Since its release last year, the Comchek Mobile app from well-known fuel-card and other transport financial solutions provider Comdata has been garnering about 5,000 new users monthly. Comdata’s wide presence in facilitating load payments and fuel advances has translated to perhaps unprecedented ability for the provider to leverage the transaction ease enabled by smartphones with appropriate security to, as a general rule, help drivers and owner-operators “better maximize the use of their day,” says Terrence McCrossan, Senior Vice President and General Manager. “A lot of what we’re focused on is [along those lines of] driver empowerment, and getting the maximum amount of time on the road as they can.”

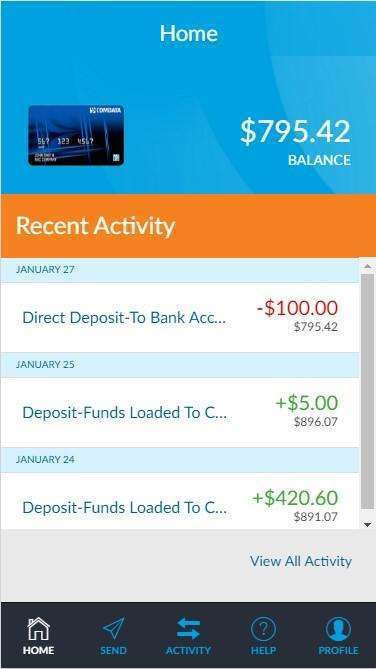

Screenshot from with the Android version of the Comchek Mobile app, also with an iOS version for iPhone users.

Screenshot from with the Android version of the Comchek Mobile app, also with an iOS version for iPhone users.Operators who use the mobile app with a central account are issued a personal debit card to which they can make funds available through the app. Funds can come directly into small fleets’ and independents’ accounts, of course, from brokers and others they do business with who use Comdata for payment processing.

The app also allows operators to input an express code from a physical Comchek and transfer funds from that check to their debit card, providing what McCrossan calls “a convenient way to use it at point of sale” locations.

Success has been such that Comdata’s garnering organic new business itself from referrals from trucker app users today, McCrossan says. After utilizing the app with other freight or carrier partners, “drivers themselves are requesting to get paid via Comchek mobile.” Transactions — both purchases and deposits — are then easily trackable and accounted for at tax time and in business-analysis programs.

The app “provides a two-year history of transactions for drivers,” accessible at any time, McCrossan says. “Notes can be attached to each transaction, [offering] a lot of convenience from the driver’s standpoint to manage their funds.”

Hauler spouses can register for the service too and drivers can make funds available “to family members,” McCrossan says, calling Comchek Mobile the “first peer-to-peer payment platform built for the trucking industry” specifically. Such peer-to-peer transfers within the Comchek Mobile network are happen free of charge.

What it all amounts to is an instant-pay platform from a company with tentacles spread throughout OTR trucking. As operators more and more come to expect it, quick/instant-pay models are “where we see both brokers and factoring companies really competing” with each other for carriers, McCrossan says.

Among brokers implementing Comchek Mobile’s capabilities in their systems is the tech-enabled Fr8Star and its open-deck-centric marketplace. As we reported previously, Fr8Star utilizes the Comchek Mobile system to partially automate payments upon completion of certain “milestone” events in any haul. At pickup, for instance, a certain portion of the load’s payment can be taken as a fuel advance, if needed.

At electronic proof of delivery, payment is delivered near instantly for owner-operators with the Comchek Mobile app, says Fr8Star CEO Matt Kropp, which is what users of the platform are most excited about. “The take rate” for fuel advances isn’t all that high, he says. “Why we were so excited about working with Comchek is that, 1) people know what it is but most importantly that it allows us to keep the promise we’ve made to carriers — that if you deliver, we will pay the same day.”

With typical direct-deposit set-ups, which Fr8Star is also capable of doing for non-Comchek Mobile users, it still takes a day or two for bank processing, ultimately.

And it’s not broker quick pay, or broker-facilitated factoring, given “we never charge our carriers a fee” to utilize the payment service, Kropp adds. “When we transfer money, we take the fee. It’s important to us that carriers get 100 percent of what they bid on the load, that if we tell them they’ll get $3,000, they get it.”

Comdata confirms that for Comchek Mobile users a small flat fee (not a percentage of the load, for instance) is assessed for those sending money. For cardholders, point-of-sale fees are borne by merchants, standard practice with credit and debit cards. Transactions such as ATM withdrawals have charges typical of a bank debit card.