This picture from the Quality Transport driver described in the article shows the long line of trucks awaiting to unload at a Costco distribution center in California last week.

This picture from the Quality Transport driver described in the article shows the long line of trucks awaiting to unload at a Costco distribution center in California last week.Mid-week last week, a driver for Quality Transport Company, a 31-truck fleet out of Freeport, Illinois, was hooked to brokered load bound for a Costco distribution center in Tracy, California. The operator happened upon a sight he’d not seen before seen before in his 30 years behind the wheel: An approximately 200-truck line — and growing — waiting to drop off.

“We didn’t know what to do,” says Amanda Schuier, senior vice president at Quality, who was communicating with her driver at the time. Of course, the driver had another load after the Costco drop-off awaiting a pick-up at another facility, but he was stuck with the dry van full of food-safe containers.

It was uncharted territory for all involved, says Schuier. “Do we try to reset the appointment and attempt to deliver again? Do we take it back to the original shipper? We ended up pulling him out of the line and getting him to a safe place to park for the night so we could try to figure out a plan,” she says.

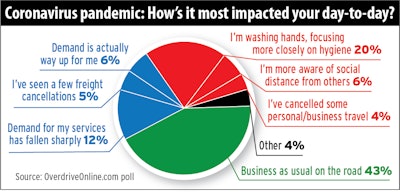

For almost more than half of poll respondents late last week and over this past weekend, business as usual and a new sense of urgency over basic personal hygiene were the orders of the day, yet already severe ripple effects of tightening travel, big-event cancellations and other curtailed economic activities were already being felt. Some saw rise in demand, too, with retailers’ emergency restocking efforts as panicked buyers cleared some shelves at stores – notably dried beans, rice, toilet paper and a variety of cleaning supplies and hand sanitizer. (Click through the image to enlarge the text.)

For almost more than half of poll respondents late last week and over this past weekend, business as usual and a new sense of urgency over basic personal hygiene were the orders of the day, yet already severe ripple effects of tightening travel, big-event cancellations and other curtailed economic activities were already being felt. Some saw rise in demand, too, with retailers’ emergency restocking efforts as panicked buyers cleared some shelves at stores – notably dried beans, rice, toilet paper and a variety of cleaning supplies and hand sanitizer. (Click through the image to enlarge the text.)The driver then waited at a nearby truck stop for two days before he was able to get to the facility and deliver the load. But the delays obviously rippled through the fleet’s scheduling. As of Monday, Schuier was making plans for her in-office personnel to work remotely, but “most of my drivers seem to want to continue to do their jobs the way they always do,” she says. The fleet has “communicated to them to limit exposure and contact in truck stops the best they can, but they want to stay on the road.”

What the Quality driver faced was likely an extreme example at a retailer, Costco, who faced a nationwide swell of consumers seeking food items and other household goods last week as fears surrounding the outbreak of the COVID-19 coronavirus ratcheted up. But he’s not the only trucker to report a variety of headaches in pick-ups and deliveries surrounding the unprecedented effects of the pandemic.

Trucker Eli Vaughan, for instance, noted that as a result of COVID-19 precautions “my main shipper will not allow drivers or visitors to enter their facility. Back up near the door, take the chains, straps off. … Or vice versa. Can’t use the bathroom or break room” at all, he says.

Many respondents to Overdrive polling conducted in recent days report business as usual, though almost 20% reported either cancelled appointments or a sharp decline in demand for their service. “We haul fuel, and there are now no loads, yet the bills continue,” says Iva Ludlow, awaiting word with others on whether relief packages coming out of Washington could ultimately deliver support to small business and/or wage workers impacted by the crisis.

As Michael Baskinger voiced in response to the poll question, “I do entertainment transportation. My tour was canceled and my income has now come to a screeching halt.” For those with truck payments in this emergency situation, some advised consulting with finance partners to potentially skip payments as a result of the emergency. One operator had success with his bank with a call placed late last week.

Six percent of respondents reported a spike in demand for their service, but 43% said business appeared normal. Other readers (26%) reported concentrating on “social distancing” — keeping at least six feet of distance between yourself and others in public places — and focusing on washing their hands and practicing good hygiene.

Commenter Larry, a self-described “ol’ guy” who’s “seen a lot in my time,” got down to brass tacks with his advice for his fellow driver. “If you get sick, stop. Rest. Get well. Go back to life.” He was cynical, as were some others, about the threat for most in the population, including himself, believing the response to be well out of proportion to it.

Immediately, some freight sectors within dry van and reefer are “busy helping retailers restock empty store shelves,” says Peggy Dorf, an analyst at DAT, though coronavirus-related cutbacks in ocean freight and air cargo are bound to hit trucking soon, she says.

“The impact of the coronavirus will add volatility to freight flows, as surges in consumer demand alternate with potential constraints on imports, exports, and industrial production,” adds Ken Adamo, chief of analytics at DAT.

FTR, likewise, says the impact on U.S. freight demand will be hit hard as imports in recent months fell off a cliff. Panic buying and retail replenishment will be short-lived, the firm notes, and some sectors in the coming months could take enormous hits, with many economists predicting a global recession coming, even if short-term.