he’ll pay somebody else to bother with it.

For his longtime regular customers in blanket-wrap (some brokers among them), he’ll keep working directly — but with an eye out for other growth opportunities.

Next in this series: Volatile year shows growing pains of in-app freight pricing, value of negotiation