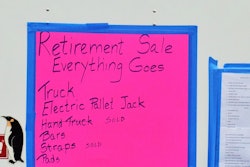

Retirement isn’t something many of us want to think about. Yet think about it we must. The decision to retire from the road can happen by choice or be forced upon us because of health, injury or other circumstances. Recently, a friend I met working as a company driver 21 years ago told me his career behind the wheel was ending due to health issues, and his inability to pass his DOT physical.

This all prompted me to start an online discussion in my Truck Business Network group to try and help others better prepare for their own eventual exodus from driving.

Too often, retirement income needs get shoved aside until our career's sunset is staring us in the face -- I’ll deal with that later, we say. Next thing, as with my old friend, later happens, and we’re still uncomfortable facing the unknown.

[Related: Do you have an exit strategy?]

This week, Ray P., a longtime owner-operator, responded to my posted question about retirement -- what do you do when your plans don’t work out as expected? – by asking questions about what kind of retirement savings he might start at age 60, given a limited number of years left in business.

Is it too late? That’s a common concern. My thought is that it’s never too late. If you are working, any contribution to a retirement savings account is a good one, no matter how old you are. Younger owners, dealing with start-up costs/debts and struggling with cash flow, often lack the right mindset to support retirement contributions and put it off for far too long.

Ray’s income, as is the case for many lately, has increased dramatically in the last 18 months. As a couple, he and his wife have low debt and have accumulated significant savings, great first steps that open the door to advance to the next plateau of financial security.

If you are among younger owners, with more than 15 years of likely projected ownership or employment in your future, your advantage of time offers even greater return with compounded earnings. Lesser contribution amounts made now provide good long-term potential.

The suggestions I am going to share come from my experiences along with advice from the financial and tax advisors Marcia and I have known for many years.

Retirement account options: Know the differences

I’m going to focus on three basic plans with hopes this gives you enough to begin discussing this subject with a certified tax preparer, hopefully before this year’s tax filing deadline. These different retirement account options offer advantages for the amounts you may contribute and how these accounts are taxed in the current year – likewise earnings in the future when you begin making withdrawals for your retirement income needs.

The financial advisor Marcia and I use, Brett Petersen, vice president of Busey Bank Wealth Management of Bloomington, Illinois, suggests in most situations to first fully fund your own Roth IRA. This offers the greatest long-term return. Though you will pay taxes on the contributions, the upside is the growth in earnings are tax free when you make withdrawals.

The Traditional IRA difference is that contributions are not taxed in the current year, lowering income tax liabilities now. The earnings, however, are taxed at the time of distribution after you retire. Generally, the tax advisors I’ve asked about this suggest you likely will pay more in taxes in the long run.

When you open an IRA prior to the April 15 tax deadline, you can make contributions for either the previous or current year. To get the tax breaks with a Traditional IRA on this year’s return, make sure you're maxing out your contributions for 2021 first before saving anything for the current tax year.

Find more information about retirement-account options, strategies and tactics in Chapter 19 of the Overdrive/ATBS-coproduced "Partners in Business" manual for new and established owner-operators, a comprehensive guide to running a small trucking business. Follow this link to download the 2022 edition of the Partners in Business manual.

Find more information about retirement-account options, strategies and tactics in Chapter 19 of the Overdrive/ATBS-coproduced "Partners in Business" manual for new and established owner-operators, a comprehensive guide to running a small trucking business. Follow this link to download the 2022 edition of the Partners in Business manual.

Setting up an IRA is comparable to setting up a checking account. Many banks and other financial institutions (both in-person and online) offer IRAs. The first, best place to check might be where you currently bank. If they don’t offer IRAs, they certainly could direct you to a reputable institution. Once an IRA is initiated, it’s simple to arrange for automatic monthly or quarterly deposits into the account from your checking account.

The SEP difference

Separately establishing an SEP, or “simplified employee pension”, account offers other advantages to truck owners. Contributions to SEPs, a form of an IRA yet with potentially higher annual contribution possibilities, are tax-deductible and grow tax-deferred.

I contacted ATBS to verify how much you can contribute to an SEP account. If you file taxes as a sole proprietor and aren’t operating as an LLC and filing as a S Corp, paying yourself as an employee, here is the short answer.

- The sole proprietor may contribute up to 25% of profit, since all profit is considered your payroll and will be taxed as such.

- If you pay yourself as an employee: The SEP contribution is limited to 25% of your W2 income.

[Related: How to set up an owner-operator business as an S Corp to save on self-employment tax]

It’s important that you begin discussing this with your tax preparer in order to make clear just what the maximum contribution you are allowed will be. You’ll also get a better idea of how much it may help reduce your current tax liabilities.

You can set up an SEP for a year as late as the due date (including extensions) of your business income tax return for the year you want to establish the plan. This is where filing for an extension may benefit your planning, enabling careful considerations without rushing the process.

Do you employ others? If so, also ask your tax preparer what benefits might also be offered to your employees via SEP plans.

SEP accounts, as with IRAs, can be set up with banks or other financial institutions. You send SEP contributions to the financial institution where the SEP is maintained.

Set-up requires a formal written agreement, executed with IRS Form 5305-SEP or through your account provider.

If you’ve been pondering retirement but haven’t acted out of simple discomfort, push past that and take the first step: Make the call or send the email to your tax preparer and ask the hard questions now. This has the potential to save you thousands of dollars in the long run, and enhance quality of life down the road.

Access a three-part series on Retirement Planning, published originally in 2019:

Part 1: How owner-operators can transition to the slow lane

Part 2: When should you start drawing Social Security?

Part 3: A small fleet as a big nest egg