Bookkeeping is one of the most important activities of successful owner-operators. The receipts and othe financial records you keep are used in a number of areas of your business -- income tax reporting and minimization, warranty issues, maintenance information and monthly profitability, to name a few.

A business services provider can save you time with this task, but you should take an active role in collecting the information. The more organized and thorough you can be in receipt gathering and expense recording, the better.

You can simplify the bookkeeping task by following six simple practices that translate to higher profit with less hassle:

1. Save every receipt, no matter how small.

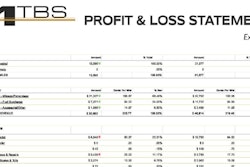

Why “tip” the taxman? It’s the job of you and your business services provider to deduct as many legitimate costs as possible. Place an envelope in your truck for collecting your receipts, or use dedicated folders on your computer or in the cloud for e-receipts and scans of paper receipts. At the end of each month, send them to your business services provider, who can sort and tally them and provide you with a monthly profit-and-loss statement as well as accurate quarterly tax estimates. If you’re doing the bookkeeping yourself, many owners have found keeping a weekly or even twice-weekly cadence for recording and tallying helps avoid getting behind, providing a real-time boost in cost analysis, too.

Whether you’re building your own profit-and-loss spreadsheets on a laptop or using online software such as that available via LetsTruck.com or other vendors, the receipts are crucial in case you are audited.

Scanned images of receipts are acceptable; keep the original paper copy for any big-ticket item for warranty purposes. Business services firm ATBS today houses scanned receipts sent to them via its ATBS Hub and mobile app easily accessed by owner-operator clients to track and manage paperwork easily. That's necessary when you're on the road and need to pull up key information, such as the receipt for the purchase of a battery that proves it is under warranty.

If you’re not sure if something is tax-deductible, save the receipt and check with your business services provider.

2. Open a separate checking account for your business.

If you're the sole owner of the business, open an additional personal account and save yourself the extra fees that are associated with business accounts. Deposit your settlement checks and collected invoices in this account, and pay yourself for driving from these funds. The amount to pay yourself is determined by your budget.

Pay all business expenses from this account. A separate account also will give you easy access to needed information in case you are audited, and bank fees for this account are tax-deductible.

3. Use a separate credit card for business expenses.

Likewise, it’s wise to keep business and personal credit card spending distinct. Find a credit card without an annual fee and with a low interest rate and, ideally, a generous rewards plan. Pay the balance in full every month.

4. Save your logbook/ELD records.

Your log records are the best proof of your entitlement to per diem (daily) expenses, mainly meal costs. If you’re using electronic logs, now a requirement for most truckers, know how to save and access your history.

5. Get a dedicated notebook or use mobile tech to record expenses.

Use this notebook or document/spreadsheet record on your smartphone or computer to record those expenses for which you cannot obtain a receipt, such as when you wash your truck at a pay facility, business use of your auto, etc. Give a monthly record of these expenses to your business services provider along with your other receipts.

You must track the date, location, amount and reason for each expense to meet Internal Revenue Service regulations. Special circumstances include:

Entertainment. Expenses for yourself, such as movie rentals or books, are not deductible. However, if you entertain a business associate, such as a fleet manager or shipping clerk, the expense is deductible. Note the cost of the expense, the date, names of who were there and the meeting’s purpose.

Business gifts. If you make a gift to a business associate such as a dispatcher or a customer, record the cost, date, gift description, the recipient’s name and relationship to you.

Transportation. For use of a personal vehicle for business, include the date you started using it for business, mileage for each business use and annual total miles. Include your business destination and purpose of each trip.

6. Save your records.

You must keep the records that were used to prepare your tax return -- records that support income and deductions -- for three years from the date you filed the return.

Other records to keep include IRS quarterly estimated tax payments; monthly profit-and-loss statements; insurance documentation; maintenance records and reports; warranty information, which should be available immediately to keep your truck on the road and minimize downtime and maintenance costs; required registration information; settlement statements from your carrier if you’re leased; and bank statements, business credit card statements and canceled checks.

Read next: Profit and loss statements: Tracking, analyzing your progress to effectively compete