Rates haven’t been as good as they were last week since the Snowpocalypse of 2014, notes DAT’s Ken Harper. But before you attribute that to the unknown number of owner-operators who shut down last week (best estimate we have from online polling of readers, likely a high estimate at that, available at this link) in solidarity with demonstrations around the country against the FMCSA’s electronic logging device mandate, consider truck posts on DAT boards throughout the week weren’t off by much.

“Initial data indicates the shutdown doesn’t appear to have had much effect on truck posts on DAT” boards, Harper said at the end of last week, a couple percentage points at most.

What that amounts to is a few hundred truck posts less than seen in the prior week, and what Harper calls a “drop in the bucket” of well more than half a million combined load and truck posts over the course of any given week. Not all truckers make it a habit to post their trucks to the load boards, of course, nor do anywhere close to the total utilize boards as a principal load source. So measuring the impact with that number alone wouldn’t work.

And in a market like the one we’re currently in, “with the volume of freight that’s moving, there’s no perceptible decline in searches,” Harper says. Just the opposite, in fact. “It wouldn’t be unusual at all for truck posts to decline in a robust market like this with national average van rates at $2.09/mile, but searches to remain high as carriers can be more selective.”

At once, I might postulate that if brokers were finding it more difficult to match freight with trucks, and there was anecdotal evidence of such from owner-operators last week, an overabundance of load posting activity could have led what was a national van load-to-truck ratio that hit its highest mark ever recorded in DAT Trendlines last week.

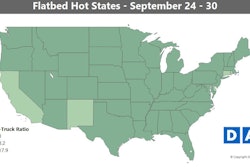

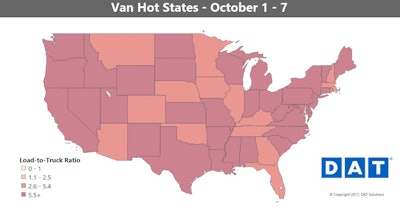

Spot market conditions were already quite good for truckers, as we reported last week with the weekly update of DAT’s state-by-state demand charts for dry van and flat segments. As for this week, says Harper, “anytime the national van load-to-truck ratio is above 6 and national rates are north of $2/mile, it’s good times.”

Other factors at play include a strong economy “gaining steam as we go into the holiday season, which is now extended and accelerated by e-commerce,” he says, tightened capacity as a result of that as well as Hurricanes Irma and Harvey, and East Coast ports benefiting from ships unloading there rather than the Southern ports (Savannah, Miami) that were still recovering from the hurricanes or dealing with relief efforts in the Southern U.S. and, later, Puerto Rico.

Then there’s cases like that of Springfield, Mo.-based small fleet owner Harold Hoffman, who might well represent another number that can’t be captured by any board. Hoffman believes “the government really screwed up when they took away” the ability to stop the clock in the hours of service with a mid-duty period nap. Before the change now more than a decade ago, “it was safer for the trucks and it was safer for the cars.”

When we talked a few weeks back, Hoffman, 67, was in the process of “selling all my equipment,” he said. “I’m selling everything – I’m going to be out of it by December.” He had plans to join on with another area carrier to help manage the operation. “I’ve had enough of Big Brother telling us what we can and can’t do” as a business owner.

At one time in recent years Hoffman was “running 18 trucks, then I went down to five a year or two years back. I parked the last one the other day, and it’s sitting out there.”

The national average van rate blew past the $2 mark last week and hit $2.09 per mile, the highest national average 2014. As noted the national van load-to-truck ratio is still high, after hitting the highest mark ever recorded in DAT Trendlines last week.

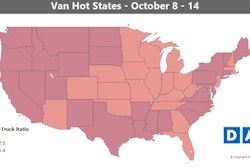

The national average van rate blew past the $2 mark last week and hit $2.09 per mile, the highest national average 2014. As noted the national van load-to-truck ratio is still high, after hitting the highest mark ever recorded in DAT Trendlines last week.Hot van markets: As can be seen in the map, hot markets shifted westward last week, and the biggest rate increases were in Seattle, Los Angeles, Denver and Stockton, Calif. Outbound rates have soared 40 percent in Seattle in the past month. Seattle has a reputation for being a “backhaul” market, meaning that outbound rates are usually quite a bit lower than the inbound rates. Load-to-truck ratios have been high throughout the Pacific Northwest, though, with higher reefer load counts in the region contributing to tighter van capacity. That meant that fewer reefer trucks were competing for van loads.

Not so hot: Things are finally starting to slow in the Midwest, but rates are still high. Columbus, Ohio, has been one of the hottest van freight markets ever since Hurricane Harvey caused massive disruptions, but rates have started to normalize. Prices are still way above seasonal norms, but they’re not quite as high as they were 2-3 weeks ago.

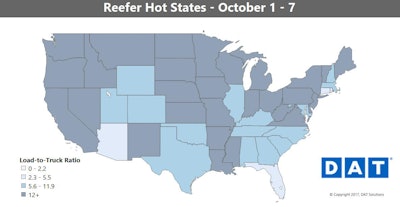

Seasonal harvests are winding down, but capacity is still tight for refrigerated freight. That’s led to higher reefer rates on the West Coast and in the Midwest, and as with vans, the national average reefer rate is the highest it’s been since 2014.

Seasonal harvests are winding down, but capacity is still tight for refrigerated freight. That’s led to higher reefer rates on the West Coast and in the Midwest, and as with vans, the national average reefer rate is the highest it’s been since 2014.Hot reefer markets: Reefer rates were up big in Northern California, where sizable numbers of owner-operators from the Sikh Indian-American community demonstrated last week. Reefer load counts got a big boost along the Mexican border in McAllen, Texas, and Nogales, Ariz., though not enough to turn the state dark in the map above. Potato shippers also seem to be feeling the effects of the ELD protests that have been scattered across the country. Those, combined with the supply chain disruptions caused by the hurricanes, have led to tight capacity in southern Idaho, and outbound rates continue to climb out of Twin Falls.

Not so hot: Outbound reefer rates continued to slide in Florida. The weakest reefer lane was from Lakeland, Fla., to Charlotte, N.C., which averaged just $1.19 per mile last week.