Owner-operators shutting down this week in protest of the electronic logging device mandate are forgoing some of the best freight and rate conditions on the spot market that have been seen in the past several years. Whether that’s cause for commendation or scorn depends on your political persuasion when it comes to the prospects of mandated ELDs, but that’s a discussion for elsewhere.

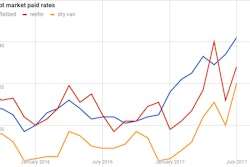

This week’s market charts from DAT, based on data pulled and crunched at the end of last week, show that, nationally, demand has been very strong and “rates soared in September,” notes DAT’s Ken Harper — the van per-mile average was 19 cents higher over the month than it was in August, and that’s 35 cents higher than September a year ago. Significantly improved conditions can in part be attributed to an uptick in movements following from Hurricanes Harvey and Irma, but it doesn’t tell the whole story.

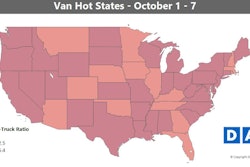

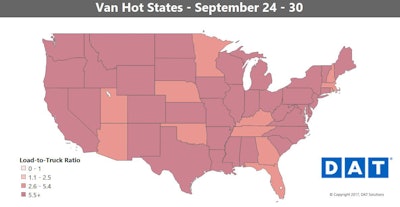

A big increase in port volumes back in July led to more truckload demand last month, too, since much of that freight didn’t start moving on trucks until August and September. Other indicators showed an improving economy in Q3, which also contributed to higher demand. All that pushed the national load-to-truck ratio up to 7 van loads per truck last week – uncharted territory for van freight.

A big increase in port volumes back in July led to more truckload demand last month, too, since much of that freight didn’t start moving on trucks until August and September. Other indicators showed an improving economy in Q3, which also contributed to higher demand. All that pushed the national load-to-truck ratio up to 7 van loads per truck last week – uncharted territory for van freight.Hot markets: Columbus, Ohio, is a key distribution point for the Midwest and the Northeast, and it shipped more to the Southeast after the storms. Freight disruptions have caused rates to skyrocket there in the past month. The lane to Allentown, Pa., soared 50 cents to an average of $3.86 per mile last week. Outbound rates also continued to climb out of Chicago.

Not so hot: We’re seeing more of a moderating trend compared to recent weeks, though, with lower van volumes and declining prices in a few areas. The biggest declines were for van loads leaving Atlanta and Charlotte for Florida, but rates on those lanes were still high.

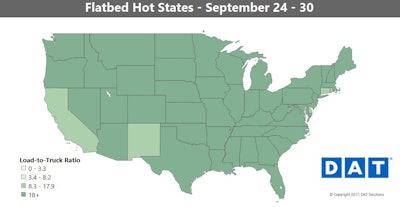

The immediate impacts from Harvey and Irma first showed up in van freight, then reefers. Now it looks like flatbed’s turn.

The immediate impacts from Harvey and Irma first showed up in van freight, then reefers. Now it looks like flatbed’s turn.Flatbed load counts are up to support rebuilding and recovery efforts. Outbound flatbed traffic from Houston stalled after the hurricane, but now it’s getting back to normal there and along the rest of the Gulf Coast.

Hot markets: After Irma, flatbed rates rose sharply out of Baltimore, likely due to ocean cargo being diverted to that port from Miami and Savannah, Ga. Flatbed freight trended downward in Las Vegas immediately after Harvey, but prices are on the rise again now that construction materials from Houston are moving again. Outbound rates in Cleveland rose 16 percent in September, with high volumes on the lane to Houston.

Flatbed rates coming out of Houston haven’t moved much, though, even as volumes have come back on nearly every major lane – could be something to watch going forward.

Not so hot: Rates to flatbeds have been down in port cities that were affected by Irma: Tampa, Fla., Jacksonville, Fla., and Savannah. The lane from Tampa to Atlanta remains the weakest of the high-volume flatbed lanes, since inbound loads from Atlanta are still well above normal. That leaves a lot of trucks in Tampa looking for a load out, so the outbound rate has stayed low at an average of $1.21 per mile.