Successive rounds of diesel emissions regulations from the Environmental Protection Agency over two decades and more have had numerous cost impacts for heavy-duty trucks, including both the upfront cost of new equipment and downstream maintenance costs.

Beginning with the introduction of exhaust gas recirculation (EGR) with 2004 model year engines, followed by the diesel particulate filter (DPF) in 2007 to trap soot, diesel exhaust fluid (DEF) in 2010 to take on nitrogen oxides (NOx), and further greenhouse gas emissions reductions between 2014 and 2026 model years, changes to truck engines and their aftertreatment systems have been constant.

An early 2024 survey of Overdrive readers set out to analyze how those changes have impacted the cost of a new Class 8 truck, with the next emissions round quickly approaching with the 2027 model year. That's when EPA’s latest NOx-reduction regs take effect, barring further attempts to halt them. Congress last year put a revocation of EPA 2027 on the president's desk, with at least a small measure of bipartisan support, but that's where the effort fell flat. President Joe Biden vetoed the rollback.

Overdrive's survey report shows not only real-world cost impacts for small-business truckers, but also how different generations of equipment have performed, for better or worse, when it comes to long-term reliability and value.

The average price paid for a new truck before more recent emissions-reduction technologies came into play (generally the 2000-2002 model years), was around $113,750, based on information provided by the survey's largely owner-operator respondents. That jumped to $117,611 during the initial EGR era of emissions, up through the 2007 model year, when most units were produced with a 2006 model year engine.

By the time the DPF began appearing in earnest on trucks with 2007 engines, new buyers among survey respondents reported an average in the mid-$130Ks. A couple years later, when DEF was introduced for emissions systems with selective catalytic reduction to reduce NOx, averages jumped considerably more -- to around $140,000.

By 2015, when Phase 1 Greenhouse Gas regulations took effect for model year 2014 trucks, prices had ballooned to more than $160,000. The most recent emissions regulations, the Phase 2 GHG regs, began officially with the 2019 model year. Prices of those trucks have shot up considerably since, to just shy of $200,000 on average, with respondents reporting an average of $195,115 for a new truck between 2020 and 2024.

The inflationary impacts of COVID-19 pandemic-inspired supply shortages, and plenty federal stimulus spending on the demand side, no doubt played a big role in that most recent inflation. The price of any good has increased since the early-2000s due to factors innumerable -- increased labor costs, materials costs, research and design spend, escalating emissions regulations themselves yielding higher transport costs, and more. Separating out the regulatory impact on price inflation is thus exceedingly difficult. Yet around trucking, it’s generally believed that implementation of emissions regulations and the technology required to meet those standards are largely to blame for a nearly 100% increase in average new truck prices over the last 20-plus years.

“There is real cost [to meeting emissions standards] and it is really passed on" to the truck buyer. --Scott Pearson, President, Peterbilt of Atlanta

Results of a secondary Overdrive poll, conducted recently and with results charted below, underscored the view. Most readers indicated they felt the cost of trucks had outpaced the inflation rate of the broader U.S. economy since the turn of the century. But by how much?

The cost of emissions regulation: Perception/reality mismatch

Nearly a quarter of poll respondents (22%) chose the highest by how much estimate among "Yes" responses, noting they believed truck prices outpaced inflation by more than 40%. Only 5% chose the "by less than 10%" answer Overdrive arrived at after analysis of readers' reported prices paid for new trucks detailed in the survey report.

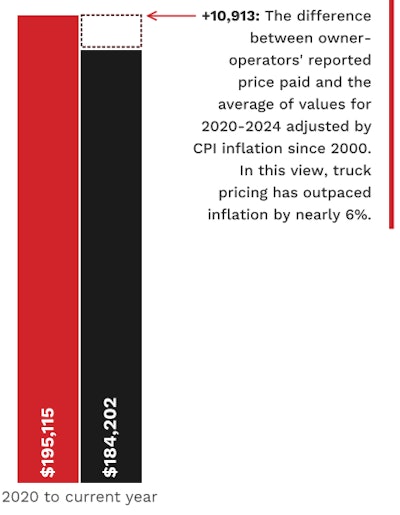

This snapshot of part of the owner-reported new truck price analysis, versus the Consumer Price Index inflation rate since the year 2000, showed truck pricing outpacing inflation by just 3%. Download the full report and analysis via this link.

This snapshot of part of the owner-reported new truck price analysis, versus the Consumer Price Index inflation rate since the year 2000, showed truck pricing outpacing inflation by just 3%. Download the full report and analysis via this link.

Looked at another way, comparing owners' emissions-regs model-year group average prices directly with averages for each group derived from the inflation rate since 2000, the result isn't much different.

The mismatch between survey respondents' expectations for truck price inflation's outpacing and the reality of economic inflation since the beginning of the century could point to emissions regs' impacts not just on the prices of new trucks, but on the broader economy itself.

And keep in mind, $195K-plus for 2020-'24 model year trucks is an average. Many respondents reported a purchase price of well above $200K for new trucks the last few years, some specialized units even north of $300K. On the flip side, depending on the truck and specs, some reported a purchase price as low as $120K for a new 2020-’24 rig, illustrating wide variation in operations and equipment needs.

Scott Pearson, chairman of the American Truck Dealers group and president of Peterbilt of Atlanta, said hard costs have certainly been associated with emissions changes through the years. At one time, he said, Peterbilt “literally put on the invoice a non-discountable emissions charge,” which “wasn’t part of the negotiated price of the truck.”

Extremely cost-conscious owner-operators, too, might opt for a less-costly style of truck than they did or would have bought in the early-2000s, Pearson noted. “Are they going to move out of their preferred long-and-tall platform? Or because of the emissions changes and the increased price of the vehicle, are they going to have to move to a jelly-bean aerodynamic truck just like everybody else has?"

Those trucks have "lower residual value over time, but lower up-front costs,” Pearson added. Such an owner pays less up-front for the new truck, or an equal price over time for less truck.

[Related: 'It's a deal': Perfect timing yields $50K saved on a new T680]

Pearson added that before working on the dealer side, he worked for Cummins and Peterbilt at the OEM level, leaving Peterbilt as an assistant general manager to “join the dealer world,” he said.

“I was at the OEM during several of these emission changes,” he said. “There is real cost [to meeting emissions standards] and it is really passed on" to the truck buyer.

Earlier this year, Cummins introduced its next-generation X15 diesel and natural gas engines, part of the company's fuel-agnostic engine platform. Reps detailed massive research and design investments the company was making to set itself up for the future of diesel and other power sources (natural gas, hydrogen) on a journey they're calling "destination zero," a reference to an ultimate emissions goal. Engine Business President Brett Merritt noted "tough challenges. But history proves that when Cummins faces challenges, and has enough time to innovate," the company delivers. In 2023 alone, Merritt said Cummins "invested $1.5 billion in the research and development of new engine platforms," likewise big facilities upgrades in New York and North Carolina plants.

Asked how all that investment and emissions regulations generally might impact the price of the product to the end user, Merritt noted it's generally too early to put a hard number of it.

Cummins North America On-Highway Vice President Jose Samperio, though, underscored a very real impact of ever-stricter emissions regs achieved through "new technology that has an impact on the cost of the product." He noted Cummins' ultimate goal, though, is to not only reduce emissions in line with regulations but increase fuel economy potential and other factors.

"At the end," added Merritt, "we have to deliver total cost of ownership with benefits to the end user."

“When DPF first came, I mean, we were clueless. Nobody knew anything. So, I don't expect that it's going to be as tough as when DPF first rolled out, just because we have a lot of very talented guys that have been working on these long enough, they actually have a clue now going into this.” --Owner-operator Joel Morrow, on EPA 2027 and prospects for maintenance difficulty

Pearson, though, suggested some of the value achieved to offset added costs wasn't always exactly a top priority for OEMs during past emissions rounds. As he noted about his earlier time working for equipment OEMs, "How a customer decides to mitigate that cost increase was a bit up to them.”

[Related: Cummins readies new diesel engine for 2027]

What to expect with the 2027 model year changes

Exactly how much emissions aftertreatment regulations and equipment has impacted costs is difficult to determine, but it’s clear that research and development costs, the cost of the actual equipment on the trucks and more have all contributed to price increases.

Joel Morrow, co-owner of the Alpha Drivers Transportation small fleet and owner of the Alpha Drivers Testing & Consulting firm that works with OEMs on improving truck efficiency and more, ballparked the cost increase of emission-reduction technology on today's trucks somewhere between $20,000 and $40,000. But he said there's some nuances to those figures that should be accounted for.

Joel Morrow drives this 2024 Volvo VNL 760, nicknamed "Boo-berry."Courtesy of Joel Morrow

Joel Morrow drives this 2024 Volvo VNL 760, nicknamed "Boo-berry."Courtesy of Joel Morrow

Growing up with a father who owned trucks, Morrow said he remembers replacing the rod main bearings every 150K-200K miles. "We were replacing air compressors, alternators, stuff on a rate, and that was just normal back then," he said. "It's stuff that we don't see a whole lot of today. So a lot of the stuff that were big ticket items back then, we don't do hardly at all today."

Morrow's family's business, Ohio-based Ploger Transportation, has "been running Volvo power since, I think, 2006 ... They've never done an in-frame." His brother Jerry Morrow has "a hundred-truck fleet, never had to do an in-frame. So the reliability of the base engine, despite what some people are gonna tell you, has gotten much, much, much better."

Perhaps the biggest indication so far as to how engine manufacturers are going to handle the next round of EPA regulations is a recent announcement from Paccar that its new MX-13 engine, available for order later this year, will be compliant with 2027 California Air Resources Board low-NOx standards.

When asked directly during reporting for this package of stories, the engine manufacturers were mostly quiet about the impacts of previous emissions regulations and plans for upcoming standards.

Paccar’s announcement, however, highlighted a larger-volume aftertreatment system that features a 48-volt generator located in the flywheel housing, and an electrical heater located in the inlet to provide lower NOx output.

Cummins, during its next-generation X15 event early in the year, also mentioned the addition of a "belt-driven 48-volt alternator," Samperio said, delivering power to an "aftertreatment heater" on-demand.

ATD’s Pearson said that while he couldn’t speak for what Peterbilt was working on, he said he expects “increased diesel exhaust fluid required to knock down NOx. You’ve got to pour more DEF in there to help the catalyst.” With that, he expects a bigger catalyst, which will add more weight to trucks. Additionally, “you might need to have some sort of heat injected into the exhaust.”

Part 2 in this series: 'Not gonna be a guinea pig' -- owners wary of maintenance unknowns with EPA 2027

Owner-operator Henry Albert, a member of Freightliner’s Team Run Smart and the Trucking Solutions Group of owner-operators (Albert was Overdrive’s 2007 Trucker of the Year), echoed Pearson’s expectations that there will likely be “increased DEF consumption,” which, he added, “I think that’ll also be offset by higher fuel efficiency.”

[Related: In a tough trucking-business environment, owner-operators must increase efficiency to compete]

Morrow said he expects Paccar’s aftertreatment heater solution “is going to become pretty standard across the industry,” coupled with “a lot of higher-voltage charging systems to accommodate these heaters,” such as the 48-volt systems Paccar and Cummins both mentioned.

Morrow works closely with Volvo Trucks as part of his consulting business, having a lot to do himself with the creation of Volvo’s I-Torque spec. While he said he can’t speak for Volvo and what the company has in the works, he believes new equipment for the 2027 model year will be more reliable than was the case after earlier emissions regs changes.

“I think as we become more and more comfortable with emission systems and more and more people start to understand the basic fundamentals of how things work, and the guys in the shop and the techs really start to understand how things work, as we transition into a more sophisticated emissions level, the level of understanding going in is much greater,” Morrow said. “When DPF first came, I mean, we were clueless. Nobody knew anything. So, I don't expect that it's going to be as tough as when DPF first rolled out, just because we have a lot of very talented guys that have been working on these long enough, they actually have a clue now going into this.”

[Related: The top 5 diesel fault codes, and emissions issues you can do something about]

Million-dollar question: How much will new emissions tech increase costs?

Henry Albert today drives this 2022 Freightliner Cascadia. He said that while trucks have certainly gotten more expensive (the first truck he bought in 1996 cost him $63,000), "with the amount of uptime, if they're properly maintained and properly driven," the cost savings are significant compared to older trucks when considering maintenance requirements, he said.Courtesy of Henry Albert

Henry Albert today drives this 2022 Freightliner Cascadia. He said that while trucks have certainly gotten more expensive (the first truck he bought in 1996 cost him $63,000), "with the amount of uptime, if they're properly maintained and properly driven," the cost savings are significant compared to older trucks when considering maintenance requirements, he said.Courtesy of Henry Albert

Morrow speaks to one of the biggest impacts owner-operators have seen with big emissions changes through the years. Maintenance headaches were earmarked by Overdrive survey respondents as a principal effect of emissions regs, coming in among the absolute most common responses to the question charted below.

Also among the biggest impacts? You guessed it -- truck equipment price increases were also flagged by about two-thirds of respondents.

In its final rule published in December 2022, putting the 2027 NOx reduction requirements in place, EPA itself estimated a $4,827 per-truck increase for technology costs for long-haul combination trucks. That figure, however, was based on 2017 dollars -- it's equivalent to $6,243 in 2024 dollars.

EPA also estimated the lifetime DEF costs per truck associated with the 2027 regs. Based on DEF prices using 2017 dollars, EPA estimated an additional $3,612 (or $4,671 today) over the lifetime of the system, at a 3% discount rate to account for “operating costs which occur over time.”

Finally, EPA also estimated an increase in lifetime emissions-related repair costs per vehicle for long-haul combination trucks.

“The final extended warranty and useful life requirements will have an impact on emission-related repair costs incurred by truck owners,” EPA said in its final rule. The agency expected generally lower owner-incurred emissions repair costs because of longer emission warranty requirements, as well as "improved serviceability in an effort by OEMs to decrease the repair costs that they will incur. We also expect that the longer useful life periods in the final standards will result in more durable parts to ensure regulatory compliance over the longer timeframe.”

However, outside the warranty and/or useful life periods, EPA said, “we also expect that the more costly emissions control systems required by the final program may result in higher repair costs, which might increase owner-incurred costs” once warranty periods expire.

Part 3 in this series: Used-truck pricing, value: A role for aftertreatment maintenance

Assuming all emission-related repair costs are paid by manufacturers during the warranty period, and beyond the warranty period the emission-related repair costs are incurred by owners, EPA estimated a $3,028 increase in lifetime emissions-related repair costs per truck, or $3,916 today.

Pearson sees four areas that will impact truck prices and associated costs: hardware, R&D, extended warranties required by EPA, and potential downtime due to unexpected service needs.

“You add more to the vehicle, that hardware’s got a cost,” he said. “So there’s a true hard cost right there. Getting that hardware developed, designed, created, tested. That’s development cost, and that isn’t free either. You know that gets figured out and gets rolled into what the new overall cost to produce that vehicle has got to be.”

Then, with EPA requiring longer warranties from the OEMs to ensure the trucks and their aftertreatment systems “are maintained at optimum levels through the initial life of that engine and the emission system. Well, that warranty costs,” Pearson added.

Couple all of that with the potential for maintenance issues that have occurred in previous rounds of emissions standards. Maintenance issues yield downtime -- that, of course, even if repair costs are covered under warranty, costs a business in lost work. “I haven’t seen a new emission system that came out and was 100% reliable,” Pearson said, “so I’ve got to anticipate there’s another cost there.”

With previous emissions regulations rounds in mind -- EGR in the early-2000s, DPFs in 2007 -- Pearson said he believes the coming round could be “DPF on steroids. And with software that’s going to try to control it ever more so precisely ... it’s going to be a pretty big one, in my opinion, in terms of the changes that we’re going to see.”

[Related: 3 ways to extend DPF life and keep filters running cleaner]

While Morrow believes there will be “a significant price increase” with the 2027-emissions-spec engines, he does see some potential for offsetting that increase with efficiency. “As we have to up the voltage capacity -- maybe go from 12- to 24- to 48-volt, whatever the case may be -- being able to generate that type of power on the truck will open up a lot of avenues towards further enhancing eAPUs and things like that that might potentially help offset some of this cost through increased fuel mileage,” he said.

He also expects to see better fuel mileage in general with the new systems, but asks, “Is it going to be enough to offset that cost? That remains to be seen.”

Owner-operator Theron Thompson, driving a 2021 Kenworth T680 leased to Sioux Falls, South Dakota-based K&J Trucking, said he understands there’s a cost associated with everything that goes into designing and building new trucks and engines. “I do have to say that technology is probably one of the biggest increases in price. Materials will be the next,” he said.

New truck designs, like the new Peterbilt 589 replacing the iconic Model 389, represent a “huge bunch of money that Peterbilt or Paccar spent to redesign that truck to still continue to keep the long hood out there to keep the independent owner-operators happy,” Thompson added. “There’s a lot there just in development work … so that increases [prices] quite a bit because you’ve got to have somebody that can sit there and envision something that is going to sell.”

Add on top of that the EPA adding new emissions requirements, and OEMs then have to spend even more time and money figuring out how to meet the standards, he added.

The next story in this series focuses on reliability issues of past, present and future emission-reduction technologies. Find reliability ratings for various generations of diesels over the decades in the survey report, EPA's Diesel Emissions Regulations: Pricing and reliability impacts over two decades.