The number of load posts on the spot market closed the month of October on a high note, increasing 16% during the week ending Nov. 3, said DAT Solutions, which operates the DAT marketplace for spot truckload freight. It’s a sign that holiday freight is moving, at least in the van and reefer segments. The number of truck posts fell 8%, which helped lift load-to-truck ratios and give van lane rates a boost after several weeks of declines, which ended October on a down note compared to the previous month in all segments:

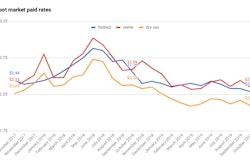

National average spot rates for October

**Van: $1.80 per mile, 4 cents lower than the September average

**Flatbed: $2.17 per mile, 3 cents lower

**Reefer: $2.11 per mile, 5 cents lower

National average rates during the first three days of November were lower than the overall October average but were unchanged compared to the previous week: Van — $1.79 per mile; Flatbed — $2.12; and Reefer — $2.09. But spot van rates were higher on 59 of DAT’s Top 100 largest van lanes by volume, and from two big retail freight hubs—Los Angeles ($2.23 per mile, up 6 cents) and Columbus, Ohio ($2.14 per mile, up 7 cents).

Trend to watch: O flatbed freight, O flatbed freight

No one is putting a bow on the spot flatbed market. The flatbed load-to-truck ratio averaged 10.8 in October, down from 14.7 in October 2018 and 37.5 in October 2017, and rates are generally soft.

However, Christmas tree growers in North Carolina and Oregon, where six counties in the two states account for more than half of the 16 million trees harvested nationwide, are a huge source of spot flatbed loads in November. Harvests are under way there and in other hot spots for Christmas trees, including Spokane, Wash., Missoula, Mont., and Rapid City, S.D. These markets may not make up for weakness from traditional flatbed freight sources — construction, oil and gas, machinery, agriculture — but carriers can use something merry and bright right now.

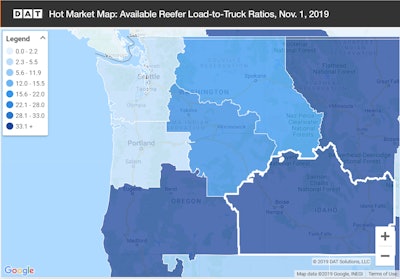

Market to watch: Pacific Northwest reefers

November began with more demand for trucks in the Pacific Northwest and Upper Rockies — prime regions for potato growing and processing.

November began with more demand for trucks in the Pacific Northwest and Upper Rockies — prime regions for potato growing and processing.The markets with the most reefer loads posted and moved on the spot market in late October and early November were, in order, southern Idaho; northeastern Oregon and southeastern Washington; and Spokane. In fact, the load-to-truck ratio on Friday, Nov. 1, stood at 36:1 in Twin Falls, Idaho; 28:1 in Pendleton, Oregon; and 20:1 in Spokane. The national average at the time was 3.8 loads per truck. As potatoes move from Idaho this time of year (and turkeys from Minnesota…), look for reefer capacity to tighten across the map in the coming weeks—and for rates to firm up further.