Updated August 18, 2022, to better reflect the reality of the IRS-funding provisions after the Act's signing:

The Inflation Reduction Act, currently being debated in the House after Democrats pushed it through the Senate, stands to make major changes to the U.S. tax code, environmental policy, and even health care policy. For owner-operators and other small trucking businesses, the most impactful provisions are likely extended changes to Affordable Care Act subsidies and an influx of cash for the Internal Revenue Service to hire new agents.

The Act "actually keeps things pretty simple" in terms of health insurance, said Michael Schneider, tax manager at owner-operator business services provider ATBS. "Essentially what they’re doing is extending the [current levels of] ACA subsidies" for three more years, "through the end of 2025," when the subsidies had been set to expire on New Year's Day, 2023. The subsidies, most recently boosted and extended under the American Rescue Plan, allow many people without employer-provided health insurance, such as owner-operators, a shot at affordable care.

Marc Ballard, who oversees the National Association of Independent Truckers' various avenues to health coverage, noted during the last open enrollment period for ACA plans that the current subsidies better apply to the middle class than they have in the past.

"We're seeing about 90% of people who enroll can get a plan for $100 a month," he said in November. "Take, for example, a guy who may be 45 with a spouse and two kids, lives in Florida and expenses a bunch of his income. ... Let’s say his net adjusted income is $60,000. He grossed $200,000, but the reportable income is $60,000. He could literally be paying zero dollars for a health care plan."

Others making more, according to Ballard, may have to pay just a few hundred a month.

But even though the subsidy-change extension will mostly represent "business as usual" for independent businesspeople, Ballard still said now is a good time to shop around.

"I bet most people didn’t even know that this was due to expire. For them it’ll be seamless but with some new or additional options, so it's always a good idea to shop their plans," he said.

With the pandemic period going down as record years for owner-operator income, and the current relative slowdown in freight rates against a steep rise in fuel, Ballard said to consider your income projections and see if you can score a better deal. Not only income: Any change in family or personal status could open up new possibilities for health-expense savings.

"With our drivers, their incomes fluctuate, so the premium they’re paying now is based on some very specific metrics like size of their family, where they live, and their ages," he said. "If they had a particularly good or bad year in 2022 but project it to be different in 2023, that's a pretty substantial reason to shop the plans and have an agent or someone plug into the marketplace and make sure they're recording the proper income in 2023."

Importantly, Ballard pointed to possible caps on prescription drug prices for people on Medicare. Ballard cited the Kaiser Family Foundation's website, well-known for its health-insurance analysis/information, as saying the bill would require drug companies to pay rebates if prices rise faster than inflation, and that overall out-of-pocket drug costs for people with Medicare could be capped at $2,000 a year, with insulin specifically capped at $35/month.

It's currently unclear if there will be "some bleed over" for people under 65 to get in on the caps on prescriptions, Ballard noted, adding that his organization was monitoring the legislation in detail. Overall, the slight bump in subsidies to offset inflation and an increase in insurers moving into the space makes now a historically good time to explore health-insurance options.

IRS beefs up to crack down

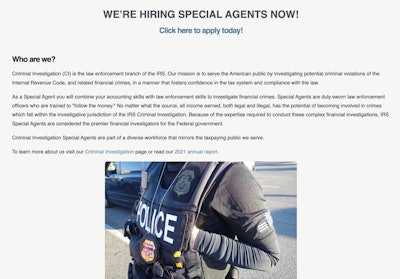

A job listing on the IRS website looking for armed special agents might not be such a big deal to worry about after all.IRS

A job listing on the IRS website looking for armed special agents might not be such a big deal to worry about after all.IRS

One of the more sensational stories out of the Inflation Reduction Act comes in the form of $80 billion put aside to improve the IRS' enforcement of tax codes as the Treasury has stated a need to hire 87,000 additional IRS agents and workers over the next decade. While the White House denies any of these potential additional agents would target the middle class, which it defines as people making less than $400,000, many Republicans remain skeptical. Fear of this provision's potential ramifications reached a fever pitch recently when many online saw the above IRS job listing for agents that would carry guns.

The IRS has been understaffed for years, according to the Treasury itself and others (and as anyone who has tried to get in touch with them on the phone well knows). Additionally, the IRS has always employed armed agents, though they're only involved in criminal investigations, not regular tax dust-ups, the Associated Press reported. Frankly, many in business more fear a letter in the mail from the IRS than the agents themselves.

ATBS's Michael Schneider said it was "hard to say" if 87,000 new IRS employees would lead to an increase in audits for self-employed businesses or otherwise middle-class Americans, and that we "might see more audits or more letters going out, but probably not field audits."

Schneider did have some good news, pointing to $3.2 billion of the $80 billion in funding "going to taxpayer services like the IRS answering phone calls and returning emails. That's going to be a plus," he said.