Health is the third core reason owner-operators fail -- behind only poor truck maintenance and a lack of business skills. Many over-the-road drivers struggle to find the time to see a family physician at home, much less a doctor while on the road. Many also lack a disciplined approach to diet and exercise.

Complicating this health picture for many owner-operators is inadequate health insurance coverage. According to the most-recent Overdrive polling on the subject, nearly half of owner-operators do not carry any health insurance at all.

The average owner-operator who spends money on health, dental and vision insurance pays about 8% of his average net income. One bright spot among the high costs is a sizable tax break. Independent contractors can deduct 100% of their premiums, provided a spouse doesn’t qualify for health insurance through an employer.

Assume you have a family policy with a moderate deductible that costs $10,000 a year in premiums. If you’re in the 15% tax bracket, that knocks $1,500 off your tax bill.

In spite of all the risks, many owner-operators go without health insurance. Although the Affordable Care Act initially levied penalties to those who chose to go without insurance, that individual mandate went away for the 2019 tax year. However, the structure of health insurance exchanges that came with the ACA remains in place.

Otherwise, the health insurance landscape continues to change, though there are other ways to get at least a minimum level of health coverage or to reduce the costs for good coverage.

Your spouse. If you’re married and your spouse is eligible for family health care coverage through an employer, it's wise to take advantage of it.

Your company. If you’re leased to a carrier, you may be eligible for its group policy, though not in the same way as an employee. You’ll pay all of the premium plus a fee for processing.

Check with your business services provider to make sure the plan doesn’t endanger your status as an independent contractor.

Alternatives to insurance. There are some ACA alternatives that combine preventive care with what’s been called a “health care sharing ministry” for hospitalization. The concept arises from old religious entity-based risk-sharing groups.

It’s not insurance, exactly, but is intended to provide members with quality medical services.

[Related: Health-share plans prove to be attractive insurance alternative for small fleets, owner-ops]

In such a plan, each member of the group pays a “premium,” or contribution, and if they need health services, it works like an insurance claim. Such plans are available to begin more or less anytime, not restricted like the ACA plans to enrollment during the annual late-year open-enrollment period.

Additionally, the cost of coverage in health-sharing plans might fall between 40% and 60% of the cost of an ACA plan with comparable coverages, not taking into account the premium-reducing subsidies available to many owners through the ACA -- and sweetened by American Rescue Plan legislation (see below).

The COVID pandemic also spurred a rise in telemedicine for basic healthcare services. In many cases, for a relatively low subscription fee, owner-operators can get telemedicine access for themselves and their families, allowing them to set appointments and talk on the phone or video chat with a nurse or doctor, get prescriptions and more.

Navigating the Affordable Care Act's health-insurance exchanges

The Affordable Care Act has solved some owner-operators’ health care financing problems. Overdrive polling (see above) suggests just more than a quarter of owner-operators have purchased a plan through the ACA, while approximately 9% are covered by a spouse’s plan.

Premiums available on the health-insurance exchanges vary widely by plan level, family size, age, income-based premium subsidies and where you live. The lower an operator’s taxable income is, the better rates look in the exchanges.

The 2021 American Rescue Plan Act (ARPA) COVID-19 stimulus package not only included stimulus payments, unemployment boosts, and childcare tax credits -- it also made it cheaper for many to get health insurance on the ACA exchanges.

The legislation killed off the so-called “subsidy cliff,” a level of income above which subsidies on premiums simply weren't available to purchasers on the exchanges. That income level, 400% of the federal poverty line, according to the Kaiser Family Foundation, was right around $51,000 annually for a single individual, well less than the almost $70K the average owner-op brings in annually.

The Rescue Plan legislation capped exchange Silver plan premium costs at 8.5% of income, no matter how high the income -- which delivered substantial benefits in particular to older Americans with incomes up to $20K and a little more above the old “subsidy cliff,” KFF found in its analysis of how the changes apply to an individual aged 60 at various income levels.

When Overdrive reported on the changes in 2021, representatives from a health-insurance provider offered a few examples of the savings increased subsidies were providing to owners, detailing the change for a then-61-year-old owner-operator whose previous lower-level Bronze plan was costing him $852 monthly premiums with a $65 copay for up to three doc visits and a $6,300 deductible for prescription expenses. The owner's annual income was slightly above-average at $75K annually, and under the new terms he could upgrade to a Silver plan featuring better coverage, with the same California insurer, for less than half the premium costs of the prior Bronze plan -- $294 monthly. Lower copays, too, for visits at $40, and a Rx copay of just $16.

Subsequent legislation the following year extended those particular changes through at least the current tax year. Owners purchasing on the exchanges would be wise to stay updated about potential changes come 2026.

Paths to the exchanges

There are numerous health-insurance concierge services that serve as, effectively, brokers to potential federal and state exchanges and the plans available therein, and truckers' associations may well be willing and able to help, from the insurance services of the National Association of Independent Truckers to those of the Owner-Operator Independent Drivers Association, state trucking associations and others like TrueNorth.

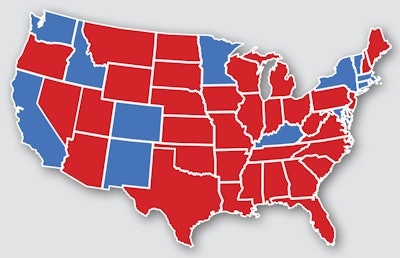

Yet it's certainly possible to shop on the exchanges yourself. The main federal exchange at HealthCare.gov can be utilized as a starting point to redirect any insurance shopper to the right place, yet note that some states (in blue in the map below) operate their own fully controlled state exchanges. Find links and contacts for all them below.

FEDERAL EXCHANGE STATES (shaded red on the map) | HealthCare.gov, (800) 318-2596

(Since completion of the map graphic, Georgia, Maine, Nevada, New Jersey, Pennsylvania, and Virginia have all opted to establish their own state exchanges. Find links to their program websites below.)

California | CoveredCA.com, 800-300-1506

Colorado | ConnectForHealthCO.com, 855-752-6749

Connecticut | AccessHealthCT.com, 855-805-4325

District of Columbia | DCHealthLink.com, 855-532-5465

Georgia | GeorgiaAccess.gov, 888-687-1503

Idaho | YourHealthIdaho.org, 855-944-3246

Kentucky | KYEnroll.KY.gov, 855-326-4650

Maine | CoverME.gov, 866-636-0355

Maryland | MarylandHealthConnection.gov, 855-642-8572

Massachusetts | MAHealthConnector.org, 877-623-6765

Minnesota | MNSure.org, 855-366-7873

Nevada | NevadaHealthLink.com, 800-547-2927

New Jersey | NJ.gov/GetCoveredNJ, 833-677-1010

New Mexico | BeWellNM.com, 877-769-6642

New York | NYStateOfHealth.NY.gov, 855-355-5777

Pennsylvania | Pennie.com, 844-844-4440

Rhode Island | HealthSourceRI.com, 855-840-4774

Vermont | HealthConnect.Vermont.gov, 855-899-9600

Virginia | Marketplace.Virginia.gov, 888-687-1501

Washington | WAHealthPlanFinder.org, 855-923-4633

Read next: Ways to reduce health insurance costs with plan choice, tax-deductible savings in HSAs