More trucks competing with fewer spot market loads in the near term will put downward pressure on rates. That could continue through the year as shifting consumer habits and natural market cycles contribute to a bearish environment for spot rates.

More trucks competing with fewer spot market loads in the near term will put downward pressure on rates. That could continue through the year as shifting consumer habits and natural market cycles contribute to a bearish environment for spot rates.

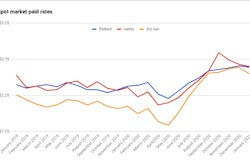

The spot market roared back to life in the months after pandemic-caused shutdowns sapped freight demand last spring, with per-mile spot rates in all three major truckload segments (flatbed, dry van and reefer) jumping every month from June to November, according to Truckstop.com's monthly averages. Dry van and flatbed rates continued that run in December, though reefer did slip some.

Those surging rates helped buoy many operators and small fleets who, in the depths of last year’s steep downturn in the spring, had to persevere through the worst rates downturn in a decade.

That spot market momentum, however, might be on course to stall, at least briefly, as normal freight seasonality trends and typical market cycles return and override the factors that caused that spot boom in the first place.

For starters, “capacity is coming back online,” said Jim Nicholson, vice president of operations at digital brokerage Loadsmart. That puts downward pressure on rates, with more trucks competing for loads, even though freight volumes haven’t slowed.

Secondly, he says, more stability in the market is shifting loads back to the contract market and away from the spot market, which likewise softens demand and rates in the spot market.

However, “We do expect a resurgence as we get into the second quarter,” Nicholson said. “We do expect volumes to increase, but those relying on spot volume could be in a pinch here for the next few weeks.”

Chris Pickett, analyst at Pickett Research, foresees a more systemic slowdown in freight demand, particularly on the spot market, looming this year. He’s tracked freight and rate cycles over recent decades’ ups and downs, and he foresees the freight market heading into bearish territory for most of the year.

He contends the market was ripe for the boom phase of the normal boom-and-bust cycle in late 2020 and early 2021. “And that’s exactly what we got,” after the market crash and quick recovery in last year’s second quarter, he said. In the back half of 2020, “rates marched sequentially higher, which is exactly what was arguably supposed to happen as part of the normal cycle,” he added.

That stage could play out in the first part of 2021, before rates begin another recessionary cycle, he said.

“If you’re a carrier, expect the spot market to weaken over the next few months,” he said. “To the extent you can, you’ll want to be overweight contract and underweight spot from a fleet allocation standpoint.”

While that may not be possible for many owner-operators, especially those operating just one truck, look for opportunities to leverage relationships with brokers to lock in regular loads and rates, said Gary Buchs, longtime owner-operator and now an owner-operator coach. Likewise, he said, start looking for opportunities to develop shipper-direct freight.

“I know many owner-operators have been trying to really lean hard on the spot market. After all, when it’s hot, you need to work the system,” Buchs said. When it’s not hot, you need to find alternatives, he said.

Pickett and Nicholson foresee a scenario in which a ramp-up in COVID vaccine deployment could shift consumer habits back toward services and experiences and away from the goods-heavy consumption patterns seen in 2020. That could undercut freight demand later this year, too — another potential ding in spot market activity.

“When consumption abruptly shifted from services to goods during the depths of the downturn, the trucking industry got an unexpected tailwind,” said Pickett. “Presumably when consumption shifts the other way, we will see the opposite. We could very well see an environment characterized by strong GDP numbers yet disappointing domestic truckload freight demand – at least relative to 2020.”

Forecaster FTR, notably, has predicted a robust year for freight demand, as the industrial sector continues to recover, housing construction remains strong, consumer retail demand has remained elevated and retail inventories have remained low. FTR predicts rates growth of 10% this year overall when combining contract and spot rates.