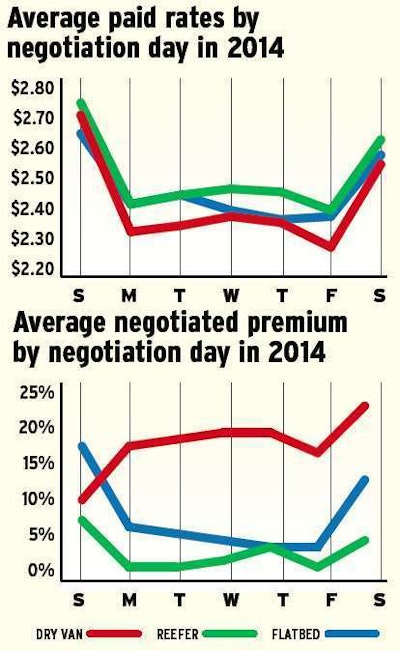

DRY VAN. Non-weekend rates were strongest for owner-operators on Tuesday and Wednesday, upending late-week strength patterns seen in 2012-13 and other years.

REEFER. The long-term stability in reefer freight translates to rate averages, with less marked variation in rate patterns by day of the week and generally less difference between posted and paid rates datasets.

FLATBED. Posted rates for flatbed, unlike dry van and reefer, reflect traditional wisdom on rate strength, with Friday offers consistently highest for flatbed freight. The spreads between paid and posted rates, however, suggest carriers achieve the highest percentages above broker offers on loads negotiated earlier in the week. Overall negotiation strength was strong in 2013, falling last year because of the big drop in fuel prices and a falloff in demand for freight to oil-drilling operations.