Cherryville, N.C.-based independent Tim Hepler is proud of his 1998 Volvo 770, powered by a newly rebuilt Caterpillar 3406E. Asked if he’d noticed any shift in the market for pre-2000 model-year trucks in the wake of the Federal Motor Carrier Safety Administration’s electronic logging device mandate final rule, he slapped a price on his truck: “$150,000 now, and it will go up as December 2017 gets closer.”

That’s the compliance date for the ELD mandate, which exempts all owners of 1999 and older model-year trucks from compliance (based on the chassis Vehicle Identification Number, not the engine’s model year).

Published also in the December issue of Overdrive, this feature begins a series of stories about the real-world implications of the Federal Motor Carrier Safety Administration’s plans to require ELDs, from substantial opposition to the mandate, efforts to thwart it, and a growing number ELD service providers to potential impacts on capacity, rates and pay.

Published also in the December issue of Overdrive, this feature begins a series of stories about the real-world implications of the Federal Motor Carrier Safety Administration’s plans to require ELDs, from substantial opposition to the mandate, efforts to thwart it, and a growing number ELD service providers to potential impacts on capacity, rates and pay.While Hepler was being facetious with his offer, such sentiment has been a staple of comment boards and conversations with truck owners this past year as the compliance date has drawn closer and the Owner-Operator Independent Drivers Association’s efforts to overturn the mandate have been as yet unsuccessful.

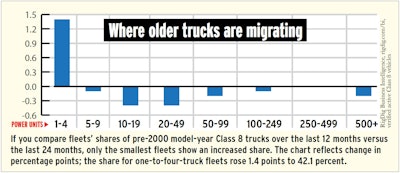

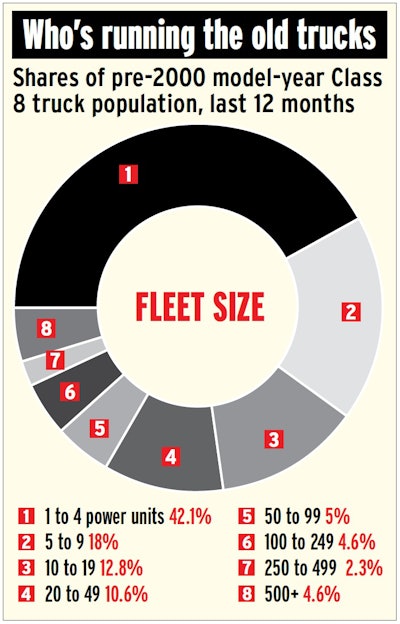

There’s evidence of some movement in the last year toward older trucks by the smallest of fleets. According to Overdrive sister business RigDig Business Intelligence, its database of verified Class 8 trucks on the road today saw the share of pre-2000 trucks owned by one- to four-truck fleets grow by more than a percentage point in the past 12 months.

During most of that period, a wait-and-see mode relative to future ELD mandate compliance has prevailed among most owner-operators, given it wasn’t until Oct. 31 that the 7th Circuit Court of Appeals upheld the ELD mandate. At press time, OOIDA still planned to press the appeals court for a rehearing. “We will file requesting the re-hearing before the deadline,” Dec. 15, said spokesperson Norita Taylor just a week before that deadline.

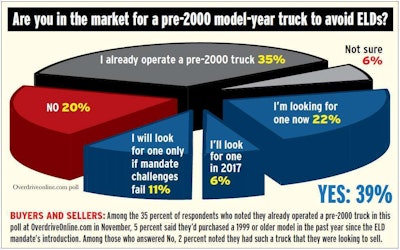

Among the 5 percent of Overdrive readers (reflected in the above graph in the share already running a pre-2000 truck) who’ve already put older vehicles into service since the mandate was announced is David Morin, owner of Z-Tranz, a Morganton, N.C.-based small fleet. Prior to the mandate being introduced, the owner-operator had four trucks, “two 1999 models, one 2000 and one 2001,” he says.

Though Morin was somewhat confident that broad opposition to the mandate at the time of its release might lead to its repeal, fear of the unknown with ELDs set in quickly. When the chance arose early this year to buy an additional ’99 model, he jumped at it.

A private party was selling the Western Star. “It needed a good amount of work,” Morin says, but at least “the motor supposedly had been rebuilt.” New head gaskets and other evidence gave him some confidence in the seller’s claim.

The work he put into it before introducing it into his fleet included “a bunch of small things” to start, and more after its first big run. Months later, with the unit in service and about $20,000 spent on parts and his time for the fixup, he feels like the seller was telling the truth about the rebuild. “It doesn’t use any oil,” he says.

David Morin and the 1999 Western Star he bought early in 2016, anticipating the ELD mandate.

David Morin and the 1999 Western Star he bought early in 2016, anticipating the ELD mandate.A $20,000 investment is not an insubstantial amount for a truck of that age, Hepler believes. About his own 1998 Volvo, he says, “Normally a truck like this, because of the age on it, might be worth between $3,000 and $5,000. But since this one’s been well kept up, it’d probably be worth a little more – $10,000 at the most” – in a normal market.

But that era of engines is already in higher demand, given minimal emissions equipment, says Chris Visser, National Auto Dealers Association senior analyst and product manager. “EPA ’98 and earlier trucks still in solid, usable condition are already bringing strong money in non-emissions regions due to their simplicity, fuel economy and reliability. The ELD cutoff will further increase demand for remaining trucks in usable condition.”

As the ELD mandate gets closer, Hepler wouldn’t be surprised to see “older trucks like this going to $30K to $50K retail, especially aerodynamic trucks with electronic motors. Those will be not just gold but diamonds, and might go even higher.”

Tim Hepler’s 1998 Volvo 770 primarily moves trailers in a power-only operation, often on lanes between Hepler’s Charlotte, N.C.-area home region and Florida. He uses laptop program Driver’s Daily Log, long popular with owner-operators, for his recordkeeping and has no plans to move to an ELD with the mandate in December 2017.

Tim Hepler’s 1998 Volvo 770 primarily moves trailers in a power-only operation, often on lanes between Hepler’s Charlotte, N.C.-area home region and Florida. He uses laptop program Driver’s Daily Log, long popular with owner-operators, for his recordkeeping and has no plans to move to an ELD with the mandate in December 2017.Morin agrees. “Right up close to the mandate, demand will go through the roof, and there’ll be price-gouging.”

Presenting at the Used Truck Association’s annual conference in November, Steve Tam of ACT Research predicted some private carriers and owner-operators will go for pre-2000 trucks. “The ELD impact should be a small positive” for the used truck market in 2017’s fourth quarter, Tam said.

Avondale Partners’ Donald Broughton, also speaking at the UTA conference, likewise expected some increased demand for pre-2000 tractors next year. He believed the number of owner-operators who will purchase specifically due to the mandate isn’t high.

Overdrive’s November polling results (see above) suggest a different assessment: 39 percent of readers indicated they are looking for a 1999 or older unit or would be by next year unless the mandate is overturned.

UTA President Craig Kendall, also president of Peterbilt of Knoxville in Tennessee, still sees strong demand for pre-2004 pre-EGR engines in “the right spec and useful mileage.” A couple of recent anecdotes from sales representatives have told the story of “customers talking about even older trucks to avoid electronic logging devices.”

Kendall says his dealership cautions buyers about financing. Even with a 2007 truck, he says “there aren’t as many finance sources, and rates aren’t near as good as on a newer used truck.” Mileage on a 10-year-old unit is often 800,000-900,000 or more, and closer to 1.5 to 2 million on a 1999. The increased cost of operation and maintenance for such a truck is a lot “just to avoid electronic logs.”

Landstar-leased owner-operator Gary Buchs agrees. “If operators rush in and then they run into a huge maintenance problem,” disaster would be the result, he says. “One of the biggest reasons people fail is that they get hit with a devastating bill for maintenance.”

Morin says that with any pre-2000 truck, it’d be safe to assume the need to rebuild the engine, up to a $20,000 investment or a lot of time if you’re performing most of the work yourself.

Also consider the overall cost of operating older equipment, Buchs says. “It could easily far outstrip how much e-logs might cut into their ability to operate.”

An easy way to find out the latter would be to download one of the non-engine-connected apps that will give you the ability to game your operation on e-logs without making a full investment or plugging/wiring into the engine. BigRoad, KeepTruckin and others have basic log book apps that can allow you to easily simulate an ELD environment, though you’ll have to manually key in all changes in duty status just like on a paper log.

Kendall ultimately believes the rush to ELD-exempt trucks may never materialize in a significant way, particularly as more owner-operators not in ELD-exempt trucks today get over the “fear of the unknown” that is trucking with e-logs. “Some of the feedback that I’ve gotten from company drivers and owner-operators is that at first, e-logs can feel constrictive, but once you get used to it, you don’t want to go back to keeping paper logs.”

Morin, for his part, remains categorically opposed to the ELD mandate. He makes a variety of arguments against it, believing it amounts to a prejudicial ruling. In recent times, he’s made his opposition known to his Congressional representatives in a series of letters (read one of them here) that make his arguments, something many other readers have done as well. All of Z-Tranz’ trucks are well-maintained, he says, and “have gone through in-frame overhauls. All the ABS systems are kept in working order as well. We have invested a lot of money and time into the two trucks that will fall under the mandate — the 2000 and 2001.”

He believes the mandate renders these trucks useless to him for resale, with little chance of being in demand. “Although they are in good working order, no one will buy them due to the mandate.”

Next: