Previously in this series: ELDs’ capacity squeeze assumption no. 1: Fewer miles

Assumption No. 2

Owner-operator-controlled businesses will leave the industry in large enough numbers to produce a significant capacity shortage in the spot market, driving up rates.

DAT analysts heard what Overdrive saw upon release of the ELD mandate Notice of Proposed Rulemaking in early 2014 — an alarmingly large number of operators noting an intention to exit the industry if the mandate went through. Overdrive’s initial survey about the mandate yielded percentages as high as 71 percent of nonleased independents saying they’d hang up the keys for good.

How much among those threats, DAT’s Ken Harper asks, is bluster? “We’re playing with fire” when trying to draw real conclusions from such polling, Harper says.

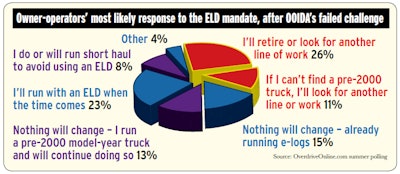

Owner-operators’ ELD intentions: Summer 2017

The percentage of owner-operators noting an intent to leave the industry fell precipitously but remained at 26 percent as recently as June in Overdrive polling, as you can see above. If you include those who say they intend to leave the industry if they can’t find a suitable truck with a pre-2000 model-year engine to avoid using ELDs, it rises to 37 percent.

If a fourth of owner-operators quit, it could amount to as many as approximately 60,000 trucks sidelined. That’s based on an owner-operator population of 240,000, the most recent for-hire owner-operator population estimates Overdrive’s made.

RigDig Business Intelligence, a service affiliated with Overdrive, estimates the for-hire operating Class 8 truck population at around 1.2 million. So if that quarter of owner-operators does indeed quit at year-end, for-hire trucking could be down 5 percent of capacity just from businesses shuttering and owner-operators retiring, to say nothing of the impact of lower productivity.

That’s principally why White sees a big opportunity for rate growth. “I do think some companies will shut down, whether they don’t want to comply or won’t be able to comply,” he says.

After a seasonally slow start, rates have strengthened in a fairly typical pattern this year, but better than the last couple of years. DAT reports spring linehaul averages not seen since 2014, making it a good year for truckers on the spot market. Truckstop.com’s national load-to-truck ratio has been above the 12 loads per truck ATBS’ Todd Amen feels is the equilibrium point.

Detention pay as productivity stimulus | Following a shift to e-logs, Old Time Express’ Mark White doubled the small fleet’s detention rate with its direct customers, who account for about 85 percent of its business, from $50 to $100 an hour after two free hours. That free time, something of an industry standard, he’s now cut in half with most of the brokers he uses, insisting on $100 an hour for detention after a single free hour when he can. “On any load – two hours loading, two hours unloading – that’s four hours you’ve lost,” he says. “You’re going to lose some productivity going paper to electronic, but it’s not all on the trucking company. Shippers and receivers are going to have to understand that they play a bigger role in it than anybody.” Hear a conversation with White and his brother, Mitch, via this link to a July edition of the Overdrive Radio podcast.

Detention pay as productivity stimulus | Following a shift to e-logs, Old Time Express’ Mark White doubled the small fleet’s detention rate with its direct customers, who account for about 85 percent of its business, from $50 to $100 an hour after two free hours. That free time, something of an industry standard, he’s now cut in half with most of the brokers he uses, insisting on $100 an hour for detention after a single free hour when he can. “On any load – two hours loading, two hours unloading – that’s four hours you’ve lost,” he says. “You’re going to lose some productivity going paper to electronic, but it’s not all on the trucking company. Shippers and receivers are going to have to understand that they play a bigger role in it than anybody.” Hear a conversation with White and his brother, Mitch, via this link to a July edition of the Overdrive Radio podcast.All that may well be true for spot averages, but as Harper notes, it takes a sustained period of growth or decline in the spot market before the contract market adjusts accordingly. White hasn’t seen contracts changing substantially in his automotive-related contract dry freight.

“If you go try to get a rate increase right now, you’ll get a polite ‘no,’ and someone else will get your freight,” he said in July. “I don’t know if it’s people going out and trying to get all they can before they get out of the business or just natural competition, but I see that downward pressure now.”

With spot improvements in May and June, White is hopeful for sustained improvement soon and beyond with ELDs, combined with economic conditions.

“If you can stand it for the next six to eight months, there could be some reward on the other side,” he says.

Next: