Another mega-storm has disrupted freight movements around the country, and with this spot market update let’s send a message of goodwill to the people whose lives have been affected by Hurricanes Irma and Harvey, likewise the wildfires out West. If you’re a resident of one of the affected areas, our hearts are with you.

DAT notes this week that Houston freight levels bounced back last week to 88 percent of where they were before Hurricane Harvey, somewhat remarkable considering that last week also included Labor Day.

Meanwhile, recovery efforts have gotten underway in Florida. Atlanta and Charlotte are the two major van markets that serve Florida, after shifting as distro points for Houston relief, and outbound rates soared in those markets ahead of the storm. Volumes, however, were down a bit last week. That means the storm threat might have led shippers to cancel or postpone some freight movements instead of expediting them. That could lead to pent-up demand in a spot market that was already tightening. All of this with the large uptick in fuel has put a lot of upward pressure on all-in freight rates and line-haul rates (figures minus fuel), too.

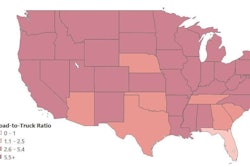

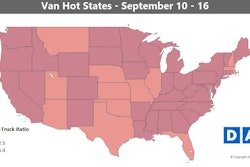

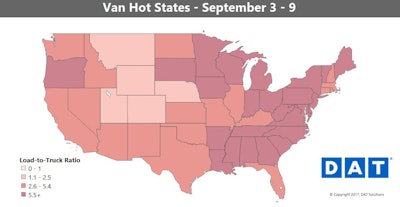

The load-to-truck ratio states map doesn’t tell the whole story for regions around the country. Compare it to the more granular hot markets map that follows, which tracks load-to-truck ratios on DAT boards by major freight markets rather than overall states, in which the darker red — showing good demand for truckers — is spread more evenly.

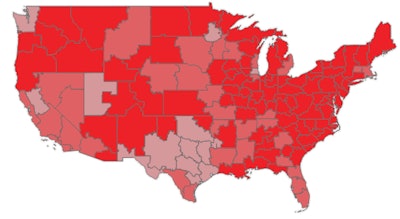

The load-to-truck ratio states map doesn’t tell the whole story for regions around the country. Compare it to the more granular hot markets map that follows, which tracks load-to-truck ratios on DAT boards by major freight markets rather than overall states, in which the darker red — showing good demand for truckers — is spread more evenly. Late September is typically when the “second freight season,” historically associated with Halloween and Christmas retail markets, warms up. But to see it this hot, virtually across the country, is unusual to say the least. This map illustrates the ratio of load posts to truck posts. The bright red indicates a ratio of 5.5 loads or more for every truck posted.

Late September is typically when the “second freight season,” historically associated with Halloween and Christmas retail markets, warms up. But to see it this hot, virtually across the country, is unusual to say the least. This map illustrates the ratio of load posts to truck posts. The bright red indicates a ratio of 5.5 loads or more for every truck posted.Two types of of opportunity in relief efforts exist for owner-operators. One is well-illustrated by the shuttle operation Landstar-leased Bill Ater detailed for Overdrive in a recent edition of the Overdrive Radio podcast. The other is in distribution lanes coming near to the affected area from farther afield. Foxhole Logistics, a brokerage started under the direction of former disaster-response contractor and current TBS Factoring President Jennifer Fogg, earlier this week noted the broker anticipated plenty of demand for lowboys, vans and other equipment. “Lowboys, anything you can put larger oversize pallets on, anything that can haul a generator,” she said.

If you’re going in, though, get your day wait rates in the contract ahead of time, she notes. “Getting down there and then getting delayed and asking for extra money – probably not” the best tack to take. “Ask a lot of questions about fueling options along the route,” too. “One of the biggest problems we have is carriers getting into fuel with just enough to get to the location, then [having trouble] refueling to come out. It can be a big problem in some of these areas – not as big a problem in Houston,” but definitely in Florida. “There needs to be some forethought in that process – at least verify reliable sources of fuel” before you go in.

Van hot markets: Volumes rebounded in Dallas, as traffic is moving throughout the state now. Rates fell from the spikes we saw immediately after Harvey, but they’re still well above average. A secondary effect from Hurricane Irma has been higher outbound rates from Northeast markets like Philadelphia and Buffalo, N.Y., which is a typical trend when the flow of freight shifts southward. DAT’s Ken Harper notes that outbound van rates for typical “backhaul” markets like Denver, up 10 percent in volume in the last week, are showing some rare strength with all the re-positioning going on in the supply chain. He shares this quick look at the top outbound van markets, by percentage increase in volume in the last week:

Allentown, Pa. — +6.1%

Buffalo, N.Y. — +3%

Philadelphia — +3.2%

Atlanta — -0.2%

Charlotte — -0.1%

Memphis — +1.2%

Chicago — +8.3%

Columbus — +7.3%

Dallas — +10.5%

Houston — +16.4%

Not so hot: As fuel rose considerably, rates were up pretty much everywhere, though prices in California showed the least amount of change. Prices on many inbound lanes to Florida are still trending up, but remember that it’ll likely be even harder than usual to find loads coming back out.

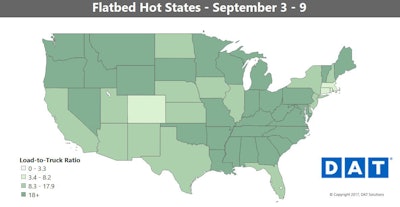

Houston is typically the No. 1 market for flatbed freight, but flatbed demand takes longer to recover after a big weather event. Vans and reefers have been bringing emergency relief into the storm zone, but flatbeds won’t get deployed in large numbers before it’s time for construction equipment and materials. Irma gave flatbed rates a boost across the Southeast last week, though, as shippers moved freight out of the way of the coming storm.

Houston is typically the No. 1 market for flatbed freight, but flatbed demand takes longer to recover after a big weather event. Vans and reefers have been bringing emergency relief into the storm zone, but flatbeds won’t get deployed in large numbers before it’s time for construction equipment and materials. Irma gave flatbed rates a boost across the Southeast last week, though, as shippers moved freight out of the way of the coming storm.Hot flatbed markets: Rates haven’t moved a lot in the past month for flatbed, but one thing that’s stood out has been the use of Baltimore as an alternative hub to serve the Southeast. Some strong lanes as of late have been from Pittsburgh to Grand Rapids, Mich.; Harrisburg, Pa., to Buffalo and Atlanta to Nashville, Tenn.

Not so hot: Hurricane Harvey may have also disrupted the flow of building supplies into the West. Construction materials often move out of Las Vegas and Reno, Nev., and rates have tumbled on some high-traffic lanes out of those markets. Nevada is still dark in the Hot States Map above, though, and it’s a little early in the season for prices to fall like that. Those markets could improve as volumes rise along the Gulf Coast.