Though the firm offered no specific numbers on the number of carriers who’ve gone under, its report says small carriers have had a much harder time absorbing the poor freight volume and sinking rates than their larger counterparts, given smaller carriers “higher unit cost structure,” Stifel says.

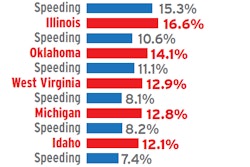

What’s more, Stifel says, the trend will likely continue for some time, especially as federal regulations drive up carrier costs and further restrict small carriers’ productivity. “[Small carriers] struggle to make money in this challenging spot market even though a good number of these carriers are not compliant (i.e., they cheat) on hours of service and speed,” the report says. “Many of these carriers may fall out of the industry faster than they otherwise would have had the cavalcade of federal regulations been their only headwind.”

Stifel notes in its report that all carriers are being adversely affected by the current freight and rate environment, and larger carriers are cutting their fleet size in an effort to cut costs and protect equipment utilization.

Shippers are “pounding on rates,” the report says, referring to the present pricing situation as “rate carnage.”

Though coming federal regulations — like next December’s ELD mandate — will likely be a pain point for smaller carriers, such regulations could cause rates to spike, offering small carriers at least partial reprieve from poor rates and costly compliance with new regulations.