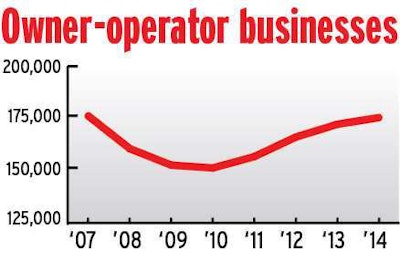

Combining leased and independent businesses, the number of owner-operators has rebounded almost to pre-recession levels.

Combining leased and independent businesses, the number of owner-operators has rebounded almost to pre-recession levels.Almost six years past the end of the last recession, the owner-operator marketplace is still reflecting its aftershocks, though you can take that in a good way.

It’s borne out by Overdrive’s annual owner-operator population study, produced by Commercial Motor Vehicle Consulting. The number of owner-operators (for-hire businesses where the owner still drives) increased for the fourth consecutive year to 174,700. That’s only 800 below pre-recession levels, notes Chris Brady, CMVC owner. The number of trucks they control grew 2.3 percent year-over-year to 246,300.

Just as the economy has had a sluggish recovery from the recession, the owner-operator population is also bouncing back at a slower rate than in the prior recovery, says Todd Amen, president of ATBS, the largest owner-operator financial services provider. He observes that “cheap, easy money that got burned in the recession hasn’t come back strongly to finance subprime independent contractors.”

Amen notes another factor that has dampened growth of owner-operators and the fleet size of those who want to grow beyond one truck: “a much smaller pool of cheap, quality used trucks than in the early to mid-2000s.” That period had produced a glut of used trucks, thanks in part to an ambitious buy-back program from Freightliner. “With recent near-record Class 8 truck production, used trucks may become more readily available in the next year or two,” Amen says.

This is already happening to some extent. And it’s likely to continue for the foreseeable future, based on comments from Martin Daum, Freightliner Trucks North America president and CEO, at the recent Mid-America Trucking Show. He forecast a stunning 19 percent increase this year in sales of Class 8 trucks in the United States.

The availability of easier credit and plentiful used trucks could be great timing for those looking to go independent. In fact, one other measurement in Overdrive’s study, average owner-operator fleet size, hints that move might have begun already.

Though the populations of owner-operator businesses and trucks has been growing for four years, the average owner-operator fleet size has been in decline. After hitting 1.59 trucks per business in 2006, it fell every year to 1.40 in 2013. Then it reversed last year, to 1.41 trucks per business.

The 2013 level “is likely the trough of fleet size during this business cycle as owner-operators will respond to increasing demand for transportation services by expanding capacity,” Brady says. Enough stability has entered the trucking industry that aggressive owner-operators are starting to see opportunity. The expanding economy “will reduce the risk of owner-operators adopting the independent business model,” he says.

Upcoming Event

Join a community of truckers at GATS

From free concerts to highly educational sessions, GATS is where trucking gathers. August 23-25, in Dallas, Texas. Register today.

Where Trucking Improves

The Great American Trucking Show is bigger and better than ever before. Don’t miss out on the rigs, the swag, the education and more.

Discover GATS! →

It looks like the owner-operator market is shaking off the last shackles of the recession. If you can overlook the growing regulatory burden, this may be the best time to be in the market we’ve seen in years.

What’s your outlook for the rest of 2015?