Reader Thomas Lawson, commenting here on OverdriveOnline.com, had this to say about National Transportation Institute Principal Gordon Klemp’s analysis of driver wage growth — lack thereof, in fact — over the 35 years since 1980: “And this is a surprise to whom?”

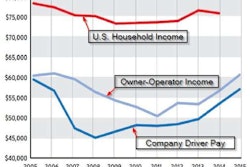

Klemp’s analysis showed that, if mean driver pay in 1980 had risen in tandem with the common Consumer Price Index’s inflation measure over the entire time period since, today drivers would make more than $110,000 a year.

Such isn’t out of bounds for a particularly successful owner-operator, but that’s far and away above the current truckload average pay, which in Klemp’s analysis equates to around $55K annually.

The long fall in pay is no secret, chronicled in a variety of ways here and elsewhere around the industry over the years. (Most recently: “The driver shortage alarm” on the cover of last month’s magazine.) On Overdrive‘s Facebook page, Paul Bazydlo uttered a helpful LOL along with this contextualization of the long-term fall in the value of a driver’s work in the context of the last decade’s worth of proclamations of a “driver shortage” — “It has been and will be a wage shortage, not a driver shortage. It’s not rocket science! Refresh my memory, but what happened in trucking around 1980?”

Deregulation offered something of a trade-off to the independents of the day, greater freedom to gain operating authority and compete as a motor carrier but, with deregulation of prices in large part, what many call a “race to the bottom” on rates and, ultimately, driver pay was a long-term result.

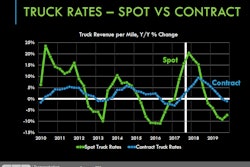

In Overdrive‘s recent reporting on the disconnect between driver shortage claims of more recent years and the lack of evidence for such in long-term wage growth, small fleet owner Cline Everhart notably shared an anecdote that well illustrates the issue. As prices for everything else continue to rise, a recent series of brokered loads he described as moving for “10-years-ago rates.”

Says Gary Carlisle, truck owner and manager of the Agri-Empresa oil-service fleet out of Midland, Texas, “From my perspective, there a lot of loads moving for 1980 freight rates” at this moment, “much like was happening in late 2008/early 2009. And I am talking freight less than $1.25 a mile – fuel may have gone down, but every other cost we have is still up and in some instances getting higher.”

Tough times, he adds, could be on the way.

At once, some operators welcomed further recognition of the problem with pay. Noted one under the story about Klemp’s analysis: “This is the discussion we really need right now. … I’m glad to see that at least someone has taken notice of how little trucking pays now.”

Richard Viers: Having been a trucker back in the 70s, 80s and 90s, I would have to agree. The cost of living and housing in particular. When I bought my first home in the 70s, a home in a decent neighborhood in Anaheim, Calif. was $70,000. That same home sold for $400,000 during the peak of real estate in that area. That was in 2010 after the real estate crash. If you drive for a living and are on the road your average hourly rate should be computed by all hours spent in control of the truck. We all know that is not the case.

What’s your take? If you’re reading on a smartphone, tap the image to call and leave us a message to weigh in. We’ll round up responses in a special mailbag podcast. Alternately, drop a comment below. If you’re on a desktop, call 530-408-6423. Make sure to tell us your name and state of residence.

What’s your take? If you’re reading on a smartphone, tap the image to call and leave us a message to weigh in. We’ll round up responses in a special mailbag podcast. Alternately, drop a comment below. If you’re on a desktop, call 530-408-6423. Make sure to tell us your name and state of residence.Criss Wilson: Prior to electronic logs, drivers who wanted to earn more, drove more. That created abundant capacity, which kept shippers’ rates low. Low rates equals low pay for drivers and owner-operators alike. Additionally, low barriers for entry into the Class 8 marketplace compounded the abundance of supply. Don’t misinterpret where I stand on this matter — I love mom-and-pop carriers. They are small business and small business makes America what it is. Free markets also make America a place where anyone willing to work hard can win. Now with regulations and the bite of absolute compliance, productivity will drop. Capacity will effectively contract and rates will adjust. They already have begun to move. [Minus] fuel, base rates are increasing. Average owner-operator pay rates are above $60K and climbing.