When broker AGX Freight shuttered, it left hundreds, maybe one thousand carriers unpaid and with its receivables pledged to a bank.

It's something AGX CEO Mike Williams said he "absolutely" regrets, but AGX leadership has already launched a new brokerage, raising questions about "chameleon" brokers at a time when "chameleon carriers" have been blamed for hiring unqualified drivers and driving a rising tide of freight fraud.

- AGX Freight recently closed after a dispute with a lender, and an inside source said the company's leadership misled carriers about getting paid.

- The company immediately pivoted to promoting a new brokerage, Freedom Freight Logistix.

- AGX leader Mike Williams said this isn't the case of a "chameleon broker," but declined to show documents proving AGX and Freedom have been transparent about affiliations, and won't offer broker transparency documentation to carriers looking to get paid.

Separately, a lawsuit against AGX and more than a dozen other brokers all caught up in the closure of the R&R family of brokers alleged the companies "continued to operate and incur debts that they could not pay." That's even after its lender, Huntington Bank, told them to "wind down their affairs in an orderly manner" as they lacked sufficient liquidity to carry on, all according to a civil complaint filed by Huntington Bank against R&R.

AGX's Williams forcefully denied Huntington's characterization of events, but said he'd pledged the company's receivables to the bank.

"There are hundreds of carriers and hundreds of loads that are unpaid to carriers. There might be a thousand" carriers unpaid, Williams said.

As for any future load payments from AGX, "the money gets remitted directly to a Huntington lockbox and they are bound and determined to collect their money first," said Williams.

In a long-challenged freight market, when the failing brokers and their banks disagree, it's carriers who left holding the bag.

AGX agent alleges carriers were misled about payment

An employee of AGX detailed to Overdrive how in the brokerage's final days in January, company leadership directed them to mislead carriers about payment.

But AGX's troubles stretch back further than January. In November 2025, R&R and the other borrowers, including AGX, hired "turnaround consultants to help R&R and the other Borrowers develop a plan to deal with their financial crisis," the bank's lawsuit said.

That same month, AGX let go of its marketing and communications director, Curtis Hazel. AGX's VP of business services and human resources, Kim Lessen, renewed her interest in a second MC number the firm had developed in 2023, changing its name from AGX 2 to Freedom Freight Logistix, according to Williams.

Williams said Lessen had long wanted to "spread her wings" and launch a woman-owned brokerage, and that going into the U.S.'s 250th anniversary, she changed the name for patriotic reasons.

Hazel, who AGX hired back on a contract to do crisis communications in late January, described launching a new MC as "common practice" among brokers.

Launching and holding multiple MC numbers is also a relatively common practice for carriers, too, yet it's often linked to fraud, and many of the "carrier vetting" systems employed by brokers in efforts to weed out bad actors flag carriers with shared addresses or common ownership.

By early January, the cracks were beginning to show at AGX.

"Going into 2026 we were going to exit our association with R&R," said Williams. "We had essentially decided to close down our trucking operation," a reference to affiliate carriers AGX Carriers and AGX Intermodal, "because we had been losing money for the last two or three years."

The AGX agent who spoke to Overdrive said that on January 8, after negotiating a load, the carrier wrote to say its factoring company wouldn't factor any AGX load.

Kim Lessen, VP at AGX, "told me to tell this carrier" they would get paid, and in the subject line of the email to put "ACH next day," the agent said.

The credit issue, the agent learned, had to do with AGX's relationship with R&R. AGX wasn't officially one of the R&R Family companies, but shared a lender.

"There are two owners of AGX, myself and R&R Express Holding -- the parent company of R&R," said Williams, who confirmed that the credit issue the carrier observed owed to AGX's relationship with R&R.

The agent "had no clue" about R&R and AGX's troubles and assured the carrier they'd get paid.

Williams said the "ACH next day" email sounded like AGX's "quickpay" option, something the broker commonly offered, but the agent said they'd "never offered" that option before.

The carrier "moves the load and everything is great," the agent continued.

Then, on January 9, AGX held an "all agents" call, wherein leadership told everyone "to find new homes" and that the brokerage would soon close, the agent said.

Four more days pass. The carrier delivers the load successfully. But by mid-January, no ACH payment had come through, and the proverbial next day has come and gone.

On January 10, the agent said a fellow agent posted on LinkedIn relaying what AGX's staff was told the prior day, that all would soon be looking for work, but they were told by someone at the company to take the posting down.

"I was told by Kim we would pay ACH next day. I did exactly like instructed," the agent said. "This hurts my reputation" with carriers and customers.

Finally, the agent said Lessen instructed them to tell the carrier to file a claim against AGX's surety bond. Carriers Overdrive spoke to who went unpaid after AGX's closure said they weren't expecting much of anything from the $75,000 bond when hundreds, possibly a thousand other carriers would seek payment.

"I don't care if it's $300, $3,000 or $300,000, they knew they couldn't pay," the agent said.

Shortly after, the agent learned that Lessen "already had another MC" and had already started a new brokerage.

Chameleon broker concerns around AGX and Freedom Freight Logistix

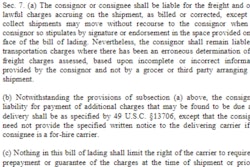

A screenshot from Freedom Freight Logistix's website.

A screenshot from Freedom Freight Logistix's website.

Freedom's website says it has the same ownership and leadership as AGX 2, as well as "decades of battle-tested experience in freight logistics" and "access to a capable network of carriers and service providers" that delivers "patriotic precision and unwavering accountability."

Lessen and Freedom Freight did not respond to Overdrive's requests for comment. Lessen's LinkedIn profile says she started a position as the Principal at Freedom Freight immediately after AGX's closure.

In February, records show Freedom Freight changed its address on file with FMCSA to another address in Jacksonville.

"Why are they doing exactly what they are trying to fight carriers doing?" said the agent. "We fight this every day with carriers buying new MCs or changing the MCs."

[Related: How much is your MC worth? Maybe as much as $30,000]

Williams said he "absolutely" has regrets about how AGX ended up, and that he's "doing everything I can to get the carriers paid," including waging an ongoing "debate" with Huntington, to whom AGX gave first dibs on all payments.

"AGX has an upstanding reputation and it was derailed" by Huntington, said Williams.

Further derailing that reputation was a hack days after AGX shuttered, when an entity posing as AGX began trying to book loads.

"As far as I know, AGX Freight’s credentials were not compromised," said Williams. "Someone appears to have spoofed AGX email or identity and was simply posing as an AGX rep for some possibly fraudulent purpose."

Overdrive asked Williams if Lessen had disclosed affiliations between Freedom Freight, as is required by Public Law 112-141 § 32103(D)(i), better known as the MAP-21 highway bill legislation.

Williams said he and AGX "have nothing to hide," but declined to show Overdrive OP-1 and MCSA-5889 filings to prove they had properly disclosed affiliations between the entities. "I'm sure we did" disclose affiliations properly, he said.

Are there "circumstances where brokers are not disciplined around their financial management and get out over their skis, so to speak? Sure," said Williams. "It ends up hurting carriers and it's wrong, but this isn't a chameleon broker. This wasn't part of some thing to screw over carriers."

Yet the agents at AGX got paid their commissions, shippers who would have paid AGX for moving the load are now paying the Huntington bank, if at all, and only the carriers who actually spent the time, effort, and fuel now sit empty-handed -- unless they can convince the shippers to pay them.

Lessen now advertises her experience and carrier network, perhaps the same established at AGX, to potential customers, but Williams said the brokerage isn't actually active.

"They are not booking trucks on Freedom Freight" right now, he said.

Broker transparency and brokers in default

As far as getting the carriers paid, Overdrive asked if Williams would hand over to carriers broker transparency documentation. 49 Code of Federal Regulations 371.3 states that broker must keep a records of each transaction, including the name and address of consignors, the bill of lading, the amount of compensation paid to the broker, and a description of any non-brokerage services performed in connection with the load.

[Related: FMCSA drops major hint on fate of broker transparency rulemaking]

"Each party to a brokered transaction has the right to review the record of the transaction required to be kept by these rules," federal regs state, although most owner-ops know exchange of full documentation between brokers and truckers rarely ever happens.

Would Williams hand over the paperwork to help carriers pursue payment from the shippers?

"No," he said.

Williams said carriers only want transparency documentation to negotiate better rates, and that the FMCSA's current rulemaking intending to make transparency an obligation for brokers would not "be helpful at all" when it comes to assuring brokers actually pay carriers.

But the Transportation Lawyers Alliance in a comment on the agency's broker transparency Notice of Proposed Rulemaking argued the opposite.

Broker transparency is "essential to determine regulated carriers’ compliance with rules of commerce for civil and criminal litigation, to address carriers’ rights in broker bankruptcies, as well as to facilitate production of records essential for the tracing of both stolen freight" and brokers' embezzlement of money rightly meant for trucking companies, the lawyers wrote.

In other words, co-mingling funds due to carriers and pledging receivables to a bank may violate brokers' duty to act in the financial interest of carriers.

Dale Prax, leader of FreightValidate, a carrier and broker vetting tool, argued an anti-fraud case for broker transparency enforcement.

"In the context of freight brokerage, brokers act as fiduciaries, holding payments collected from shippers in trust for the carriers," Prax told Overdrive in July. "By complying with 49 CFR 371.3, brokers uphold their fiduciary duty, ensuring transparency, proper allocation of funds, and the prevention of fraud or misappropriation."

The AGX case described here isn't unique, of course. When a big broker goes out of business, carriers commonly don't get paid.

In 2023, the collapse of Convoy, a digital freight brokerage once valued at $3.8 billion, left carriers in a nearly identical situation -- with a bank claiming first dibs on any payments from shippers that ought to have gone to carriers.

Williams described much of AGX's activity as standard industry practice, including the relationship with R&R and Huntington Bank, likewise starting a new MC.

But with dozens of brokers large and small shuttering every month after three years' worth of a tough freight market and shrinking broker margins, it's clear that standard industry practice includes stiffing carriers for uncontested, claim-free loads when the brokers and the banks don't get along.