The U.S. DOT has said it is investigating complaints filed against brokers by motor carriers, who allege violations of federal law that requires brokers to provide carriers records of what shippers paid for a load.

Federal Motor Carrier Safety Administration chief Jim Mullen, speaking to a general session of the Truckload Carriers Association’s Virtual Safety and Security Meeting on Tuesday, indicated ongoing efforts to enforce 49 Code of Federal Regulations 371.3, which governs the record-keeping of brokers. The rule enshrines carriers’ right to request and review a copy of records that include, significantly, brokerage fees and, ultimately, what the shipper paid the broker to get the load moved.

Mullen noted the agency had received allegations of violations of the provision. These are instances where a motor carrier hadn’t signed away its right to review a transaction record, which some brokers require in their contracts, yet the broker failed to “provide the data required by the regulation” when requested, Mullen said. “It’s not a lot” of cases. “Maybe five to ten allegations. … We’re investigating those. There’s been a ‘notice of violation’ issued to a broker that didn’t provide it, and we verified that the motor carrier didn’t waive it.”

Carriers who’ve been audited are like to be plenty familiar with such a notice, often issued post-audit and detailing violations the auditor found in his/her investigation of the carrier business. What follows is a process giving the business opportunity to come into compliance, as Mullen noted in his talk. If it doesn’t, “the next step is the ‘notice of claim,’” he said, or a fine issued to the business for the violation as an enforcement action.

Brokers may not be very familiar with this process – there’s evidence it hasn’t happened to many. In Overdrive’s dive into FMCSA’s investigatory history over the four years since 2016, published in December of 2019 in the context of FMCSA’s driver coercion rule, the publication found exactly zero broker entity enforcement cases there. That remained the case as of this morning when it comes to closed cases where enforcement action was taken.

Mullen also signaled FMCSA’s willingness to explore the issue of brokers “trying to circumvent the process by requiring the waiver” of a carrier’s right to review the record in contracts, he said, and “if the motor carrier doesn’t waive it, then they get blackballed” by that broker.

Mullen referenced the Owner-Operator Independent Drivers Association’s petition for rulemaking to disallow the use of waivers, and require an automatic disclosure within 48 hours of any load’s delivery.

He urged attendees of the TCA virtual meeting to keep an eye on the Federal Register for a request for public comment on the petition and related issues.

“You have to look at this with an eye of what is within the agency’s statutory authorities,” Mullen said. “You could say that it makes sense that the FMCSA regulate and prohibit these contractual waivers, but then do we have the authority to even do that?”

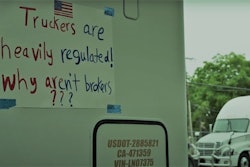

This issue was brought to the fore by what some carriers saw as outright predatory, “reverse price-gouging” behavior of some brokers as the market tanked with the COVID-19 pandemic’s associated lockdowns and their immediate effect on certain business sectors and, subsequently, the wider economy. Truckers, including many independent carriers, drove the point home with demonstrations around the country, including a three-week period during which dozens parked along Constitution Avenue near the White House, grabbing the Trump administration’s attention, ultimately, to the issue.

Mullen recognized the frustration among many about the slow pace at which the agency is working on the issue. “I know that some folks are dissatisfied at the pace [at] which the agency’s working,” he said. “Some folks are dissatisfied that we aren’t already taking action against those brokers who do have [contract waivers] in their broker-carrier agreement, and I would say this is what the process is for. Hence why we’re going to do the notice and comment period.”

Other federal agencies, he added, were involved in this particular issue, too – those less likely to speak publicly, or even to him, about their work, he suggested.

—Tom Quimby contributed to this report.