Slightly updated September 21, 2020, to reflect current market conditions:

With the news of higher rates on the spot market and with competition for drivers growing in some quarters in spite of this year’s slowdown, you’re bound to see bigger companies salivating at the opportunity to start new lease-purchase or other leasing contracts.

With such conditions, it’d be no surprise for more company drivers to ask if now is the time to become an owner-operator. Yet the decision to make that jump is often driven by an emotional sense of just how much better life will be thereafter.

I remember these thoughts from 17 years ago, when my wife and I purchased our used Freightliner Century. No boss, just me, my truck and the open road picking what I want to do, where I want to go, when I want to work. And don’t forget all that money — you know, the cash we imagine the company bosses are stealing from us.

Our eight-year road to ownership prior to that day was not without missteps. Like many things in life, timing and luck played a roll. Marcia and I did develop an ability to save money prior to making the switch, but our motivation then wasn’t to become an owner-operator. Learning to effectively manage our personal finances and build up our credit rating did, however, open the road to opportunity. Without those skills, I don’t believe I would be an owner-operator today.

The lynchpin to starting up was the Freightliner dealer offering us a bank loan on good terms to buy our used truck. However, if your personal finances are over-extended, taking on the risk of business ownership may not be the best plan, even if you qualify for good loan terms.

If you’re considering ownership, can you write down why you want to make the investment and how? What’s your plan? Be very critical. Get out that highlighter and identify what in each of your own statements is in fact true. Get out the red pen and mark up what doesn’t make sense.

Then do it again.

This can be difficult to do honestly, so imagine it isn’t your plan. Approach it as if giving advice to a friend. Are you just going to agree with the things they want just because they want them? Are they aware that becoming an owner-operator is a life-changing decision, with no certainty of success?

More things to consider:

- Resist the urge to hurry into the decision. It can easily take a year or more to do this right.

- Who’s your accountant/advisor? You need this person on your team before you sign any commitments.

- Know all the costs involved, including fixed costs, like insurance, that don’t change by the number of miles you drive. There’s a good chance there are more than you imagine. Fixed costs do not stop when the key is turned off.

- Learn about revenue sources and all the different agreements at carriers you’re considering working with. For example, percentage versus per-mile or other pay structures, various lump-sum or time-based accessorials.

- Know your likely tax liabilities and opportunities to minimize them. If you’re not paying taxes, you may not be making a profit, either.

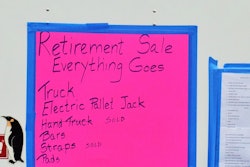

- What benefits are you giving up by becoming an independent contractor? Access to health insurance, company 401(k) retirement plans and paid vacations can have tremendous value.

- Know there is risk and stress with ownership. You are responsible for so much more than just driving.

- Speaking of those enticing headlines on the new tax law changes, any money saved regarding per-diem and depreciation deductions won’t pay your bills. These alone are not reasons to become a business owner.

Ultimately, find the truth in your own calculus. We can be very good at lying to ourselves to justify our desires.