“It may be cold across the country (other than where those wildfires are burning and South Florida, although they’d consider 60s on the cool side), but the spot market remains hot.” –DAT’s Ken Harper with this week’s spot market report

The national van average rate of $2.10/mile is up to, again, its highest level in three years.

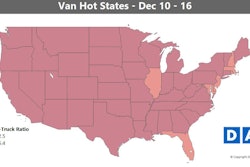

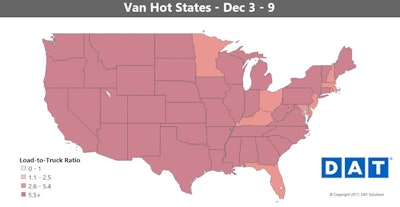

Heading into December, truckload demand on the spot market was surging, with record-high rates and load-to-truck ratios throughout November. With last week’s report, load-to-truck ratios for dry vans was so high that every state but Massachusetts and Florida was shaded as deep red as it gets in the map, indicating favorable numbers for truckers. As truck posts increased this week, ratios fell a bit in some states.

Heading into December, truckload demand on the spot market was surging, with record-high rates and load-to-truck ratios throughout November. With last week’s report, load-to-truck ratios for dry vans was so high that every state but Massachusetts and Florida was shaded as deep red as it gets in the map, indicating favorable numbers for truckers. As truck posts increased this week, ratios fell a bit in some states.Van overview: The number of loads posted on DAT load boards fell down a bit, too, from the previous week’s peak – likely a lull between holidays. As noted under the map, truck posts also rose, which meant it was a little easier for shippers and brokers to find capacity. But as you can see, the spot market is still tight, and rates are significantly higher than they were in December of 2016.

Hot markets: Most of the major van markets backed down a bit last week from the exceptionally high rates we had been seeing. The exception was Denver, typically a lower-rate market for outbound freight but where the average outbound rate was up 7 percent. The lane from Denver to Chicago only averaged $1.16 per mile last week, but the 10 cent increase from the week ago made up for the 7 cent decline going the other direction, which averaged $2.83 per mile.

The roundtrip between Los Angeles and Denver got a big boost. Van rates jumped up 15 cents in both directions. L.A. to Denver is the higher-paying direction, of course, rising to $3.34 per mile.

Not so hot: Several of the big declines last week were on lanes that were paying well above average for this time of year. For example, Seattle to Spokane, Wash., tumbled 44 cents, but the average rate was still high at $3.23 per mile. Load counts were way down on the lane from Columbus, Ohio, to Buffalo, N.Y., and the average rate plunged 75 cents to $3.06 per mile.

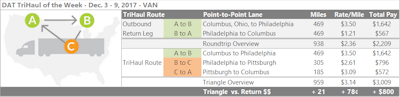

Retail shipments have been driving demand on lanes heading into the Northeast, but the flipside of that is falling rates coming out. It’s a scenario where you might want to look at alternatives to a straight return load. The Columbus, Ohio, to Philadelphia lane, for example, saw pre-Christmas demand pushing the average rate up to $3.50/mile, but the return trip from Philly to Columbus shows a paltry $1.21/mile. If you have the hours to make it work, van loads from Philly to Pittsburgh paid an average of $2.61/mile last week. From there it’s a short haul back to Columbus, which averaged $3.09. The split would few miles and it could push your average rate per loaded mile up from $2.36 to $3.14, or about $800 extra for the trip.

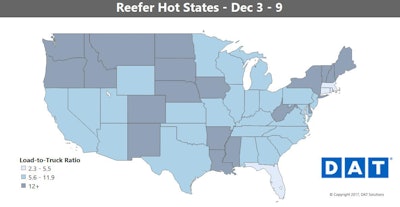

Retail shipments have been driving demand on lanes heading into the Northeast, but the flipside of that is falling rates coming out. It’s a scenario where you might want to look at alternatives to a straight return load. The Columbus, Ohio, to Philadelphia lane, for example, saw pre-Christmas demand pushing the average rate up to $3.50/mile, but the return trip from Philly to Columbus shows a paltry $1.21/mile. If you have the hours to make it work, van loads from Philly to Pittsburgh paid an average of $2.61/mile last week. From there it’s a short haul back to Columbus, which averaged $3.09. The split would few miles and it could push your average rate per loaded mile up from $2.36 to $3.14, or about $800 extra for the trip. Reefer rates skyrocketed in November, and the hot states map for refrigerated freight looked a lot like the one for dry vans two weeks ago. As you can see in this one, things have calmed down a bit so far in December.

Reefer rates skyrocketed in November, and the hot states map for refrigerated freight looked a lot like the one for dry vans two weeks ago. As you can see in this one, things have calmed down a bit so far in December.Reefer overview: Many of the crazy-high prices have fallen back down to earth in the last week, but reefer rates are still higher than usual for this time of year. Demand for fresh food at Christmas will likely keep rates elevated through the rest of the month. As DAT’s Ken Harper puts it, “We’re between holidays and expect this Christmas season to be strong and extended with e-commerce leading the way for retail [vans, mostly] and traditional seasonal foods — turkeys, hams, rib roasts, racks of lamb, potatoes and those icky multicolored items my granddaughters refer to as vegetabubbles all moving by reefer.”

Hot markets: Potato shippers have kept busy in the meantime, and there were big increases on a couple lanes out of Southern Idaho. Volumes soared on the land from Twin Falls, Idaho, to Chicago, and the average rate jumped up 33 cents to $2.50 per mile. Twin Falls to Los Angeles also added 39 cents for an average of $3.09 per mile.

Not so hot: Outbound reefer rates were way down in Chicago, and the lane to Denver plunged 50 cents to $2.70 per mile. Twin Falls had two of the biggest outbound-rate jumps last week, but it also had the biggest decline. Reefer loads going from there to Phoenix paid 52 cents less on average at $2.91 per mile.