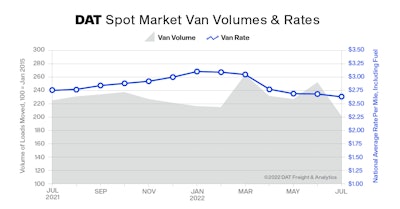

Truckload freight volumes tumbled from their June peak, and pricing for dry van and refrigerated capacity on the spot market continued to shift downward, said DAT Freight & Analytics, which operates the DAT One truckload freight network and DAT iQ data analytics service.

In some ways, the decline represents a return to seasonal freight patterns. “Demand for van and reefer services softened predictably in July and freight volumes generally settled to levels seen in July 2020 and 2019," said Ken Adam, DAT's analytics chief. "After several years of volatility, truckload volumes for van and reefer freight followed a more typical summertime pattern,” at least through July, the most recent month for which DAT's Truckload Volume Index is finalized (shown above for dry van freight).

The TVI for reefer freight was down by a lesser extent than van to 133, down 12.5%. Flatbed TVI sat at 217, down 15.9% month over month. “While the number of flatbed loads moved was strong relative to previous years, the volume decline from May through July was steeper than expected,” Adamo said.

Looking back further for a comparison point, van TVI was about equal to that seen in July 2020, while reefer had fallen below 2020 levels and flatbed remained considerably higher.

Changes in the TVI reflect the number of loads moved with a pickup date during last month, DAT said.

On the rates front, both spot and contract rates in all segments were on the move down through July, with flatbed taking the biggest hit after a more-resilient Spring in the spot market.

The prospects of further fuel-price relief continued to be a moving target, of course, particularly in the last two weeks as supplies were affected by a refinery shutdown in the Midwest.

There were demand bright spots in the freight markets, at least, in the week ahead of the Labor Day holiday, according to load board Truckstop.com and FTR Transportation Intelligence's weekly Market Demand Index figures.

Rates ticked up across all segments with more load posts and fewer truck posts.

Rates ticked up across all segments with more load posts and fewer truck posts.

It was the first rise in overall rates in almost two months, Truckstop.com/FTR reported in its full commentary, available via this link.

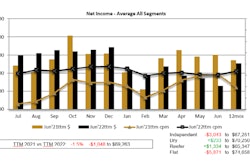

Viewed by segment, spot rates rose in the last week the most (12 cents per mile) for refrigerated carriers and least (2 cents) for flatbedders. Dry van added 5 cents per mile. Load posting volumes were down in all segments compared to 2021, and as shown above rates all-in continued to track above the five-year average.

[Related: Owner-operator income trend falls off record pace]