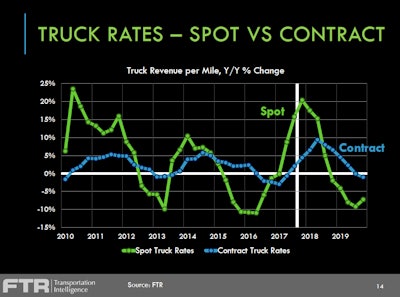

This graph from FTR Transportation Intelligence shows spot and contract rates’ historical year over year percentage change, based on Truckstop.com and other data, and offering a projection that shows an expectation of some moderation in the recent boom of spot rate growth — continued growth through much of this year, nonetheless.

This graph from FTR Transportation Intelligence shows spot and contract rates’ historical year over year percentage change, based on Truckstop.com and other data, and offering a projection that shows an expectation of some moderation in the recent boom of spot rate growth — continued growth through much of this year, nonetheless.Speaking as part of the analysis firm’s “State of Freight” series of webinars, FTR Transportation Intelligence Vice President of Research Avery Vise outlined a series of marketplace conditions that point to strong leverage for drivers looking to increase pay substantially.

The spot freight market began to turn toward the positive in terms of rate growth about a year ago, Vise noted, and contract rates paid by shippers to carriers “then began to creep higher as well.” As rates have heated further into the first week of this year with a variety of records broken in transaction data tracked by load boards, “overall trucking conditions are improving,” he says.

Evidence of some ballooning sign-on bonuses have been seen, and rising driver wages Vise dubbed perhaps the most significant “cost pressure” for motor carriers, given continued expectation of growth in pay. In reporting by Overdrive‘s James Jaillet in November, longtime analyst of carrier pay packages Gordon Klemp told the Stifel investment firm that “for-hire drivers have lost effective purchasing power over the past 10 years or so and have had to adjust lifestyles accordingly.”

Looking farther back, as is at this point well-known and which Overdrive has shown in prior reporting, Jaillet wrote, adjusted for inflation “driver wages are in effect just half of what they were in 1979, before deregulation.”

The “stage is set” at this point, Klemp told Stifel, “for drivers to realize driver pay increases over the foreseeable future.”

With the potential of mandated ELDs to push longtime drivers from the business into other sectors and compound the situation as a backdrop, this is the “strongest labor market in two decades, at least in terms of unemployment,” Vise said. “Trades that compete with trucking,” such as manufacturing and construction, “are doing well, at least compared to recent levels.” Both manufacturing and construction are in fact growing nationally but experiencing bigger surges in construction markets in hurricane-affected regions like Florida and Texas.

And while “estimates vary widely,” he added, “it’s clear the tax reform act will be stimulative of trucking activity to a degree.”

Tax reform, with its dramatic cuts in corporate tax rates, too, will give drivers plenty of reason to expect some windfall themselves. “We are seeing pressure for wage increases,” Vise said, with “bonuses at unprecedented levels for teams and other drivers.”

While fleet executives don’t make decisions overnight, truckers may be in the pay-boost driver’s seat, considering all these dynamics. Buzz around tax reform has seen “some major players in retail announce increases” in their company minimum wages and other pay. “I’d expect drivers will say, ‘wait a minute, what about us? … OK, corporate America, this is what you asked for. Now it’s time to give back.'”

The corporate tax cut does, Vise added, deliver “real money, so it’s a real opportunity.”