Previously in this series: Factoring: A view from the broker’s side

The rise of smartphones and other networked communications technologies has opened payment options to brokers that have offered quick-pay services to carriers for years. Those rates, as with factoring prices, are coming down. They often beat factoring rates, particularly the nonrecourse arrangements popular with independent owner-operators working load boards.

Chicago-area-based owner-operator Isaac Ho investigated a factoring arrangement when he started up with his own authority within the last year, but he found the terms confusing. He decided to forgo factoring in favor of quick-pay arrangements via a few larger brokerages he felt he could stay loaded with and that offer reasonable rates.

Most “take the 3 percent, and you don’t have to fill out a huge pile of paperwork to sign up,” Ho says. Among broker apps he’s relied on are offerings from Uber Freight and J.B. Hunt’s 360 service.

Isaac Ho, pictured with his Volvo, decided to forgo a factoring arrangement, instead relying on technology-enabled brokerages’ platforms for quick payment to his new independent business.

Isaac Ho, pictured with his Volvo, decided to forgo a factoring arrangement, instead relying on technology-enabled brokerages’ platforms for quick payment to his new independent business.More traditional brokers also are migrating to mobile methods of payment delivery that increasingly may upend some of the need for factoring.

Load board stalwart Truckstop.com offers the LoadPay service to brokers and carriers. The company hopes it will become something of a standard among brokerages that do or do not rely on its load board to connect with carriers. Adoption of LoadPay by the broker means it’s essentially establishing the payment technology as its central quick-pay option.

The LoadPay app for carriers allows for speedy, secure payment for a fee of 3 percent, 2 percent of which goes to the broker, say Truckstop.com representatives. Brokers benefit by avoiding bank direct-deposit/wire fees, not to mention check fees. Truckers get the ability to choose just how fast they get paid via a smartphone app that stores a history of all transactions.

Fifty or more brokers and thousands of carriers are using it now, says Brent Hutto, Truckstop.com chief relationship officer. The oversize-specialized ZMac Transportation Solutions company recently adopted it as its central method of paying contracted carriers.

Adding brokers to the LoadPay system often can include somewhat cumbersome integrations into their transportation management software systems, meaning rollout happens on a case-by-case basis.

The average number of days for a broker to pay invoices from a factoring company has fallen considerably, based on Truckstop.com factoring company partners. When Overdrive published a similar chart in 2010, the average hovered near or above 30 days. Trends compressing payment time include truckers’ growing expectation of quick payment and the dwindling of paper-check transactions, cutting mail time from the process entirely.

The average number of days for a broker to pay invoices from a factoring company has fallen considerably, based on Truckstop.com factoring company partners. When Overdrive published a similar chart in 2010, the average hovered near or above 30 days. Trends compressing payment time include truckers’ growing expectation of quick payment and the dwindling of paper-check transactions, cutting mail time from the process entirely.Triumph Business Capital offers a somewhat similar service, TriumphPay, which also has seen greater market penetration. Blaine Waugh, Triumph senior vice president of sales, says about 100 brokerage clients use it.

Brokers increasingly will be interested in such platforms, says Terrence McCrossan, Comdata senior vice president: “The immediacy of the payment is a big part of the incentive for taking the load.”

Truckstop.com data verifies that. When looking for a load, the second-most-common metric by which users filter a search is the board’s “days to pay” information for the broker. “If you’re not in the 20- to 25-days range” as a broker, the days-to-pay average in recent years, “and your rating as a broker is not very good, your freight doesn’t move very fast,” Hutto says.

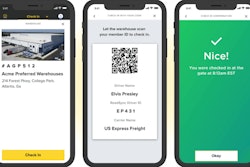

McCrossan’s company last year debuted Comchek Mobile, an app that helps add utility to speedy payment for users — whether that payment is coming from fleets in the form of a fuel advance or in a broker’s quick-pay program. Flat fees are assessed on those sending the money.

Comdata inked a partnership with the Fr8Star company, one of the newer technology-enabled brokers, to offer payment in stages upon the completion of milestones tracked within the Fr8Star app as truckers move the load. McCrossan describes Fr8Star’s interest in speeding up payment to its carriers as a way of “creating loyalty to their business model” among carriers that have a lot of options for freight.

A new generation of owner-operators like Ho increasingly are looking to such digital platforms as first-choice freight sources.

Next in this series: Real-time cash flow clarifies operations for small fleet