A scene no trucking company large, medium or small wants to see involvement in, that's for sure. The DialVan small-mid-size fleet out of Laredo, Texas, has been the victim of civil litigation after such incidents, including this one, where it was clearly not at fault in the crash. That, said the company's safety director, is the biggest driver of insurance premium cost increases going.

A scene no trucking company large, medium or small wants to see involvement in, that's for sure. The DialVan small-mid-size fleet out of Laredo, Texas, has been the victim of civil litigation after such incidents, including this one, where it was clearly not at fault in the crash. That, said the company's safety director, is the biggest driver of insurance premium cost increases going.

A year ago I wrote about the case of independent owner-operators Rick and Lisa Weddle, whose insurer singled them out for their good-Samaritan actions after a crash that had happened ahead of them. After they pulled over in efforts to assist the injured – and, yes, worked the CB mightily (to some debated effect given the aftermath) in order to get the word out to those behind them that a crash had happened ahead and to slow down, their rig was plowed into by another, and Rick suffered an injury in that himself.

Officially an injury crash now, the event would appear on their federal record in the CSA system, and figure into the risk scoring private companies serving insurers have now long done with that data, essentially re-creating the CSA system.

The underwriter sought to assure the Weddles' agent, though, that the accident would not directly affect their premiums if their insurance was tapped for the repairs – or more exactly: this is a not-at-fault loss and we will NOT rate for it regardless of what coverages end up paying out.

Come November and the Weddles' renewal, nonetheless, premiums were going up, Rick told me several weeks ago. "Our agent said it was because Northland was raising across the board," he said.

For Sergio Hernandez, safety director with the 60-truck, Laredo-based DialVan fleet, he sees the long ongoing increases for trucking companies around the nation as a result of what he calls "the biggest problem affecting all trucking companies nowadays, especially here in Texas."

Claims. "These lawyers are having a field day ripping these trucking companies apart right in front of the jury" in civil litigation, said Hernandez. "Our insurance agent surprised us when our insurance renewal's down payment went sky high, from always paying around $60,000 for 65 trucks to $133,000 up front," creating a cash flow nightmare for the fleet. "We had to let go of two employees because of this."

What does Hernandez attribute this to?

Let's say it again. Claims. Paid-out settlements in civil litigation, even though the trucking company was in no way at fault in the crash.

Small fleets and their required liability insurance policies, among other carriers', are the targets, ultimately, of such litigation. Right at this moment, Hernandez noted, "our company has two opened lawsuits waiting for court."

It's the last settlement and how it played out he sees as particularly insidious: "Our last settled lawsuit was for an accident that we had no fault in," Hernandez said.

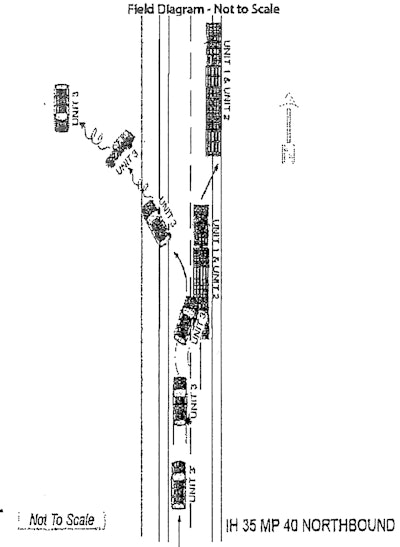

In the words of the investigator's narrative of the crash, the DialVan rig "was traveling northbound on the right slow lane" of I-35 when "Unit 3," an SUV according to Hernandez, "traveling northbound on the left fast lane" blew a right rear tire and lost control. The car sideswiped the DialVan rig, causing minimal damage, then veered left and rolled over "several times." The "driver and three passengers were ejected from vehicle, and one passenger was pinned inside."

In the words of the investigator's narrative of the crash, the DialVan rig "was traveling northbound on the right slow lane" of I-35 when "Unit 3," an SUV according to Hernandez, "traveling northbound on the left fast lane" blew a right rear tire and lost control. The car sideswiped the DialVan rig, causing minimal damage, then veered left and rolled over "several times." The "driver and three passengers were ejected from vehicle, and one passenger was pinned inside."

The SUV that hit the DialVan rig and lost control had all but one passenger ejected as it rolled over. Helicopters arrived at the scene to transport the passengers for medical attention. It was certainly a scene no trucking company or driver ever wants to be a part of, yet Hernandez is thankful that "all the passengers from the SUV survived. However, a teenager resulted as a paraplegic," and the family tried to sue Goodyear given a right rear tire blowout was the initiating causal factor for the crash.

"They got rejected due to the tire being 8 years old," Hernandez added, "so they turned to us, suing for $6 million."

After several months, what did they get? The $1 million DialVan liability policy limit. "Supposedly, it would have been a risk to go to court with them due to there not being enough evidence to protect us," Hernandez summarized his attorney's reasoning. "Now, we are expecting our next insurance renewal to be even higher since that loss will show up on our record of losses."

As a mitigation strategy after this particular event, DialVan turned "to dashcams." In just a matter of months, "we've managed to protect ourselves from a couple of fraudulent claims already," Hernandez said. "I really believe every motor carrier should own them to prevent these cases, that are now common, from happening to them."

The vulnerabilities extend beyond simple lack of exculpatory evidence from a crash scene. Hernandez does part-time work as a service to smaller motor carriers in his area conducting mock audits – carriers anywhere from 1 to around 30 trucks, he said. "There are thousands of them here in Laredo. ... The majority of all of them fail miserably, since they have no safety program in place. This is why lawyers are mainly targeting the transportation industry. We are their bread and butter."

If the minimum liability insurance level increases from the current $750,000 to $2 million – a figure floated in the last Congress and which could easily rear its head again, as these things go – look out.

Hernandez points to advocacy on behalf of motor carriers in his state via the "Keep Texas Trucking Coalition," which was founded to "help fight against abusive lawsuits from tearing up the trucking industry," he said. He recommends getting involved to anyone who will listen. The Coalition is pushing Senate and House bills in the Texas legislature aimed at significant tort reform to prevent certain aspects of trial lawyers' manipulation of evidence, among other elements in trucking cases, that end up in massive jury awards, even when trucking companies aren't truly culpable. Such awards are a reason small carriers' insurance companies and attorneys are so willing to cave on the basis of scant evidence, as in Hernandez's case.

As for the Weddles, Rick stressed the value of a good insurance agent – theirs managed to shop the coverage around and find pricing to beat the increase their insurer wanted to hand down. And they did beat it, in the end, for their two trucks.

In that regard, some things never change.

RELATED: Crash data and other related impacts of the CSA system and civil litigation were also discussed in Overdrive's recent panel discussion as part of the "Setting the Record Straight" package of features exploring the ins and outs, and the potential for reform of, the DataQs system for challenging inspections, violations and crashes. Catch the replay in the video below.