“Uber for trucking,” long considered a freight-matching unicorn, has come to a kind of fruition, with the ride-sharing giant today unveiling its brokerage’s Uber Freight matching app aimed at the owner-operator market with a focus on dry van and reefer loads.

The unveiling comes as one of the company’s other initiatives, its autonomous vehicle development subsidiary Otto, is embroiled in a lawsuit with Google, who claims Uber and Otto stole trade secrets related to autonomous truck tech.

The app is available for both Android and iOS platforms.

The app is available for both Android and iOS platforms.Uber Freight Senior Product Manager Eric Berdinis says the company leaned on its expertise in matching supply and demand and building pricing algorithms in the passenger market, transforming that process into matching freight with owner-operators and small fleets.

“We’re technically a brokerage,” Berdinis says, “and we do that so we can take ownership of the freight and pay our drivers and carriers quickly.”

That aspect, Berdinis says, is what Uber Freight believes will differentiate the company from similar services already in the marketplace.

“We value [prompt payment for delivery] as one of our big promises to our app users,” he says. “Regardless of when the shipper pays us, we’ll pay out for any load that is taken out on our app within a couple days, no questions asked.”

Launched in Beta mode last year, Uber Freight partnered mostly with Texas-based owner-operators/small fleets to refine the platform ahead of Thursday’s public debut.

Caty, Texas-based Minnie Gilmore, owner-operator with her husband, Edwin, of Gilmore and Long Enterprises, came to Uber Freight via load boards she commonly utilized to book loads to fill their 2012 Freightliner Cascadia and dry van. They got a call from an Uber Freight sales rep early on, then “saw a load on a board and it turned out it was an Uber load,” Minnie Gilmore says.

Since, she and Edwin have relied on the Uber Freight app for a lot of their loads outbound from the Houston area, utilizing other brokers or load boards to get back. (Minnie says they stay mostly regional – venturing into Arkansas, Louisiana, and occasionally Memphis, where the couple lived until 2013.)

Interest from carriers “has been overwhelming,” Berdinis says. “The challenge has been scaling out to meet the demand” with freight. Owner-operators and fleets nationwide interested in matching with loads through Uber Freight can now start the process of signing up with the brokerage via this link.

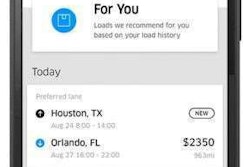

“We are a registered broker so we do go through the normal vetting process,” Uber Freight Director Bill Driegert says. Uber Freight will not work with Conditional or Unsatisfactory-rated carriers. Others, once approved, will be able to see available truckload dry van and reefer loads, paired with non-negotiable fixed rates to the truck. However, Driegert adds feedback from beta users could warrant the company considering rate flexibility and in-app negotiation tools later, as have been utilized by a variety of other brokers in the tech-enabled “uber for trucking” space to date.

The “uberization of trucking” buzzphrase has been circling through the industry for years now, following Uber’s success with its ride-hailing platform and numerous efforts around the nation to apply similar concepts and technology to the freight market. Read all of Overdrive‘s coverage of the phenomenon and many associated players via this link.

The “uberization of trucking” buzzphrase has been circling through the industry for years now, following Uber’s success with its ride-hailing platform and numerous efforts around the nation to apply similar concepts and technology to the freight market. Read all of Overdrive‘s coverage of the phenomenon and many associated players via this link.Gilmore, who works the phones at the home base in Caty while her husband operates the truck, says in-Texas freight is somewhat plentiful, at least in their area. Gilmore and Long relies on the app today for most of Edwin’s outbound hauls, and Minnie Gilmore appreciates the quick book-now options in-app, which cut out most needs for a phone call. It’s taken a bit of the home-dispatch burden off of her shoulders, as Edwin’s better able to do a lot of it on the road. Constant check calls, too, are eliminated under loads booked through the app, as progress on the load is automatically tracked.

Minnie Gilmore adds that rates delivered by the company’s pricing algorithm, thus far, seem to be “a little better” on average than what she’s been seeing from brokers working the load boards.

Uber Freight inks contract rates with its shippers but delivers more dynamic, market-based pricing to carriers, Driegert says, based on proprietary algorithms developed in part by the company specialist who led development of the surge-pricing methodology in Uber’s passenger vehicle service.

With launch today, the app enables searches for nearby loads based on a user’s current location, and likewise in origin/destination pairs, making some modicum of advance load planning possible. Berdinis says that more sophisticated planning features will emerge as the inevitable result of taking user feedback into account.

The primary limiting factor, at least as of now, Minnie Gilmore says, has been freight availability outside of Texas, something Berdinis suggests is changing with shipper interest around the nation.

In some ways, Uber Freight’s betting on the owner-operator base to answer the chicken-egg question of any freight-matching platform – which comes first, the freight or the driver?

“One of the tenants of building out Uber Freight is making drivers’ lives easier and helping them grow their business,” Berdinis says. “Our users are everything.”

“Our goal is to keep any of our users completely running and completely utilized,” Driegert adds.

If freight was plentiful enough in the network, via the app, to keep the Gilmore and Long van loaded all the time, would they use it exclusively? Yes, Minnie Gilmore says, believing “it’s always easier if you stick with one broker rather than having to be all over the load boards. Right now, they don’t have the freight to do it, but if they did, we would.”