Van freight has been “unseasonably strong,” notes DAT’s Ken Harper about recent weeks on DAT Load Boards, but “rates haven’t caught up yet.” The analysis matches what’s been happening on Truckstop.com, too, as reported Wednesday with analysis by FTR’s Jonathan Starks.

As for Harper, “there are two reasons to think van rates may rise.”

1) “There’s strong freight in Southern California, specifically Los Angeles,” Harper says, “as Asian ships bring in the cargo that would have come in earlier on Hanjin’s ships.” It’s important to remember, Harper adds, that with Hanjin’s failure it only docked 2 of 7 big ships intended for the ports of L.A./Long Beach. “This freight is probably holiday-related and will need to move around the country.”

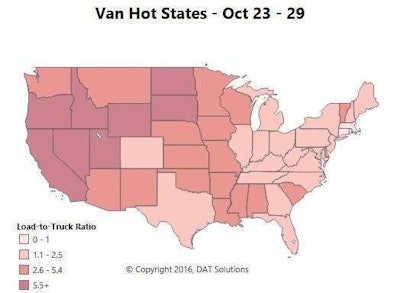

Van overview: Van freight didn’t see a big boost in the last full week of October, but load posts started rising at the end of the week, with an extra surge on Halloween. The month as a whole was strong compared to last year, however. Rising markets include three major van markets that saw outbound rates rise at least 2 percent for the month of October: Los Angeles, Dallas, and Denver. Volumes also rose significantly in L.A., likewise in Atlanta and Chicago. But as noted above, van rates barely moved on a majority of the 100 highest-volume lanes last week. Pricing stabilized in Charlotte, after some up-and-down weeks following Hurricane Matthew.

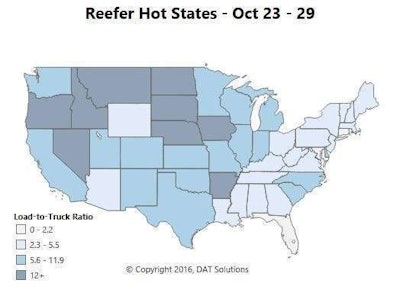

Van overview: Van freight didn’t see a big boost in the last full week of October, but load posts started rising at the end of the week, with an extra surge on Halloween. The month as a whole was strong compared to last year, however. Rising markets include three major van markets that saw outbound rates rise at least 2 percent for the month of October: Los Angeles, Dallas, and Denver. Volumes also rose significantly in L.A., likewise in Atlanta and Chicago. But as noted above, van rates barely moved on a majority of the 100 highest-volume lanes last week. Pricing stabilized in Charlotte, after some up-and-down weeks following Hurricane Matthew.2) “If you look at the load-truck ratio for reefers, you’ll see about that about 60 percent of the country (ag states, turkey states, etc.) is blue to deep blue, indicating a strong imbalance favoring carriers,” Harper says. Not all “reefer” loads require reefer units. In some cases, vans will suffice.

Reefer overview: Volumes were mostly in a holding pattern last week as a national average. There was a lot of movement in specific regions, however, which could signal the start of the run-up to Thanksgiving. Rising markets include the Mexican border market of Nogales, Ariz., which has come back strong in the past month. Other Arizona markets had plenty of trucks available, so the load-to-truck ratio was low for the state, as you can see in the map above. Rates out of Ontario, Calif., have been trending up, helped by strong van movement in Southern California. Falling markets include those in the Upper Midwest, where harvests are wrapping up, with Grand Rapids, Mich., starting to fade. But Wisconsin is still strong for reefer loads. Strong inbound volumes to northern New Jersey drove prices down out of Elizabeth.

Reefer overview: Volumes were mostly in a holding pattern last week as a national average. There was a lot of movement in specific regions, however, which could signal the start of the run-up to Thanksgiving. Rising markets include the Mexican border market of Nogales, Ariz., which has come back strong in the past month. Other Arizona markets had plenty of trucks available, so the load-to-truck ratio was low for the state, as you can see in the map above. Rates out of Ontario, Calif., have been trending up, helped by strong van movement in Southern California. Falling markets include those in the Upper Midwest, where harvests are wrapping up, with Grand Rapids, Mich., starting to fade. But Wisconsin is still strong for reefer loads. Strong inbound volumes to northern New Jersey drove prices down out of Elizabeth.Finally, if the past couple of years are any indication, Harper notes, the continuing shift from retail to e-commerce for holiday shopping means that “coupons/gift cards and discounts will be honored online after December 25. In other words, the traditional Fall freight season used to be late August/early September to November, and then it died.”

The past couple of years have seen the Fall freight season dwindle in intensity, but it’s lasted through December and January due to e-commerce.

“The joke around here is that since Christmas falls on a Sunday this year, good American consumers will discover they didn’t buy the right gift for little Johnny and Mary Jane and immediately go online and buy it with 2-hour delivery,” Harper says, “assuming they’re in a city that offers that kind of speedy service from a large company headquartered in Seattle.” You know who that is.

One lane ripe for a split

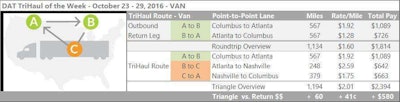

Van rates lost traction last week on the lane from Columbus to Atlanta. That’s the “headhaul” direction for that lane judging by the rate averages, but you could try to make up for the decline in revenue by turning the roundtrip into a “TriHaul” three-leg run. Instead of taking a load straight back from Atlanta to Columbus, which showed a paltry $1.28 per mile average last week, you could look for a load from Atlanta to Nashville instead. That lane paid $2.59 per mile last week, and van loads from Nashville to Columbus went for an average of $1.75 per mile. You’ll add just 60 loaded miles to the total trip, and the average roundtrip rate will jump from $1.60 to $2.01 per loaded mile. Examine the details below.