Construction, manufacturing and other industrial shippers pushed demand for flatbed truckload to its highest point in nearly three years, said DAT Freight & Analytics, operator of the DAT network of load boards. The last week looked overall like more of a leveling out on the spot market, with van, reefer and flatbed load posts up just 2.5% and the number of trucks posted falling 1%. Rates remained high, but showed little movement compared to the previous week, despite the urgency of shippers to move freight before the close of the quarter.

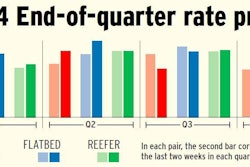

National average spot rates, March through the 28th

**Van: $2.66 per mile, 24 cents higher than the February average

**Flatbed: $2.75 per mile, 19 cents higher than February

**Reefer: $2.94 per mile, 25 cents higher

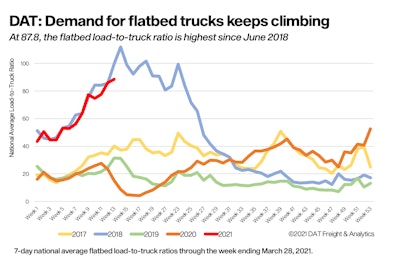

Flatbed rates ripe for the picking | Capacity is tight, as some owners and drivers have no doubt shifted toward historically high rates and comparatively lower physical demands of van and refrigerated freight. The national average flatbed load-to-truck ratio was 87.8 last week, meaning there were nearly 88 loads on the DAT network for every availably posted truck. As shown, it's the highest ratio since June 2018. The dynamic could last, with produce season around the corner. Last week the average spot rate increased on 40 of DAT’s top 78 flatbed lanes by volume, and the number of loads moved on those lanes was up 4.8% compared to the previous week.

Flatbed rates ripe for the picking | Capacity is tight, as some owners and drivers have no doubt shifted toward historically high rates and comparatively lower physical demands of van and refrigerated freight. The national average flatbed load-to-truck ratio was 87.8 last week, meaning there were nearly 88 loads on the DAT network for every availably posted truck. As shown, it's the highest ratio since June 2018. The dynamic could last, with produce season around the corner. Last week the average spot rate increased on 40 of DAT’s top 78 flatbed lanes by volume, and the number of loads moved on those lanes was up 4.8% compared to the previous week.

Lanes to watch

The country’s high-volume flatbed lane last week was Houston to Fort Worth, Texas, averaging $2.80/ mile, up 3 cents week over week. The return paid $2.44. The number of loads moved from Lakeland, Florida, to Miami was down 16.8% last week compared to the first week of March, but the average rate was 5 cents higher at $3.17. The lane with the biggest average price jump was Roanoke, Virginia, to Harrisburg, Pennsylvania, at $4.11, up from $3.73. Volumes were low, however.

Van volumes to end Q1

Typical for the end of a quarter, spot van freight volumes increased last week. The number of loads moved on DAT’s top 100 van lanes was up 6%, but the rate was lower on 47 of those lanes and neutral on 34, continuing a pattern of softer pricing seen in recent weeks. The national average van load-to-truck ratio increased slightly from 4.8 to 5.1, which could increase pressure to the upside.

Van lanes to watch included those out of the Port of Los Angeles, which has been urging shippers to focus on shorter dwell times after processing almost 800,000 20-foot equivalent units (TEUs) in February, a 47% gain compared to February 2020 and the seventh straight month of year-over-year increases. The average dwell time is between four and five days. Los Angeles outbound spot van rates averaged $3.24 a mile last week, down 2 cents on a 7.2% surge in the number of posted loads. Los Angeles to Stockton dipped 3 cents to $3.57 a mile last week – the return paid just $1.84.

Reefer is steady as she goes

The number of reefer loads moved on DAT’s top 72 reefer lanes by volume rose 4.4% compared to the previous week, with the average rate higher on 27 of those lanes, neutral on 13, and lower on 32. Overall, the number of reefer loads and trucks posted was virtually unchanged from the previous week.

Lanes to watch include those out of McAllen, Texas, where an average $2.89 a mile outbound was up 11 cents versus the previous week. Key lanes: McAllen to Elizabeth, New Jersey, at $3.08 per mile, up 21 cents week over week; McAllen to Atlanta up 17 cents to $3.24 a mile; and McAllen to Dallas 9 cents higher at $3.13.