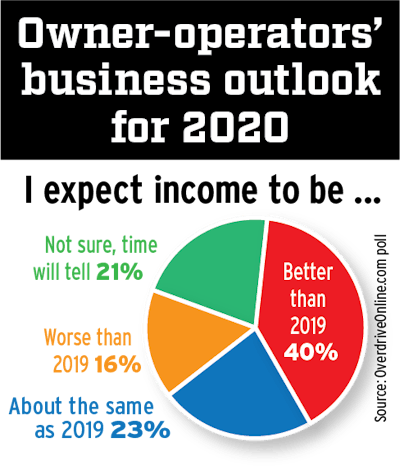

It’s not all hearts and roses and happy teddy bears holding lollipops, as it were, summed up by the variety of shrugs and SMHs the annual question on business income outlook for the new year got from Overdrive readers this year on social media.

Via Facebook, Renee Peek-Wiggins Crabtree singled out rising costs with “over-regulation, the cost of diesel fuel, driver retention, and an over-taxed industry,” she noted. It all “takes more and more. My bottom line isn’t increasing.”

Rates have been “in the sewer during 2019,” said Tom Puckett. “They will remain in the sewer for 2020. Believe it!”

Poll results, however, show a decidedly it’s got to be better than 2019 dynamic, with a great deal larger share of readers sanguine about income improvement in the year just started than was the case last year.

When we asked this question last year, a good deal fewer owner-ops were optimistic, and as rates had fallen hard toward the end of 2018 more expected, accurately, that market dynamic to continue well into 2019.

When we asked this question last year, a good deal fewer owner-ops were optimistic, and as rates had fallen hard toward the end of 2018 more expected, accurately, that market dynamic to continue well into 2019.Those inclined toward optimism for this year may have some cyclical data on their side.

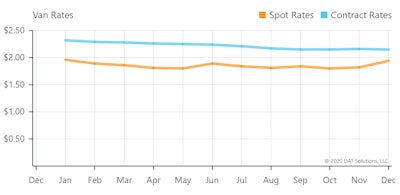

Economist Donald Broughton spoke to the rather large remaining spread between spot market and contract market averages toward the end of the year, in this piece of reporting by Max Heine, when historically it’s somewhat rare for such a large spread to remain for such a length of time.

They tend to at some point converge when shippers see opportunity in one market or another and, said Broughton:

“Traffic managers … shift more freight to the spot market” for lower rates. That “could come as a result of a rather severe increase in trucking company failures,” producing “declining capacity, which we haven’t seen yet,” Broughton said. Though Celadon’s failure was “very noteworthy,” given its size, the number of fleets going out of business in 2018 was a record low, and “2019 hasn’t been that high,” he said.

December showed the beginning of some spot/contract convergence, at least in that most ever-so-common barometer of the freight market — dry van average rates.

What moves toward convergence existed in this metric were more marked in the spot rise, at least toward the last part of the year, possibly portending at least some improvement in the general market for independents hauling spot freight. The reefer chart of this spread showed an even more pronounced upward spike in spot rates for both November and December, and flatbed moved up too in the latter month, though from a wider margin below contract rates.

What moves toward convergence existed in this metric were more marked in the spot rise, at least toward the last part of the year, possibly portending at least some improvement in the general market for independents hauling spot freight. The reefer chart of this spread showed an even more pronounced upward spike in spot rates for both November and December, and flatbed moved up too in the latter month, though from a wider margin below contract rates.It is undoubtedly that time of year, though — depths of winter, the slow period for many an owner-op (obviously not all). As always, there’s uncertainly, illustrated notably by the only category in the poll above that did not change from last year. Isn’t there a cliche phrase I can’t quite put my thumb on for that? The only certain thing is … uncertainty? (Death and taxes, too, I suppose. …)

Keep the shiny side up.

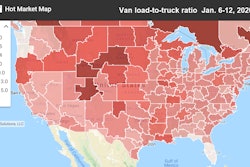

Some closer, quick looks at spot lanes and regions in the last week:

And other thoughts on the year ahead: