The spot truckload freight market showed signs of cooling last week, as freight volumes continue to level off from all-time highs. The number of load posts to DAT load boards fell 5% during the week ending Oct. 25, marking four straight weeks of declines, said DAT Freight & Analytics. At the same time, truckload rates and volumes broadly speaking are best seen as plateauing, as they remain in record-setting territory.

The number of available loads is more than double this time last year. Despite a 4% decline week over week, van load posts are up 132% compared to the same period in 2019.

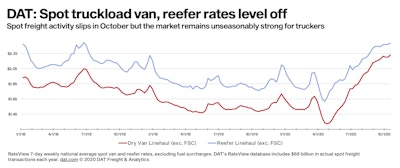

You can click through the image for a large view showing van/reefer rates averages (minus a calculated fuel surcharge) back two years.

You can click through the image for a large view showing van/reefer rates averages (minus a calculated fuel surcharge) back two years. An increase in truck posts and decrease in freight pushed down load-to-truck ratios for all equipment types last week:

**Van LT ratio: 4.0, down from 4.2 the previous week.

**Reefer: 7.7, down from 8.3, driven by a 6% drop in load posts.

**Flatbed: 33.9, down from 37.2. Load posts fell 5%.

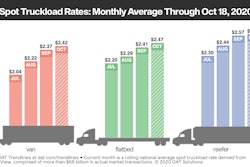

National average line-haul rates

National average spot line-haul rates (not including a fuel surcharge) remained elevated through Oct. 25 and have been within a narrow price range since the start of the month.

Van: $2.22 per mile excluding a fuel surcharge

Reefer: $2.38 per mile

Flatbed: $2.23 per mile

Add about 19 cents to those numbers to reflect all-in rates most truckers negotiate with brokers.

Trend: Urgency to move CPG and other retail goods

Demand for fast-moving consumer goods continues to drive the van freight market. IRI, a research firm that specializes in consumer packaged goods, retail, and over-the-counter health care markets, said that while CPG (consumer packaged goods) sales are up 8% year over year the e-commerce portion of that activity is up 34%. CPG and other retail freight continue to present opportunities for dry van carriers on the spot market.

Surge in imports

West Coast ports are bracing for record imports. Trucks are tight in Los Angeles and Ontario, California, and a wave of container freight in the coming weeks will stretch capacity further. The number of available loads in Los Angeles jumped 25% week over week, while Ontario volumes increased by 19%. Look for more upward pressure on spot rates in Southern California.

Reefer freight from the “salad bowl”

Around 90% of all leafy vegetables grown in the U.S. originate in the region around Yuma, Arizona, and California’s Imperial Valley, giving the area the nickname of the nation’s “winter salad bowl.” Most production takes place from November through March, with harvests packed at local salad-processing plants and shipped to major supermarket and fast-food chains. The average spot line-haul rate from the southern Arizona border market jumped by 17 cents to $2.29 a mile last week excluding fuel. Month over month, volumes are up 54%. The salad bowl is starting to roll.

Slowing East Coast reefer volumes

In other signs of reefer market seasonality, we’re seeing early reports of fall vegetables out of Florida. Reefer volumes from Miami were up 22% week over week and Jacksonville increased 16%, but loose capacity has suppressed outbound rates. Loads from Atlanta dropped 21% week over week although tighter capacity pushed the average line-haul rate (minus surcharge) up 3 cents to $2.30 a mile. Reefer volumes from Elizabeth, New Jersey, fell 10% compared to the previous week and the average outbound line-haul rate dropped a penny to $2.13 a mile.

Impact of rail surcharges on truckload demand

In Seattle, Union Pacific is doubling a $500-per-container surcharge on small shippers to move excess contract cargo by rail and intermodal. As a result, Seattle outbound spot truckload volume increased 21% week over week and nearly 17% of those loads were destined for Los Angeles and Ontario.