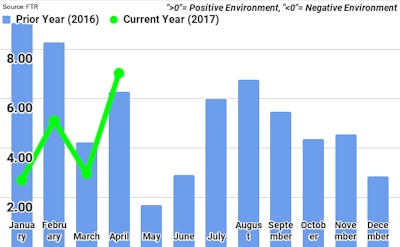

The Trucking Conditions Index (TCI) from the analysts at FTR Transportation Intelligence showed a big jump in April after falling in March. Hitting a reading of 7.03, it was up more than four points from March. FTR expects industry conditions to improve despite current year-over-year weakness in contract freight pricing.

Several data on trucking industry variables go into FTR’s monthly Trucking Conditions Index: freight volumes, freight rates, fleet capacity, fleet bankruptcies, fuel price and financing. The individual metrics are combined into a single index that tracks the market conditions that influence fleet behavior. A positive score represents good, optimistic conditions. A negative score represents bad, pessimistic conditions. The index purports to show the industry’s general health at a glance.

Several data on trucking industry variables go into FTR’s monthly Trucking Conditions Index: freight volumes, freight rates, fleet capacity, fleet bankruptcies, fuel price and financing. The individual metrics are combined into a single index that tracks the market conditions that influence fleet behavior. A positive score represents good, optimistic conditions. A negative score represents bad, pessimistic conditions. The index purports to show the industry’s general health at a glance.Demand, as Overdrive has reported in the context of the spot market in recent weeks, is moving higher as the industrial sector continues to improve and the number of available trucks tightens, FTR says. The first quarter of 2017 registered the second strongest freight growth of the current recovery. The balance of 2017 is expected to grow more modestly. FTR forecasts the Trucking Conditions Index may fall off somewhat from the April reading in the next few months, but it is expected to remain in mid-range positive territory through 2018.

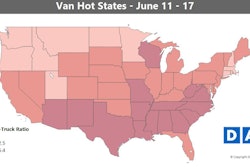

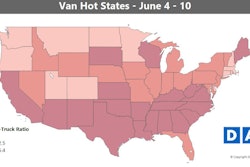

Jonathan Starks, Chief Operating Officer at FTR, had this to say about the freight picture for contract and spot carriers year to date: “Overall, our expectation of improvements in freight demand for 2017 are coming to fruition. However, we are seeing a significant difference between the contract carriers, specifically those in more dedicated routes, and the spot market. Contract markets are showing limited load growth and weak pricing, but spot market indicators are telling a very different story. Data from Trans4Cast.com shows that spot market load activity in early June was up more than 50 percent compared to the same time last year. Importantly, truck capacity in the spot market is down during that same time. This has led to significant rate increases for spot moves, with the average rate up more than 10 percent on a year-over-year basis. We typically see spot markets move prior to the contract arena, so we would expect to see stronger contract pricing negotiations as we finish 2017 and head into 2018.”