It wasn’t until I hit my mid-50s that having an exit strategy for my business even occurred to me. I saw the need to start tweaking my business plan to make the end come on my terms as much as possible.

And it’s good to think about planning for all the “exits” in our lives, not just retirement. Whether it’s closing a business, ending a relationship, estate planning or appointing the person who will be your medical power of attorney, planning makes our lives and the lives of our loved ones easier.

Frequent the truck stop Counters of Knowledge, and you’ll overhear too many truckers admit that they can never afford to retire, or that their plan is to exit when their life ends. It shouldn’t be a catastrophe that drives us into the exit lane. Taking the time to plan to retire on your own terms is a responsible choice.

When I moved from company driver to owner-operator, the exit plan included everything from building savings and maximizing the 401(k) matching offered to resigning when I could collect the maximum amount of vacation pay to help us bridge the income gap of a couple weeks. I chose a fleet, found an affordable truck and arranged financing.

About the same time, another driver displayed a different strategy. He stormed into the office, threatening to quit if the company wouldn’t meet his demands. They accepted his resignation and told him to clean out his truck. He had to scramble to find a new job.

While a well-planned career shift can be invigorating, planning for injury or death can be depressing. My wife manages paying our bills, mostly with online accounts and, I swear it, a hundred passwords. When I think about possibly taking over that job, I panic. I wouldn’t know where to start.

Lately, though, I’ve been learning. We sit together on the weekend every couple of months and discuss what I need to know, even do a couple practice runs.

Also, we use tax time to review our estate planning, life insurance policies and her employment benefits. And no worries — she’s perfectly healthy!

It may sound morbid, but these discussions can be vital to a surviving spouse or partner. A friend and I recently talked about a woman trying to sell her husband’s truck online after he died unexpectedly. This isn’t the first time we’d heard of this. And how many of us know of an owner-operator who’s fallen ill or injured and is unable to return to their chosen career? It’s not just the business our families would have to deal with in these situations. Think about other matters, such as debt and taxes.

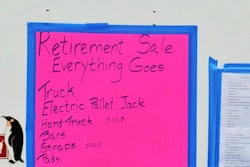

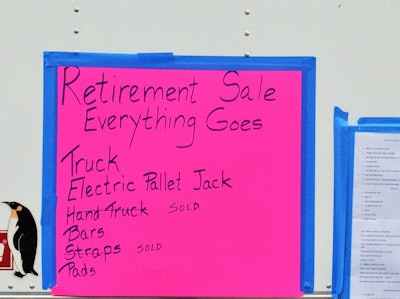

Friends have told me of how they have planned with someone to help liquidate their equipment, and so I recently asked Marcia what she would do. Her answer: Contact the business that maintains my truck and negotiate the sale through people we trust. Right answer, honey!

It’s too common that a new owner-operator has an engine failure or other large breakdown that forces him to walk away from the business with nothing to show but debt. Now that I’m 63, we have planned not to purchase any equipment that would require payments if I were unable to continue working. That way, I can turn off the key with no lingering expenses.

If you have not saved for retirement, open a retirement account like an IRA or individual 401(k) and treat it just like a payment for maintenance – another vital business expense. Contribute regularly to the account. Don’t wait until tomorrow or next year to start.

If you’re able to draw retirement income now, understand the pros and cons of when to start collecting Social Security and/or any pension or other retirement savings. Obtaining help from a financial advisor may be a wise investment.

Don’t end your career thinking you coulda-woulda-shoulda done things differently. We don’t always get to time our exits, but we all get a chance to plan for them.