Given continuing freight market challenges and other economic factors, the economy was ranked as the No. 1 trucking industry issue for the third year in a row in the American Transportation Research Institute’s "Critical Issues in the Trucking Industry – 2025" report.

ATRI asks truck operators and motor carriers to select their top three choices from a list of 27 critical industry issues and subsequently rank their top three preferred strategies that correspond to each selected issue. Write-in responses were also allowed for both issues and strategies. ATRI assigned a weighted value to respondent rankings, then, to develop the overall top 10 -- an issue ranked by a respondent as most important received three points, an issue ranked second two points and third one point.

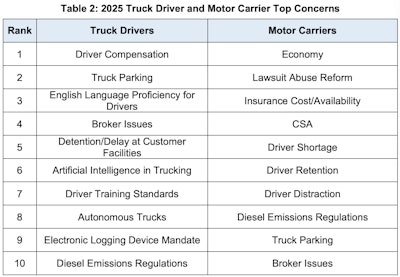

Among drivers’ top issues were concerns around compensation, truck parking, English language proficiency, broker issues, and detention/delay at customer facilities.

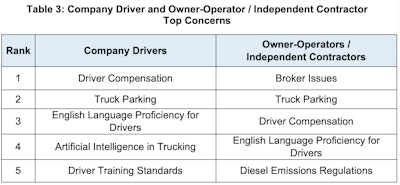

Top driver issues also differed between company drivers and owner-operators/independents. Owner-operators put broker issues at the top of the their list, with diesel emissions regs rounding out a top five.

Company drivers, on the other hand, had compensation as their top issue, followed by truck parking, ELP, artificial intelligence in trucking, and driver training standards.

Company drivers, on the other hand, had compensation as their top issue, followed by truck parking, ELP, artificial intelligence in trucking, and driver training standards.

In the overall top 10 issues were:

- Economy -- The combined impacts of rising operational costs and the lingering freight recession have led to more carrier bankruptcies, ATRI said. Non-fuel operating costs documented in ATRI’s annual "Operational Costs of Trucking" research were $1.779 per mile, the highest in the 17-year history of the research.

- Lawsuit abuse reform -- No. 2 is the highest rank for this issue in the 21-year history of the survey. While some legislation has been successful at the state-level in addressing aspects of lawsuit abuse, tactics employed by plaintiff's attorneys to target trucking companies also continue to expand, from third-party litigation funding to underwrite plaintiffs' cases to staged accidents designed to extort large settlements from trucking and insurance companies. The latter is the target of new federal legislation introduced in April 2025. The “Staged Accident Fraud Prevention Act” would make it a federal crime to engineer a crash with a commercial motor vehicle.

- Insurance cost/availability -- ATRI’s Operational Costs of Trucking research documented insurance premium cost increases of 36% over the past eight years. While multiple factors drive increases, the need for lawsuit abuse reform is certainly one of them, ATRI said.

- Truck parking -- After two years as the No. 2 overall industry concern, the lack of available truck parking dropped two spots this year. Among truck operators, however, it ranks as the second-most-critical issue.

- Driver compensation -- ATRI’s previous operational costs research found driver pay -- the primary contributor to cost increases in the three years following the COVID-19 pandemic -- rose by just 2.4%, half a percentage point less than inflation, over the most recent year. A recent analysis focused on operators' job satisfaction and found that predictable pay was cited by 81% of drivers when asked why they would look for employment elsewhere. The preponderance of votes for driver compensation as a top industry concern came from drivers themselves, yet ATRI noted that 8.1% of motor carrier respondents also selected driver compensation as one of their top concerns, reflecting the challenge of continuing to increase driver pay against a backdrop of lower freight volumes and declining rates.

- Compliance, Safety, Accountability (CSA) -- The federal CSA safety measurement program rose one spot this year to the sixth overall. Among motor carrier respondents considered alone CSA ranked fourth. In November of last year, the Federal Motor Carrier Safety Administration announced a number of changes that it intended to make to CSA in response to industry concerns, including reorganizing several categories of measurement (which will now be called "compliance categories"), simplifying severity weights, and placing a greater focus on more recent violations. FMCSA has continued to drag its feet on potential implementation -- as a result, ATRI said, CSA continues to rank high among survey respondents.

- English language proficiency for drivers -- ELP was added to the list of issues in the 2025 survey due to the significant number of write-in responses in 2024 that indicated drivers operating without being proficient in the English language was a top industry concern. With President Donald Trump’s executive order demanding ELP enforcement, and the violation’s return to the out-of-service criteria, ELP is now the No. 7 overall concern, and No. 3 for truck drivers considered separately.

- Diesel emissions regulations -- Debuting at number eight, concerns over upcoming emissions regulations emerged as a top ranked industry issue overall. This issue supplants previous concerns related to zero-emission vehicles, which had ranked as a top 10 issue the previous two years. The Trump administration’s move to revoke California’s electric vehicle sales and use requirements earlier this year dropped battery-electric vehicles from No. 6 in last year’s survey to No. 23 this year.

- Driver training standards -- This is another new issue debuting in this year’s overall top 10. Yet training standards first appeared on the truck drivers’ list of top concerns in 2019, when it was ranked No. 7 among drivers. It's remained on that list since, peaking at No. 4 in 2021. Based on the accompanying write-in comments and strategies ranked by drivers over the years, the majority believe that new CDL holders are not being trained adequately for safe commercial operation.

- Artificial intelligence in trucking -- The fourth issue to debut on this year’s list is so-called AI. Among truck drivers, AI in trucking ranks sixth overall. Now more than ever, the trucking industry is immersed in automation, electronic transactions across myriad supply chains, and technology utilization -- both in the cab and at freight facilities, according to ATRI. Researchers added that the “potential productivity and revenue gains from effectively using that data is unquestionable. However, there is concern that greater reliance on AI could lead to elimination of jobs, generating concern among industry employees. Additionally, AI-enabled fraud and theft create additional concern among industry stakeholders.”

[Relatd: OOIDA, Teamsters, ATA scrum in Senate hearing: 'Driver shortage', ELP, CDL fraud, more]

ATRI identified three other “emerging issues” that fell just outside the top 10 rankings -- driver distraction, "driver shortage," and broker issues.

The issue of “driver shortage” fell out of the overall top-10 rankings in this report for the first time in the survey’s 21-year history. “While this drop in concern is no doubt the result of the persistent freight recession, motor carriers still rank the need to find and retain qualified drivers as their number five and number six concerns, respectively,” ATRI noted.

“Driver shortage” ranked as the No. 1 overall issue for five straight years from 2017-2021 before falling to No. 2 in 2022, No. 4 in 2023, and No. 9 in 2024.

[Related: Chase away the phantom: There is no shortage of American-made drivers]

Download ATRI's full report here to see strategies for addressing each of the industry's top 10 concerns and more. Overdrive's recent survey engaged drivers' No. 1 issue with questions about compensation practices and preferences, particularly with respect to so-called "short miles" compensation. If you have missed it to date, utilize the module below to weigh in: