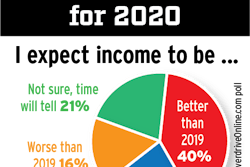

Winding down the year were you thinking 2019 couldn’t end soon enough? So many stories of companies closing, and another one just last week. The prognosticators prognosticate and predict more to come, some even speculating about particular companies. Such news can come as a big hit to the confidence of any small business owner.

As I’ve mentioned elsewhere, through the year I fielded an unprecedented number of calls and messages from owners whose lives had hit the skids. Among owner-operators, the two most frequent situations I’ve attempted to counsel: growing problems trying to keep the truck out of the shop (and the business thus shielded from the lost income opportunity downtime represents) and issues with personal, or a family member’s, health. With cash flow stretched thin, the choices owner-operators are faced with can be as stark as throwing in the towel to selling personal assets or cashing in an IRA or other nest egg (if it even exists).

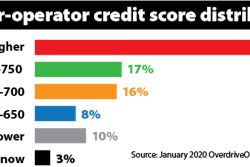

With credit ratings for folks in those kinds of situations plummeting, opportunities to arrange any kind of financing with terms and interest rates that resemble something less than what a loan shark would demand can be next to nonexistent.

It’s not only newer owners, either. I have friends with 20-plus years of experience who have had their trucks sitting at shops for more than a month at a time, repeatedly. The problems vary, but there’s some commonality in two or three factors:

- The lack of available shop locations with technicians able or qualified to perform the work in a timely fashion.

- Parts needed can’t be located, or are on back-order because of demand.

- The breakdown happens hundreds or even thousands of miles from home, putting the owner at the mercy of unfamiliar businesses. Should you rent a car and take it to the house? Or hover over the service manager trying every tactic imaginable to get your truck repair in gear?

The related costs in all scenarios are difficult to understand. Some of you have probably had the tech hook up the truck’s electronics to try and diagnose problems — and then find out this alone costs hundreds of dollars or more.

No repairs have even begun, and you have some very difficult decisions to make.

If we could turn back the clock …

Use your experiences to guide your decision-making this year. Many people are questioning whether they purchased or leased the right truck from the right source. Some had purchased extended warranties when they upgraded their trucks following profits incurred in 2018. The warranties have no doubt been helpful with repair costs, but it’s important to try and learn as much as possible about these agreements before signing contracts. Take the time to ask the tough questions. These purchases can get emotional, and we get in a hurry — all we want is to get the truck rolling and start making money.

Ask what-if questions so you aren’t caught without recourse for big-ticket repair expenses. Does the dealer have any shop services available, or will you be at the mercy of the open marketplace?

I’ve had long conversations with owners who just didn’t have the cash flow available when needed to avoid late payment and excessive overdue charges. Before you get behind, initiate a conversation with the finance company. Plenty people have been able to roll payments and extend the payoff timeline, stretching cash flow.

A “cash flow calendar” or time map like this, charting business expenses and revenue as they occur, is a tool that can be used to help visualize costs and income as they relate to time.

A “cash flow calendar” or time map like this, charting business expenses and revenue as they occur, is a tool that can be used to help visualize costs and income as they relate to time.Learn how to use credit cards and pay them off before their due dates — that will improve your credit rating, opening the opportunities to borrow capital faster and at much lower and manageable cost.

Understand your payment terms, which may allow you to spread expenses over 11 months or more – at once, I warn everyone that to avoid excessive finance cost you must make payments on or before due dates. I always managed this by arranging well-timed automatic monthly payments from my business checking accounts.

One owner-operator I’ve helped mentor was paying $1,000 a week to lease-purchase a truck with a carrier, and the large amount was hurting not only his business decisions but his personal home life. He made the decision to change and take back control.

After trying to secure bank financing to purchase the truck outright, it became apparent that wasn’t going to be an option. Because the operator owned his home, the solution became to secure a home equity loan with a very low interest rate and manageable payments, buying the truck and doing a little home improvement at the same time. This ultimately reduced what had been $1,000 weekly truck lease payments to a much more manageable minimum $500 or so per month payment on the equity loan. Built into his business plan is making triple that amount in monthly payments on the loan as time goes on to minimize the long-term financing cost as much as possible.

If there’s one takeaway from all this, it’s that owners who are continuing to be successful are those who are not simply reactive when problems present themselves. Successful owners throughout this past difficult year have an established business plan and operating procedures that enable them to be proactive with decision-making. They aren’t afraid to change, and don’t always follow the crowd.

Here’s to a happy and healthy 2020 for your business.