The individuals behind the BridgeHaul app, available for both iOS and Android devices, came to their own spin on that as yet “elusive holy grail” (as we referred to tech-enabled shipper-direct freight marketplaces/brokerages in the December issue) after company Founder and CEO Brandon Shapiro’s direct experience in the contract and spot freight environment.

Shapiro “worked for a large multinational food manufacturer … with a few billion in revenue in North America,” he says, in charge of overall strategy and post-merger affairs. The company expanded by acquisition, and after it acquired a company, it was always an involved process looking at how to integrate transportation processes.

“We spent millions on consultants, going through rigorous RFPs [with carriers] negotiating lane rates,” he says. But too often, “when it came down to booking the truck at those rates,” many carriers it had contracts with simply “didn’t have the capacity and we ended up paying spot market rates higher than what we negotiated” with them.

The entire process on both contract and spot sides, he felt, was cumbersome and inefficient, and when he came to understand the dynamic that existed between brokers and owner-operators — where relationships are often purely transactional, negotiation little more than price haggling — like so many others out there “that’s when I decided to found BridgeHaul,” he says, thinking “there’s got to be a better way.”

With a goal of delivering predictable capacity directly to shippers and true value to owner-operators, BridgeHaul as a freight marketplace is just now getting off the ground, after a couple years’ worth of the associated app existing in stealth mode of a kind, without an advertising or publicity presence in the trucking apps’ market.

BridgeApp’s home screen on an Android phone.

BridgeApp’s home screen on an Android phone.But exist it does, with a few thousand drivers utilizing it either as a truck-stop locator/trip planner or for a smartphone-based logbook/inspection-report app today. Shapiro says users can expect a bluetooth-enabled ELD connection to your truck’s engine to satisfy the mandate in the third quarter of this year, and that will be a key piece of making the freight marketplace work best to the advantage of owner-operators in the future, if all else goes well. And it’s that freight marketplace that the company believes will deliver its success, ultimately. They differentiate themselves from others out there in that they’re only bringing in shippers, not brokers, for one, and focusing primarily on long-haul. And they’re taking the rate negotiation process out of the equation, promising shippers a market average for all freight moves — basing it on familiar sources of transaction data in the spot market.

Operationally, the BridgeHaul system is “fairly significantly different from what’s currently out there” among start-ups and long-established freight players alike, Shapiro says. “We flip the current model on its head.” Rather than allowing a shipper to pick from a series of bids from a carrier, in the BridgeHaul system “the driver actually selects the routes and the group of loads [from options among what] shippers have posted. There’s no active management by the shipper” on his/her side. Rather the shipper specifies a series of preferences within the system — level of cargo insurance, equipment type, driver rating in the system, carrier years in business, safety rating and the like — and “as long as the owner-operator satisfies that shipper’s condition, he can select that load,” Shapiro adds. In the end, “all a shipper really cares about is whether a driver is reputable and he’s safe.”

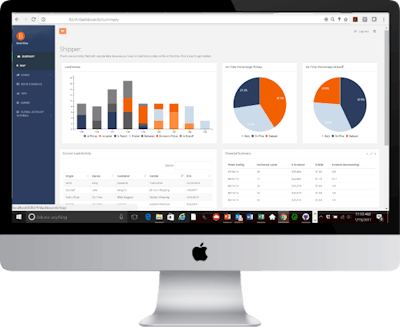

An example of BridgeHaul’s back-office dashboard for shippers.

An example of BridgeHaul’s back-office dashboard for shippers.Shippers will be posting their loads directly into the marketplace – the operator says where he/she wants to go, say L.A. to Chicago from such and such a date to another date. The algorithm powering the load-search-and-selection system is optimized to maximize profitability for owner-operator users between those two points, whether that means one single-shot load, two loads or three or more. “It might tell the driver, ‘Drive empty to San Diego – pick up to drive to Indiana, then from there a third load to Chicago.”

Operators would then review all the load details, accept them if desired, and the system would automatically establish estimated times of arrival and communicate to both parties, provide electronic bills of lading and proofs of delivery upon arrivals, automated check calls too. All of it is “filled and signed on mobile devices” on both ends, Shapiro says. Once the load is marked delivered, that “triggers automatic payment” to the carrier — again, based on average spot market rates.

Average rates are what they are, of course, and it’s no secret many owner-operator see them as generally too low, focusing on beating the averages as often and by as much as humanly possible. But Shapiro believes the value of this system will be in the ability to “optimize loads on multihaul routes,” he says, cutting down on negotiation/planning time — using technology to automate a cumbersome dispatching process that is not based on what load is hot and what’s not, but rather on maximum profitability through utilization.

Operators will take home 100 percent of the payment from the shipper in this system. Unlike other start-ups who’ve taken the model of charging a monthly fee to carriers for access to the marketplace or brokers that take a margin on the load, BridgeHaul will make its money by charging transaction fees to shippers instead, hoping to upend today’s model, where brokers are incentivized to part with as little as possible.

The company is opening up a pilot to a select few drivers with a couple of shippers in the next few of weeks. Within four-to-six weeks, Shapiro notes, the marketplace could be close to full open, depending on how things go.

As noted, there’s no cost for independents looking to try it out. Time will tell whether the company can crack the critical-mass egg on both carrier capacity and freight volume sides of the equation for it work as well as it could. While Shapiro notes the company has mid- to large-size shippers interested and is set to get things rolling, BridgeHaul will be “at their mercy” in terms of how much volume they want to feed into the system to start.