Irad Straus of the Melio accounts payable/receivable online platform wrote with a question some time ago. Why, he asked, was the company seeing third-party logistics companies as among the fast-growing set of users of its largely free technology for managing payments, invoices and collections?

Could be that a lot of you are getting paid by brokers these days through the platform was my guess. Is that the case?

Taking a little bit of a closer look at the Melio service, though, I thought I’d share some of the details on potential uses if you’re in need of a way to potentially speed up collections and/or expedite outgoing payments in a way that’s fairly easily tracked (for those of you who use QuickBooks for bookkeeping, Melio integrates with the Intuit-owned program). Much of the service itself is free to use (there are no suscription fees or business tiers where fees apply). That includes the ability to send payments via an issued check without having to cut the check yourself.

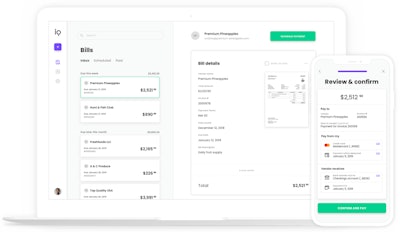

Melio’s payment processes illustrated on a laptop and mobile device.

Melio’s payment processes illustrated on a laptop and mobile device.Fees incurred when making payments with credit cards are 2.5 percent of the transaction, charged to the payer. For paying with bank cards or direct bank transfer, everything remains free. Whichever method you use as a payer, you can choose whether you want Melio to cut a check or send direct to a bank account, should you have the payee’s information.

One might utilize it for potential collections as well. If you’re an independent with regular customers that hasn’t moved beyond a single truck, this might be a way to engage the customer with a simple process, depending on the nature of the customer — if another business on the smaller side, it might help to speed things up without relying on a third-party company like a factoring service. The way it works for collections is you’d set up a custom online address through Melio which payers visit then to utilize the methods to pay described above, with a 2.5% fee applicable only if using a credit card — a reality you’d need to communicate to the customer, whoever it is.

You can find out more info via the company’s FAQs page.

Any particular cash-flow / collections tools you’re using you think others would benefit from knowing about? Drop us a note here.