I was looking at the numbers at the stock market’s open last Wednesday. Recall, that’s four weeks into a spot freight market where like as not a broker’s offer rate was little more than an insult to any cost-aware owner-operator. Emotions were running high.

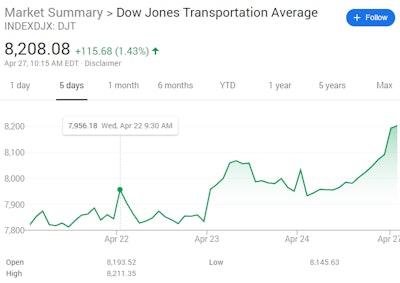

That morning, though by no means were things returning to any “normal,” I saw some signs of overall business confidence there in the indices. Transportation stocks were holding relatively stable, even a bit up at open, among other broad measures of activity.

This snapshot of the transport stocks index from this morning shows further improvement in the market, likewise that bump Wednesday last week.

This snapshot of the transport stocks index from this morning shows further improvement in the market, likewise that bump Wednesday last week.If such confidence holds, and the stock market keeps hanging in there, eventually your average American with a 401(k) will see values return to or exceed their pre-pandemic levels, and consumer confidence will be well on its way to returning. Economic activity at levels at least somewhat like what we’re used to could return.

In trucking, the picture is dim for the smallest independent carriers. The simple fact is we have just way too much capacity for the available freight. People are acting like vultures, pouncing on anything and willing to risk the loss just to try and stay moving.

The postponement of truck payments/potential lengthening of terms and/or the pause in insurance payments and some of the other aid that’s come through to operators and companies in some ways might compound that problem.

It could keep overall capacity up as companies and people think they can run at or below cost — and that the help they receive through loans and deferments will make up the difference and keep them in business.

Many are worn down pretty badly – see last week’s protests in Houston, Los Angeles and elsewhere. As my colleague here noted, others are writing letters to officials complaining about brokers pushing unprofitable pricing and other rate-related issues.

Always keep your right of refusal in mind as an independent business owner. You’ve probably heard me say it before – it’s by far your best negotiating tool. You cannot control someone else’s willingness to haul for peanuts or for a loss.

And unfortunately, trucking’s history is rife with this losing business practice. Some might call it “reverse bidding” to get freight, and in some cases it’s even built into a so-called “head haul” strategy where outbound loads for direct customers are thought to make up the difference. The spot 3PL/brokered load to get back for another of those gravy runs then might cover the cost, or even just the cost of fuel – it’s a losing business strategy, and always has been, though it’s not uncommon.

Old habits are very hard to break.

But it’s easy to criticize that other guy. You really have to ask yourself: What are you going to do? That’s what matters.

When someone buys a truck, they go from the driving being the profit center to something entirely different. The business administration becomes the profit center, not the driving. A successful business is all about decision-making and the management of relationships. Too many people don’t want to think about that.

Customer relationships are key. If you don’t have those hammered out well, or the customer is in trouble today, it’s going to be tough. Trim to save where you can, working with lenders and insurers to reduce or temporarily eliminate big costs, to try to weather for the return.

With most of the owner-operators I’ve been working with, looking to book loads two-three days in advance is the norm – in a normal time. Right now, though, that’s flipped. Customers are not ordering until the last possible day to get it there just in time. These aren’t expedited loads, exactly, but customers are letting inventories dwindle, clearly, even though money is very cheap.

That final fact could determine just how freight comes back. When customers do decide to build inventory, it will drive demand back up. The announcements of multiple states beginning to relax restrictions on businesses won’t hurt, and the amount of cash flowing out to consumers through stimulus and/or unemployment being higher than usual could spur some purchasing, too.

When demand does return, don’t forget the value of your right of refusal – that’s your line in the sand. With that, the bedrock stuff all applies: quality service, being in the right place at the right time.

I’m an optimist, generally. If I’m thinking about freight, I’m looking at June, July, August – even into December. I’m looking at second, third and fourth quarters – you can’t run this kind of business by always looking in the rear-view mirror.