One major mistake many owner-operators make when considering the move to run under their own authority is to underestimate the total cost of operations.

Consider these areas and decide if you are going to handle them yourself or pay somebody else to do them:

- Rates and lanes

- Compliance

- Safety

- Drug testing

- Hours of service

- Accounting

- Fuel tax

- Mileage tax

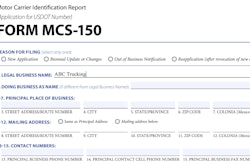

Compliance, safety, drug testing and hours of service fall under Federal Motor Carrier Safety Administration regulations. Addressing these can cause a lot of stress and confusion. But you'll need to handle it -- the new entrant safety audit awaits all new motor carriers with authority. New entrants now face a shortened deadline for correcting problems in their applications. Applicants must submit a corrective action plan within 15 days of the audit or, in some cases, 10 days.

You'll need in place a drug and alcohol testing program -- typically membership in a consortium for owner-operators -- as well as a system for keeping hours of service and vehicle maintenance records.

A carrier often handles tax filings for its leased owner-operators, but as an independent, you are the carrier. You are responsible for accounting for income and revenue for federal and state tax purposes, fuel tax, mileage tax and heavy vehicle use tax.

Also, it’s possible that you would be better off forming a limited liability company (LLC) or an S Corp for tax reasons before getting your own operating authority. Explore the question of tax structure with your business services provider or accountant before starting the application process. And keep in mind new requirements if you're filing with your Secretary of State to set-up the business: You'll likely need to make a one-time report to the Financial Crimes Enforcement Network of the U.S. Treasury.

[Related: Financial Crimes Enforcement Network's new reporting requirement hits owner-ops, small fleets]

When you are operating as a carrier, you won’t always receive 1099s for the revenue you generate. You’ll need an accounting system that tracks all income and expenses.

Other crucial preparations include developing a system for invoicing, accounts receivable and tracking fuel and mileage taxes. The latter two require filing the appropriate forms. You or a third-party specialist in this area will need to track all miles and gallons of fuel purchased in each state in order to file your IFTA forms. You also may need to file mileage tax forms in Connecticut, New York, Kentucky, New Mexico and Oregon if you travel through any of those states in any given quarter.

[Related: 'What's this $400 bill from Pennsylvania?' An IFTA primer for owner-operators new to the business]

This may sound like a lot of work, and it is. Going independent can be a great opportunity, but it can be your worst nightmare if you fail to plan and execute properly. If this is your goal, create your plan, count the costs, create your budget, and follow through.

Join Overdrive and ATBS March 22, 2024, at the Mid-America Trucking Show for the annual Partners in Business seminar, benchmarking owner-operator performance of recent history, this year with a focus on "Owner-operator survival strategies, and tactics to thrive, in a down market." Find more detail about the session at this link.

Owners looking for additional management tips for running with authority can find it in the "Going Independent" chapter, specifically, and much more throughout the Overdrive/ATBS-coproduced "Partners in Business" manual for new and established owner-operators, a comprehensive guide to running a small trucking business. Click here to download the updated 2023 edition of the Partners in Business manual free of charge.