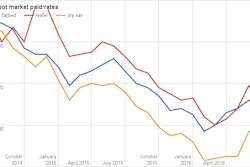

As we’ve noted in a recent weekly spot market update, the typical July slump in rates wasn’t as bad as it has been in recent years. And though a report from earlier in the week based on data from Truckstop.com showed a lower July average for rates in all three major trailer types versus June, DAT Load Boards’ network showed the opposite for vans, a slight gain in the month of July.

It’s one of a couple “good signs that we’re watching to see if they hold up,” says DAT’s Ken Harper. Also: July ended on a high note for load availability/volume, and it was looking good as we entered August this week.

“This is very atypical for late summer,” Harper adds. “Like everybody else, we’ve read that the large fleets are reducing capacity and cherry-picking lanes in response to the rate pressure from shippers. That may be putting more freight on the spot market.”

We’ll see if the trend holds through this week.

One factor is trending the “wrong” way, Harper adds, however: diesel prices are dropping, by a few cents a week. That’s good for the time being, as fuel surcharges hold, but eventually they’ll follow prices down.

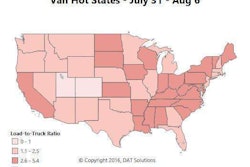

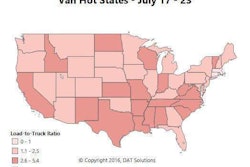

On a week-to-week basis, the national average van rate dipped a cent last week to $1.64 per mile. But load availability was also up, and load-to-truck ratios improved. Those positive signals are usually followed by rate increases. Memphis had more loads last week, as it replaced Houston as the number 3 market for load availability, following Atlanta and Dallas. Memphis outbound rates were down for the week, but rates are rising in the Midwest, starting with Columbus. This could be due to retail re-stocking for back-to-school season, which would be a good sign.

On a week-to-week basis, the national average van rate dipped a cent last week to $1.64 per mile. But load availability was also up, and load-to-truck ratios improved. Those positive signals are usually followed by rate increases. Memphis had more loads last week, as it replaced Houston as the number 3 market for load availability, following Atlanta and Dallas. Memphis outbound rates were down for the week, but rates are rising in the Midwest, starting with Columbus. This could be due to retail re-stocking for back-to-school season, which would be a good sign. The flatbed rate picture has been improving as a national average since the first week of July, but it hasn’t returned to June’s level yet. On a lane-by-lane basis, flatbed trends swung wildly. Rates were hurt by changes in the mix of cargo. Also, when demand slacks off for van and reefer freight, there are more trucks available. That extra competition drags flatbed rates down, too. Rates peaked around the July 4 holiday, and then we had these big rate swings for the rest of the month. One common theme: A lot of the lanes with rising rates go into or out of big markets in the Southeast. Hot Markets include: Jacksonville, Fla.; Savannah, Ga.; Raleigh, N.C.; and Roanoke, Va.

The flatbed rate picture has been improving as a national average since the first week of July, but it hasn’t returned to June’s level yet. On a lane-by-lane basis, flatbed trends swung wildly. Rates were hurt by changes in the mix of cargo. Also, when demand slacks off for van and reefer freight, there are more trucks available. That extra competition drags flatbed rates down, too. Rates peaked around the July 4 holiday, and then we had these big rate swings for the rest of the month. One common theme: A lot of the lanes with rising rates go into or out of big markets in the Southeast. Hot Markets include: Jacksonville, Fla.; Savannah, Ga.; Raleigh, N.C.; and Roanoke, Va.